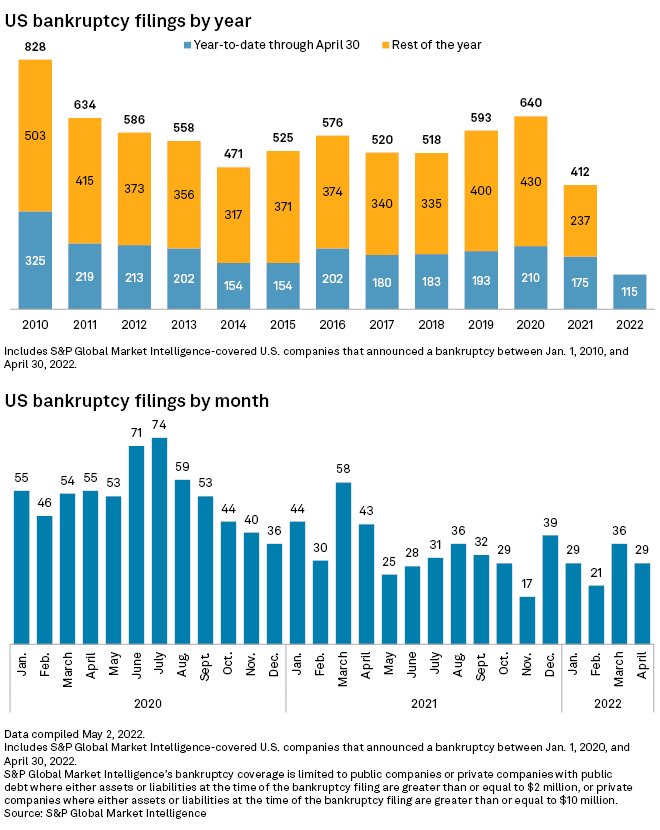

U.S. corporate bankruptcies fell slightly in April, as filings maintain the slow pace set so far in 2022, according to S&P Global Market Intelligence data.

There were 29 bankruptcy filings in April, a drop from 36 in March. The lower number of filings in April is consistent with the pace of filings in the first quarter of 2022 and in line with expectations the whole year will be a slow one for bankruptcies.

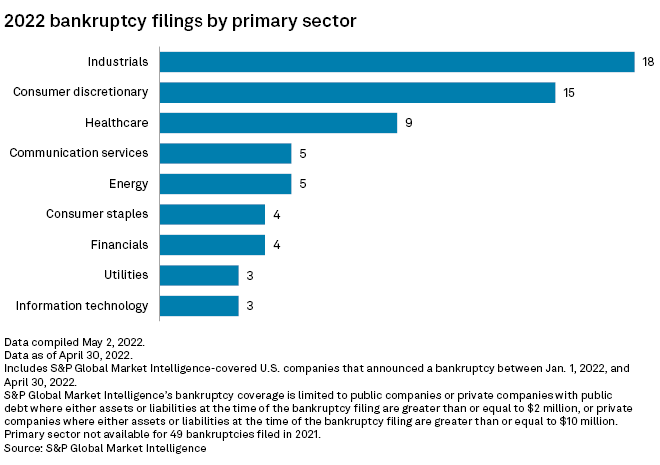

Industrials leads filings

The industrials sector continued to have the most bankruptcies so far in 2022, with 18 filings as of April 30. Announced bankruptcies in the sector in 2022 include companies in trucking, electrical components and equipment, and construction and engineering.

The construction equipment market remains tight, with new equipment pricing rising to record levels and rental rates accelerating as inventories remain low and supply challenges persist, according to an April 12 BofA Global Research report.

"A sign of caution is creeping in — the percentage of dealers reporting a 'growing' demand environment has softened," the report said.

The consumer discretionary sector had the second-highest number of bankruptcies as of April 30 with 15 filings.

U.S. retail sales narrowly missed expectations in March as shoppers confront surging inflation. Consumers are re-allocating their spending coming out of the pandemic away from material goods to services and experiences, and there are early signs of slowing consumption trends in various consumer discretionary segments, according to an April 12 Credit Suisse report.

Credit impacts minimal

The lower number of bankruptcies comes as U.S. companies showed resilience in the face of the escalating Russia-Ukraine conflict, rising interest rates, higher inflation and continued supply chain disruptions, according to an April 28 report by S&P Global Ratings.

The credit impact on U.S. companies from the Russia-Ukraine conflict has so far been neutral, with one downgrade and one upgrade directly linked to the conflict in the first quarter, Ratings said in its report. Overall, the first quarter of 2022 had more upgrades of corporate debt than downgrades, and there were fewer defaults than both the previous quarter and in the same period a year ago, according to Ratings.

"Above-trend economic growth and the falling rates of COVID-19 infections have continued to support credit quality," Ratings said in the report. "However, concerns for rising inflation, interest rates, and ongoing supply-chain challenges continue adding to credit headwinds and are already contributing to elevated volatility in U.S. capital markets."

Editor's note: This Data Dispatch is updated on a regular basis and the last edition was published April 6.

Bankruptcy figures include public companies or private companies with public debt with a minimum of $2 million in assets or liabilities at the time of filing, in addition to private companies with at least $10 million in assets or liabilities. Market Intelligence may remove companies from this list if it discovers that their total assets and liabilities do not meet the threshold requirement for inclusion.

Click here to download the charts.