S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

5 Jan, 2021

By Tayyeba Irum and Chris Hudgins

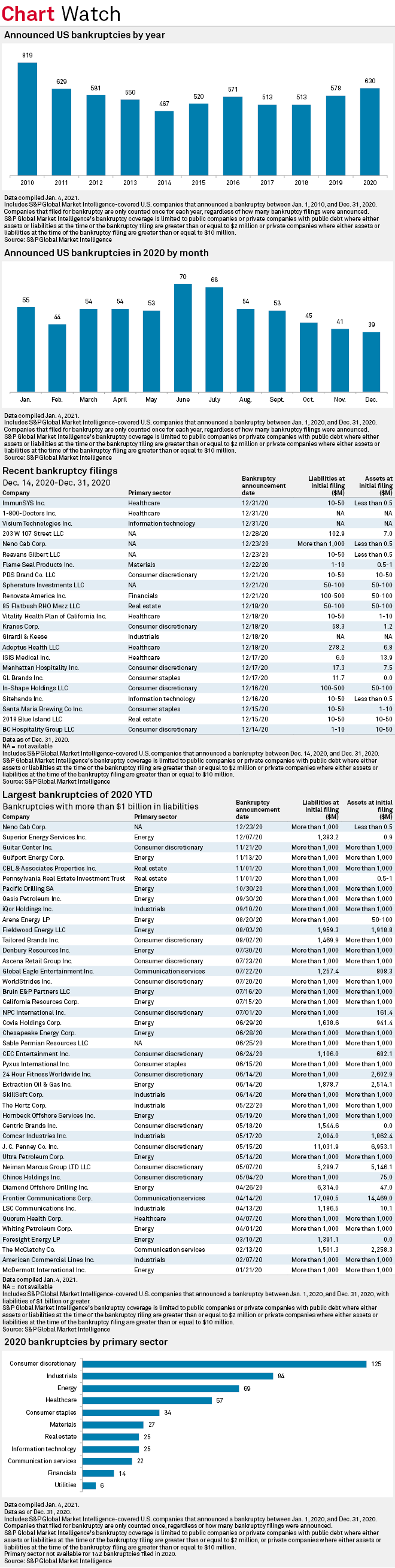

U.S. corporate bankruptcies reached their worst levels in 10 years in 2020 as the coronavirus pandemic upended global industries and struggling companies faced their breaking points.

A total of 630 companies declared bankruptcy in 2020, according to an analysis by S&P Global Market Intelligence. This surpassed the number of filings in every year since 2010.

Market Intelligence's analysis is limited to public companies or private companies with public debt where either assets or liabilities at the time of the bankruptcy filing are at least $2 million. Private companies without public debt must report at least $10 million in either assets or liabilities at the time of filing.

Several high-profile companies, especially those relying on consumer spending, turned to bankruptcy courts in 2020 as the coronavirus crisis suppressed economic activity. These included Neiman Marcus Group Inc., J. C. Penney Co. Inc., Ascena Retail Group Inc., Tailored Brands Inc., Fieldwood Energy Inc. and Chesapeake Energy Corp.

During Dec. 14-Dec. 31, 2020, 23 companies went bankrupt. Neno Cab Corp., financing solutions provider Renovate America Inc. and Adeptus Health LLC, which operates a network of independent emergency rooms, were among those that sought court protection. Overall in 2020, December recorded the lowest number of monthly filings at 39.

Editor's note: This Data Dispatch is updated on a biweekly basis and the last edition was published Dec. 15. Market Intelligence may remove companies from this list if it discovers that their total assets and liabilities do not meet the threshold requirement for inclusion. Click here to download the charts.