S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

2 Nov, 2022

By Michael O'Connor and Chris Hudgins

U.S. corporate bankruptcies rose in October from the previous month, according to S&P Global Market Intelligence data.

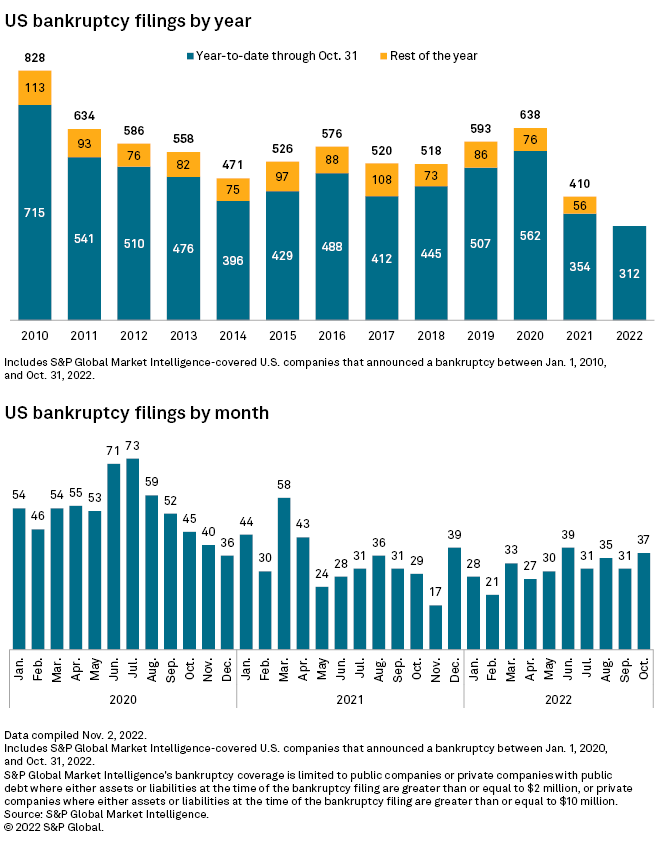

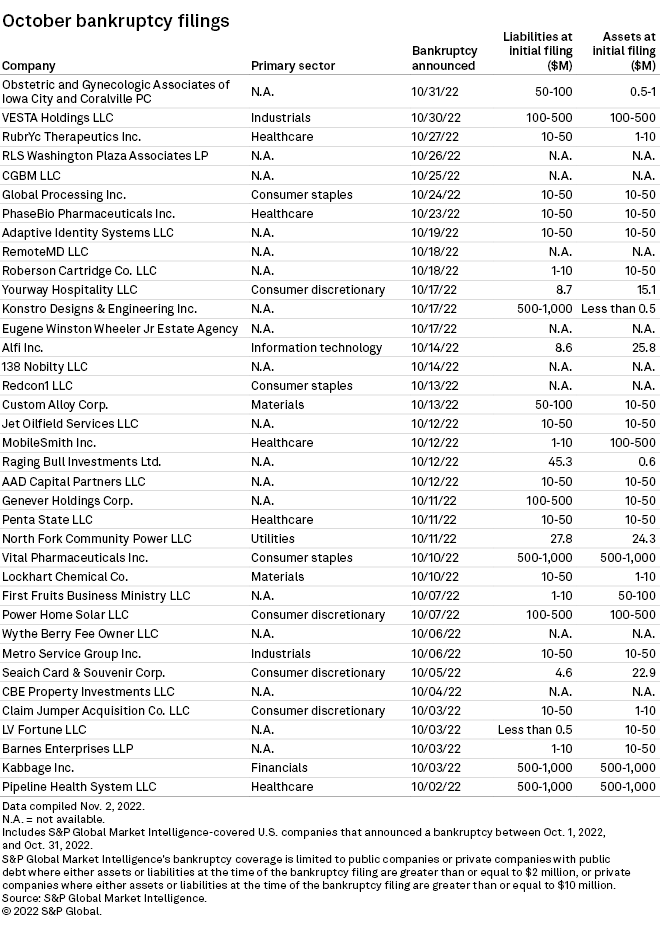

There were 37 bankruptcy filings in October, up from 31 in September. As of Oct. 31, 312 companies had filed for bankruptcy in 2022, fewer than any other comparable period going back to at least 2010.

Tightening financial conditions are expected to lead to a further slowdown of economic growth and exacerbate anticipated recessions, according to S&P Global Market Intelligence. A hot U.S. job market is defying the Federal Reserve's efforts to battle inflation through a series of aggressive interest rate hikes. The prospect of a divided government in the U.S. following the midterm elections would hamper the response to a recession.

Industrials maintains lead in filings

Industrials had the most filings for any sector, with 49 so far in 2022 as of Oct. 31.

The consumer discretionary sector has the second-most filings for the year, with 46 at the end of October. Inflation and other macroeconomic concerns were expected to negatively impact e-commerce titan Amazon.com Inc.'s holiday sales. Meanwhile, overall retail sales have failed to impress.

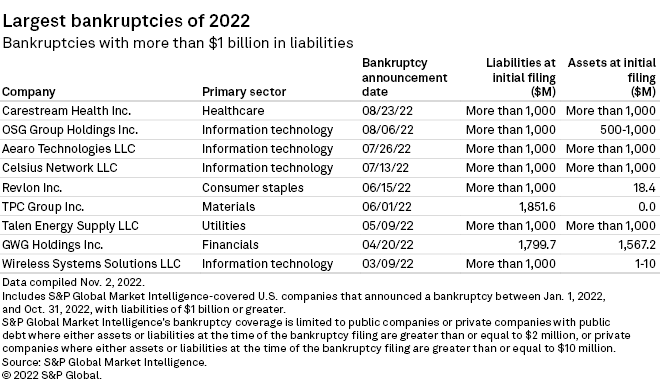

Dearth of larger filings

October had no bankruptcy filings with more than $1 billion in reported liabilities, marking the second straight month without a larger filing.

* Download the charts in Excel format.

* For retail-specific bankruptcy data, check out the monthly Retail Market Series.

Editor's note: This Data Dispatch is updated on a regular basis. The last edition was published Sept. 7.

Bankruptcy figures include public companies or private companies with public debt with a minimum of $2 million in assets or liabilities at the time of filing, in addition to private companies with at least $10 million in assets or liabilities. Market Intelligence may remove companies from this list if it discovers that their total assets and liabilities do not meet the threshold requirement for inclusion.