S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

16 Mar, 2023

Bankrupt U.S. companies are increasingly asking courts to help them reorganize their struggling businesses in 2023.

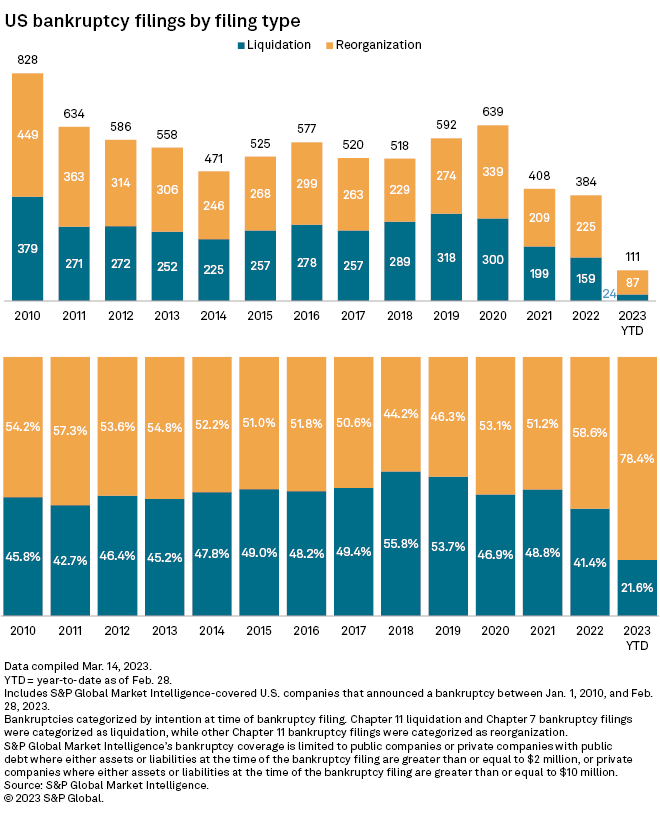

The percentage of the 111 corporate bankruptcy filings in the first two months seeking reorganization, 78.4%, is the highest in at least 14 years, according to S&P Global Market Intelligence data. Bankruptcies are rising from pandemic-era lows as companies face higher borrowing costs amid a jump in interest rates and stubbornly high inflation.

"As focus shifts toward capital preservation and cash flow efficiency, a challenging and higher-cost borrowing environment and decline in market liquidity are likely to fuel a broad-based increase in bankruptcies and financial and operational restructuring activity in the near term," consultancy PwC wrote in a February report.

Early 2023 filings heavily favor reorganization

Eighty-seven of the filings year-to-date came as Chapter 11 filings, which typically involve a company asking for a court to arrange payment of its debts and restructure the business. Chapter 7 bankruptcy filings, typically a method for companies seeking to liquidate their businesses to pay off debts, accounted for the remaining 24 filings, or 21.6% of the total.

Reorganization was the preferred form of bankruptcy filing in 2022 as well, accounting for 58.6% of the 384 total filings.

|

* For more bankruptcy analysis, check out the monthly Bankruptcy series. * For retail-specific bankruptcy data, check out the monthly Retail Market series. |

Bankruptcy filing type by sector

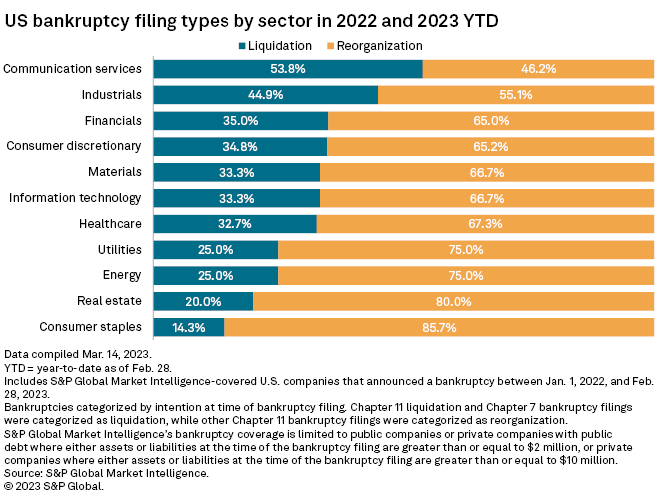

Companies from the consumer staples sector overwhelmingly favored reorganization over liquidation in 2022 and year-to-date 2023, with 85.7% of filings seeking reorganization.

The real estate sector followed, with four out of every five bankruptcy filings opting for reorganization. Some 75% of total filings for the energy and utility sectors also favored restructuring.

Communication services was the only sector with more liquidation filings than reorganization. Seven companies in the sector sought to liquidate, just one more than those looking to restructure.

Bankruptcy figures include public companies or private companies with public debt with a minimum of $2 million in assets or liabilities at the time of filing, in addition to private companies with at least $10 million in assets or liabilities. S&P Global Market Intelligence may remove companies from this list if it discovers that their total assets and liabilities do not meet the threshold requirement for inclusion.