Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

5 Mar, 2021

By J. Holzman

|

Members of the San Carlos Apache Nation protest outside the U.S. Capitol on July 22, 2015, against a potential land swap that would give the proposed Resolution copper mine access to Oak Flat, an area of Arizona held sacred by the tribe. |

The Biden presidency in the U.S. was expected to bring about enthusiasm for the green revolution and the metals to fuel it. But faced with a decision to permit one of the most valuable mining projects in the country, the new administration sided with environmentalists and Indigenous rights activists.

The U.S. Agriculture Department's decision to withdraw approval for the proposed Resolution copper mine in Arizona was the Biden administration's first politically contentious action on mining. With other U.S. mines in development also expected to test the Biden administration, mining companies should anticipate new hurdles for their projects if the Resolution decision is any indicator of the administration's direction.

The decision is unlikely to have a "huge impact in the near-term" for U.S. copper mining but "if this asset gets shut down completely, that's a signal," S&P Global Market Intelligence principal metals and mining research analyst Kevin Murphy said in an interview. In this case, the U.S. appear to be trying to avoid a "foul up" akin to the 2020 scandal when it was revealed that Rio Tinto had blasted ancient Indigenous caves in Western Australia during a mine expansion.

"It is in a very sensitive location in terms of land use, even though it is an underground mine and it is going to have relatively little surface disruption compared to an open pit," Murphy said. "Hopefully, it doesn't escalate into a complex story."

The Resolution project is a 55/45 joint venture between Rio Tinto and BHP Group. Even before the land exchange was nulled, executives were warning investors that there could be substantive delays. Rio Tinto CEO Jakob Stausholm said on a Feb. 17 earnings call that while the Trump administration approval of the exchange was an "important step," the company was "a number of years away from being in a position to consider sanctioning a full development."

"We will continue to engage in the process determined by the U.S. government and are committed to ongoing consultation with Native American tribes and local communities," Matthew Klar, a spokesperson with Rio Tinto subsidiary Resolution Copper, said in a March 1 email. The subsidiary is still reviewing the withdrawal decision, Klar said.

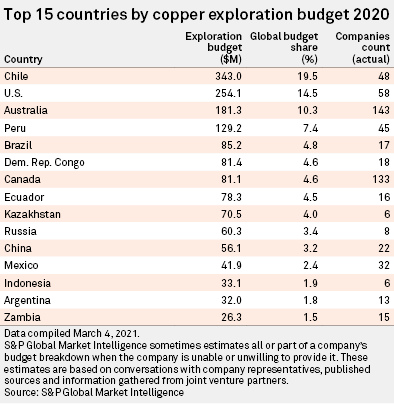

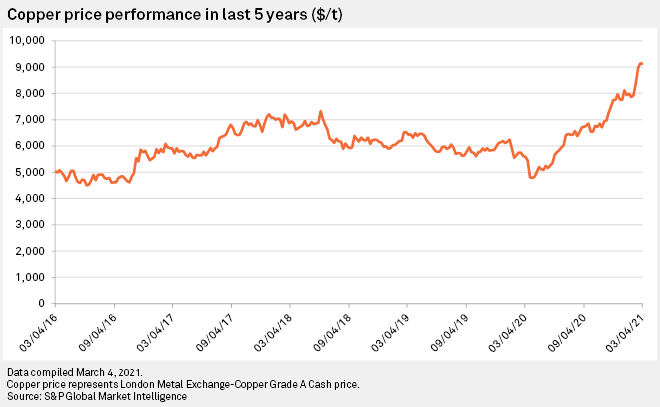

The U.S. is a hub of copper exploration and home to some of the most valuable copper mines in development, including the Resolution project, according to Market Intelligence data. A recovery in global copper demand is forecast to push the market into deficit in 2021 and result in a further spike in copper prices.

Amid these predictions, Freeport-McMoRan Inc. is expected to approve expansions for at least three of its U.S. copper mines. The company expects the move to add more than 250 million pounds of copper to annual production, Freeport CEO Richard Adkerson said in a February interview with Reuters.

"President Biden clearly has a commitment to addressing climate change, and any climate change initiative creates demand for copper," Adkerson told Reuters. "We're very well-situated to address that with the assets we have."

The Freeport expansions will be less risky because the company has already obtained necessary permits, Murphy noted. "The U.S. will always be a producer of copper with Freeport's mines," Murphy said.

Other projects may not be as safe. The next big test for Biden on copper mining will be the Maturi project in Minnesota led by Antofagasta PLC subsidiary Twin Metals Minnesota LLC. Maturi hosts resources containing about 11.7 million tonnes of copper, according to Market Intelligence data. The deposit also hosts nickel and platinum group metals.

Like Resolution, Maturi has faced considerable opposition from environmental groups. The project borders the Boundary Waters Canoe Wilderness Area within the Superior National Forest. A renewal of leases for the mine was vetoed under former President Barack Obama due to water pollution concerns.

While the Maturi project made considerable headway under former President Donald Trump, the official now tasked with giving clearances for the mine will be U.S. Agriculture Secretary Tom Vilsack. Vilsack served in that role under Obama and was the official overseeing the U.S. Forest Service when the agency canceled the renewal of the Maturi leases.

AllianceBernstein analysts said in a Feb. 1 note that 72 copper projects worldwide are of the scale to contribute 1% or more to global copper supply and that if all 72 projects were brought to production, it would add 192% to global copper output. But the "strong majority" of projects are in the pre-feasibility or scoping stages, they wrote. The analysts tagged the Maturi and Resolution developments with an "orange" traffic light label, meaning their final outcomes are "closer to a coin toss than a clear direction."

"Although the potential absolute volume in projects puts copper at moderate risk of a wave of supply, we show that many of these projects are unlikely to come to the market," AllianceBernstein analyst Danielle Chigumira said in a March 2 email.