Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

8 Nov, 2021

By Michael O'Connor and Chris Hudgins

Corporate bankruptcies have fallen to historic lows in 2021 thanks to open capital markets and a flood of liquidity keeping businesses afloat through the pandemic.

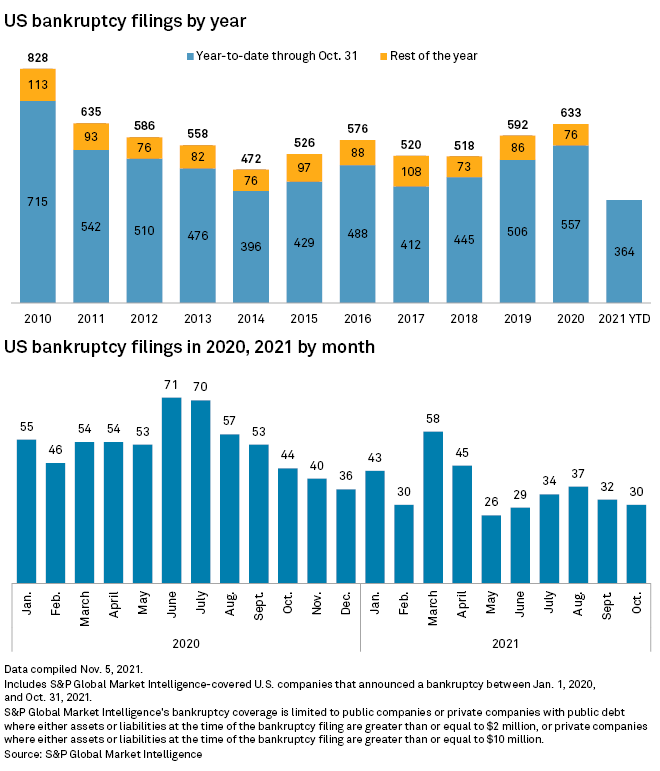

In October, just 30 companies entered bankruptcy proceedings, a slight decline from 32 in September, according to S&P Global Market Intelligence data, which excludes the smallest business filings. In the first 10 months of the year, 364 corporate bankruptcy cases were filed, lower than any of the prior 11 years and a drastic fall from the Great Recession era, when thousands of companies sought court protection each year. Looking forward, some restructuring professionals view rising inflation and tightening monetary policy as potential triggers for increased distress.

The government's response to the pandemic and the Federal Reserve's ultra-loose monetary policy upended predictions that the pandemic would trigger a bankruptcy increase. Instead, low borrowing costs have helped companies avoid restructuring and contributed to a boom in deal-making.

Companies that might otherwise need restructuring have been able to refinance out of their situations, according to Thomas Califano, a partner in the restructuring group at the law firm Sidley Austin LLP.

"A lot of government money went into various industries, and that gave people a shot in the arm," Califano said in an interview. "And then you've got an amazing amount of free capital out there that's being very aggressively lent."

Still, tightening monetary policy and rising inflation threaten distressed companies' ability to find new support.

The Federal Reserve's plans to pare back its bond-buying stimulus program will cut the amount of liquidity in market, according to Peter Young, a partner in the bankruptcy group at law firm Proskauer Rose LLP. Inflation is also running hot, potentially curbing consumer spending and adding pressure on the Fed to raise interest rates, Young said.

"Boom and bust credit cycles are certainly not extinct," Young said. "The bust cycle is undoubtedly going to return, and when it does there's going to be operational and financial distress in diverse industries affecting diverse businesses."

