Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

7 Sep, 2022

By Michael O'Connor and Chris Hudgins

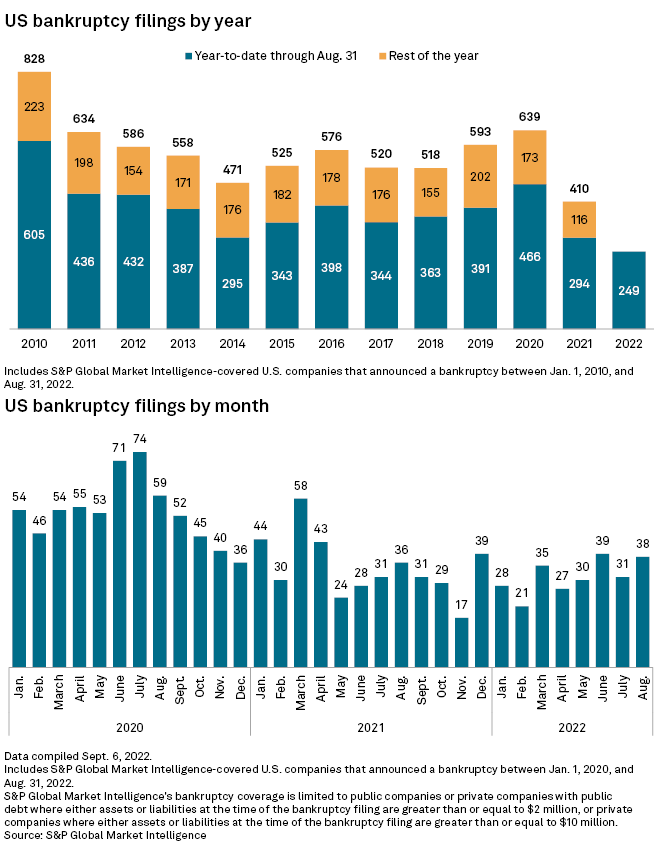

U.S. corporate bankruptcies rose slightly in August from the previous month, according to S&P Global Market Intelligence data.

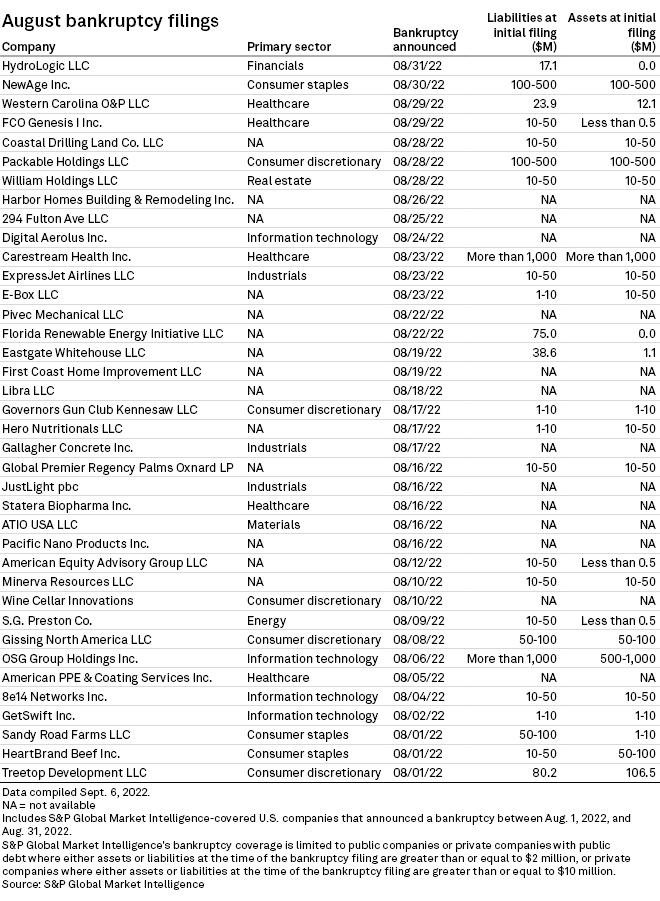

There were 38 bankruptcy filings in August, up from 31 in July. As of Aug. 31, 249 companies have filed for bankruptcy in 2022, fewer than any other comparable period going back to at least 2010.

