S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

28 Jul, 2021

By Michael O'Connor and Chris Hudgins

The slowdown in U.S. corporate bankruptcies is likely to persist through the end of 2021, experts say, as easy access to credit and the reopening economy have so far kept filings at a near-low for the last decade.

"The trend will continue for a while with companies bumping along, barely surviving but for access to capital and not filing for bankruptcy," said James Gellert, CEO of the financial data technology firm RapidRatings, in an interview.

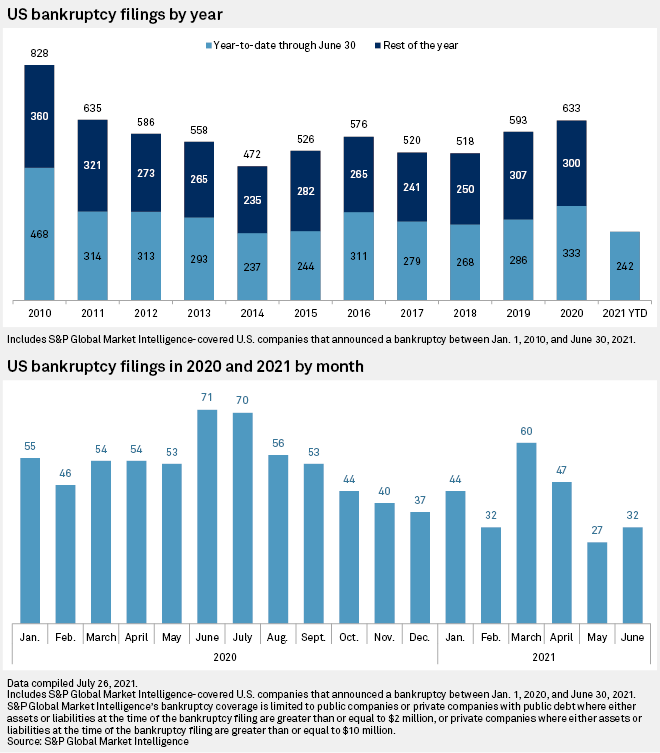

In June, 32 new corporate bankruptcy cases were filed, a slight uptick from the 27 filed in May but less than half of the 71 filings in June 2020, according to S&P Global Market Intelligence data. The slowdown compared to prior years brought the 2021 total as of June 30 to 242 cases, a drop from each of the prior 11 years except for 2014.

Cheap credit and flexible lenders continue to provide avenues for companies to avoid bankruptcy, and there are few signs suggesting the situation will change anytime soon. There may not be much activity in the coming months but the economic rebound and any changes in lender behavior will be key in whether the slowdown continues, experts said.

Corporate filings in 2021 have defied earlier expectations that the pandemic would continue to push waves of companies into bankruptcy, even after a greater number of companies rushed to courts in 2020. Federal stimulus money proved crucial in keeping many companies afloat and widespread access to cheap capital also helped. The lifting of lockdown restrictions drove consumer spending and encouraged investors to get more money off the sidelines.

Borrowing costs remain low, stocks keep rallying and the pandemic continues a steady, albeit reluctant, retreat. Barring some new shock to the system, a slow and rising tide of distress where individual companies go underwater one by one is more likely than big waves crashing across industries that many had envisioned, said Cynthia Romano, a global director of CohnReznick's restructuring and dispute resolution practice, in an interview.

"It's inconceivable right now to think of a short term in which capital dries up," Romano said. "There is just so much of it from so many sources."

A lot of equity firms are chasing a small number of deals, so the market is highly competitive from a funding and buying perspective and all kinds of lenders are looking to put their money to work, Romano said. Stimulus money continues to create liquidity "even in situations when operating metrics are upside down," Romano said.

Investment-grade companies are expected to continue tapping into demand for their debt in the second half of the year, and high-yield debt also has seen above-average demand, with high-yield bond sales into U.S. markets up 32% year over year as of July 23 to $305.94 billion, according to LCD.

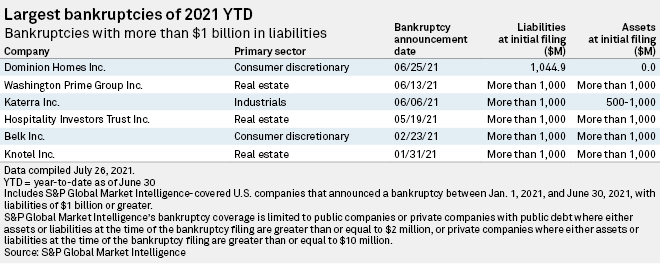

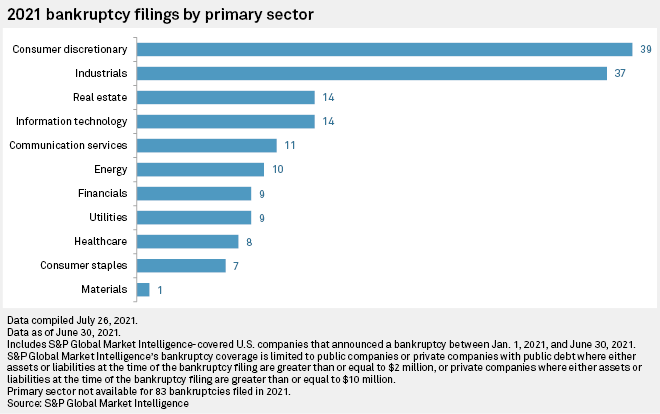

Industrial companies have had a higher number of bankruptcies in 2021 compared with other sectors. SoftBank Investment Advisers (UK) Ltd.-backed construction company Katerra Inc. filed one of the biggest bankruptcies of the year June 6 with liabilities in the range of $1 billion to $10 billion, according to S&P Capital IQ.

In a June 6 statement announcing its bankruptcy and restructuring, Katerra said the COVID-19 pandemic hit the construction industry and the company was unable to procure bonding for projects in addition to unsuccessful attempts to get more capital and business.

Industrial companies are struggling to hire workers, dealing with higher materials pricing and managing supply chains still reeling from the disruptions caused by the pandemic, said Scott Avila, a partner at advisory firm Paladin, in an interview.

Blue-chip companies selling finished products are not at risk of distress, but smaller competitors and suppliers of raw materials are, said Patrick Donnelly, a senior analyst at Third Bridge, in an interview. Cash flow for suppliers dried up during the pandemic when major manufacturers stopped their assembly lines and the pressure on supply chains is still playing out, Donnelly said.

"There will be lingering risk throughout 2021 and into 2022," Donnelly said.

LCD is an offering of S&P Global Market Intelligence.

Editor's note: This Data Dispatch is updated on a monthly basis and the last edition was published June 7.

Bankruptcy figures include public companies or private companies with public debt with a minimum of $2 million in assets or liabilities at the time of filing, in addition to private companies with at least $10 million in assets or liabilities. Market Intelligence may remove companies from this list if it discovers that their total assets and liabilities do not meet the threshold requirement for inclusion.

Click here to download the charts.