Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

11 Oct, 2021

By Charlsy Panzino and Chris Hudgins

Struggling U.S. companies will be more likely to seek out courts in 2022, pushing the pace of bankruptcy filings up from its current low, experts said.

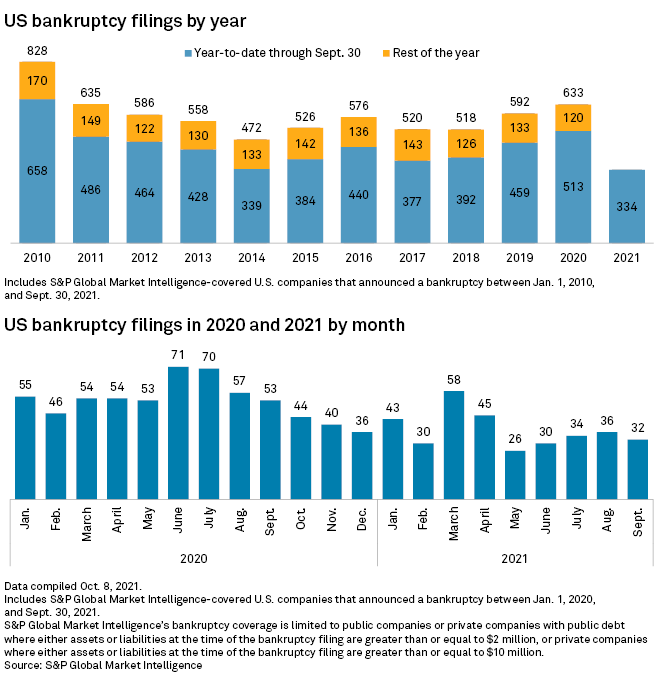

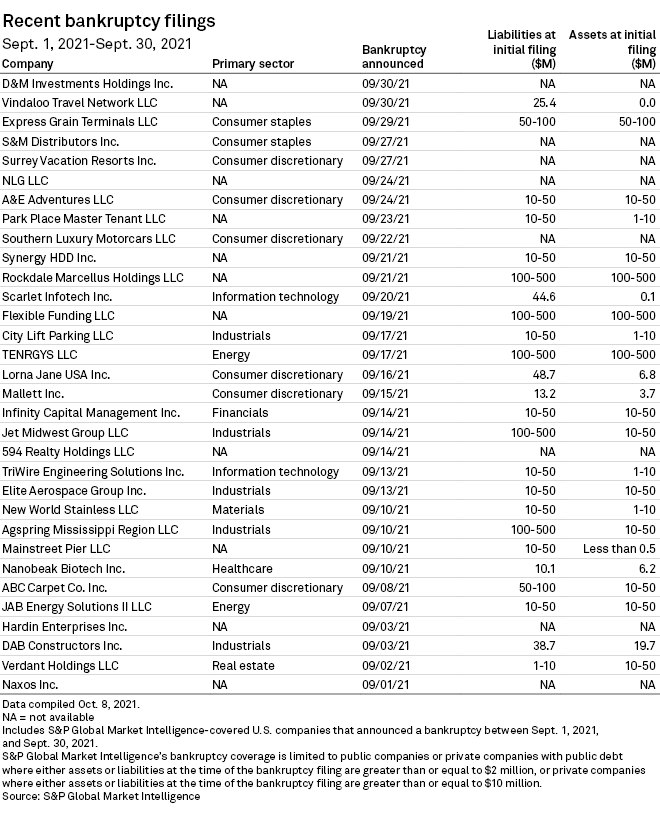

In September, 32 companies entered bankruptcy proceedings, a slowdown from 36 in August, according to S&P Global Market Intelligence data. In the first nine months of the year, 334 corporate bankruptcy cases were filed, a lower total than any of the previous 11 years.