Easy access to funding has kept struggling companies afloat during much of the pandemic.

This year, however, the Federal Reserve's interest rate hikes have limited credit availability, and banks have tightened lending standards likely due to worsening market conditions, according to a Sept. 1 S&P Global Ratings report.

"Loan suppliers believe that high inflation will lower borrowers' debt-servicing capacity, increasing their exposure to risk," the Ratings report said.

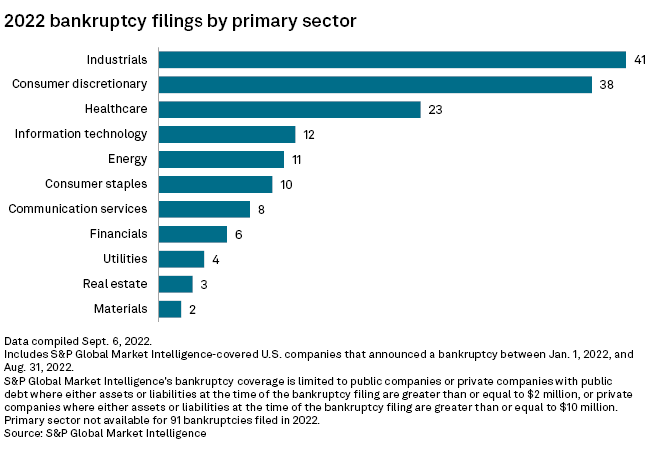

Industrials had the most filings for any sector with 41 so far in 2022 as of Aug. 31.

Announced bankruptcies during 2022 include companies in the airline, construction and engineering, and electrical components and equipment sectors.

The consumer discretionary sector has the second-most filings for the year, with 38 as of the end of August. An ongoing favorite among short sellers, consumer discretionary was the most shorted of all U.S. stock sectors in mid-August, though short sellers were backing away from the sector, suggesting that some in the market think inflation has peaked.

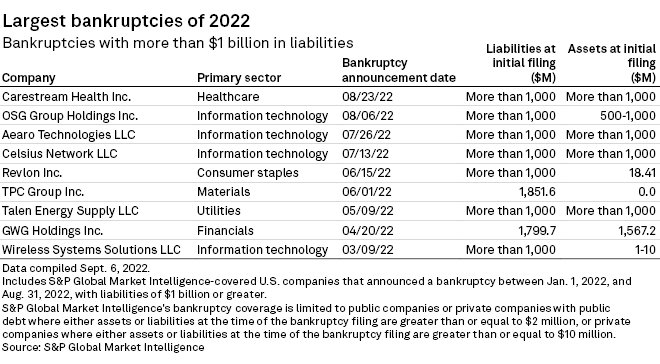

As with June and July, August added to the tally of larger bankruptcies in 2022. Two companies, healthcare equipment supplier Carestream Health Inc. and payment processor OSG Group Holdings Inc., filed for bankruptcy with more than $1 billion in reported liabilities. OSG Group emerged from bankruptcy Aug. 31 under a prepackaged reorganization plan, according to Market Intelligence.

* Click here to download the charts.

* For retail-specific bankruptcy data, check out the monthly Retail Market Series.

Editor's note: This Data Dispatch is updated on a regular basis and the last edition was published Aug. 4.

Bankruptcy figures include public companies or private companies with public debt with a minimum of $2 million in assets or liabilities at the time of filing, in addition to private companies with at least $10 million in assets or liabilities. Market Intelligence may remove companies from this list if it discovers that their total assets and liabilities do not meet the threshold requirement for inclusion.