Big bankruptcies return

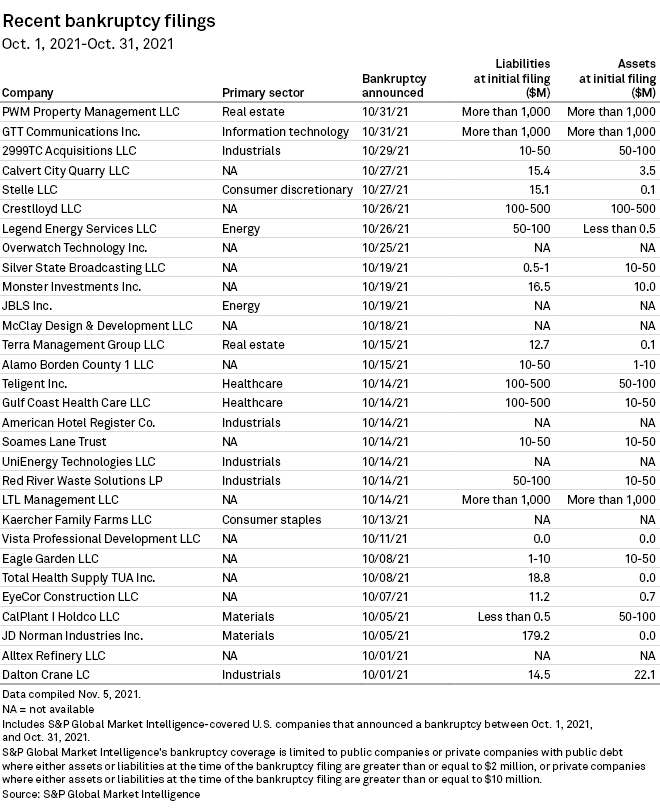

Three companies that entered bankruptcy proceedings in October listed more than $1 billion in liabilities at the time of filing, according to Market Intelligence data. They mark the first large filings since August, bringing the number of billion-dollar filings to 10 this year.

LTL Management LLC filed for bankruptcy on Oct. 14. The Johnson & Johnson subsidiary was created to hold and manage claims related to litigation over talc-based products, according to a company statement.

New York-based real estate company PWM Property Management LLC filed for bankruptcy Oct. 31, listing millions of dollars in claims related to state and local taxes, according to court documents.

GTT Communications Inc., a cloud networking services provider, filed a previously announced prepackaged reorganization plan Oct. 31.

More retail pain

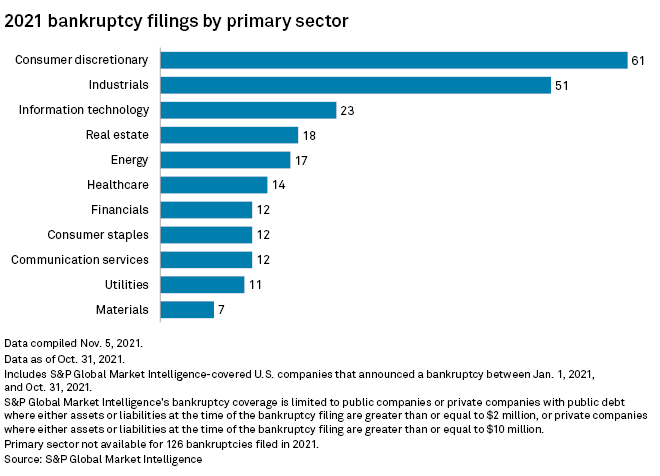

Consumer discretionary companies have had the most bankruptcies so far this year. The stakes for the sector are high as the holiday shopping season gets underway and supply chain issues bedevil retailers.

Inventory challenges will force many companies to miss out on the most important part of their year, according to Felicia Gerber Perlman, global head of restructuring and insolvency at the law firm McDermott Will & Emery LLP. The longer-term question for retailers is whether they adjusted operations well enough in response to new spending patterns as a result of the pandemic, Perlman said in an interview.

"A lot is going to be tied to supply chain and who is able to get their product to the consumer and who isn't," Perlman said. "And that is, I think, a problem that is continuing for longer than people thought it would."

Editor's note: This Data Dispatch is updated on a regular basis; the last edition was published Oct. 11.

Bankruptcy figures include public companies or private companies with public debt with a minimum of $2 million in assets or liabilities at the time of filing, in addition to private companies with at least $10 million in assets or liabilities. Market Intelligence may remove companies from this list if it discovers that their total assets and liabilities do not meet the threshold requirement for inclusion.

Click here to download the charts.