Companies that struggled throughout the COVID-19 pandemic are being kept afloat by federal stimulus money and generous lenders. Those companies could face trouble in 2022 once those funds run out and credit conditions start to tighten as the Federal Reserve expects to wind down its ultra-loose monetary policy, experts said.

"I don't think you're going to see any uptick in bankruptcies until the second quarter of next year," said Robert Hirsh, a partner in Lowenstein Sandler LLP's bankruptcy and restructuring department.

Easy money

Easy access to credit is helping companies who otherwise might have filed for bankruptcy following a spike in filings during the worst days of the pandemic.

"Lenders don't want to declare defaults," Hirsh said.

The U.S. trailing-12-month rate of default among speculative-grade companies fell to an estimated 1.4% in September, down from 2.8% in August, according to S&P Global Ratings. Higher COVID-19 vaccination coverage, supportive government policies and easy funding conditions have contributed to the decline, Nicole Serino, associate director of credit markets research at Ratings, wrote in an Oct. 8 note.

Ratings expects the noninvestment grade default rate to be 2.5% by the end of June 2022.

Smaller companies with less access to capital markets are heading to courts more frequently than larger public companies, experts said. Since July, no companies have reported more than $1 billion in liabilities in bankruptcy petitions, according to Market Intelligence data.

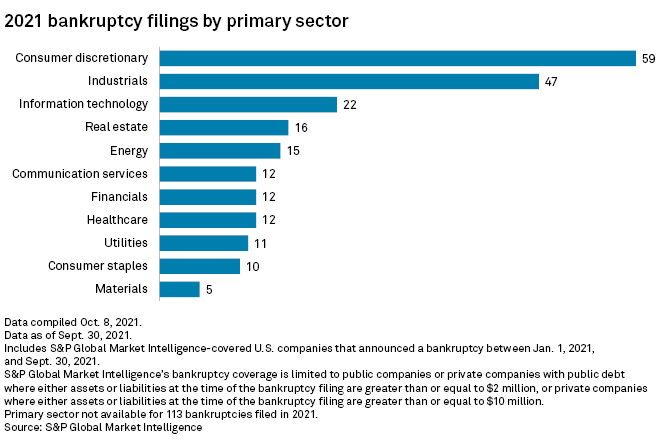

Bankruptcies in hard-hit consumer discretionary industries remain higher than other corporate sectors, with 59 filings so far in 2021. The sector largely comprises companies that sell goods and services viewed as nonessential, like vehicles and apparel, and shouldered much of the direct impact from pandemic-related lockdowns and restrictions.

Slow until 2022

Retailers may struggle to generate enough revenue after the critical holiday selling period to cover their current corporate and store cost structures, said Joseph Malfitano, founder and managing member of advisory firm Malfitano Partners. Companies might also face borrowing limitations, especially under loan programs tied to the liquidation value of their inventories.

"Absent a real need to get into court, we do not expect to see filings before the holidays," Malfitano said.

Borrowing costs are also expected to rise. The 10-year U.S. Treasury yield, a key indicator of long-term borrowing costs, has crept higher in recent days on expectations that the Federal Reserve will begin to taper its monthly securities purchases in November. Yields rise as bond prices fall.

Half of Fed officials also expect to raise interest rates by the end of 2022, according to projections released following the latest meeting of the central bank's rate-setting committee in September.

Those higher interest rates and a sustained jump in inflation could pressure more companies to turn to courts in 2022, especially if businesses have run out of stimulus, said Hirsh of Lowenstein Sandler.

"I don't think that happens until the middle of next year," Hirsh said.

Editor's note: This Data Dispatch is updated on a regular basis, and the last edition was published Sept. 2.

Bankruptcy figures include public companies or private companies with public debt with a minimum of $2 million in assets or liabilities at the time of filing, in addition to private companies with at least $10 million in assets or liabilities. Market Intelligence may remove companies from this list if it discovers that their total assets and liabilities do not meet the threshold requirement for inclusion.

Click here to download the charts.