S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

10 Nov, 2022

Share buybacks will be an increasingly important tool for boosting earnings per share in 2023 as U.S. public companies use cash to reduce share count rather than grow their businesses.

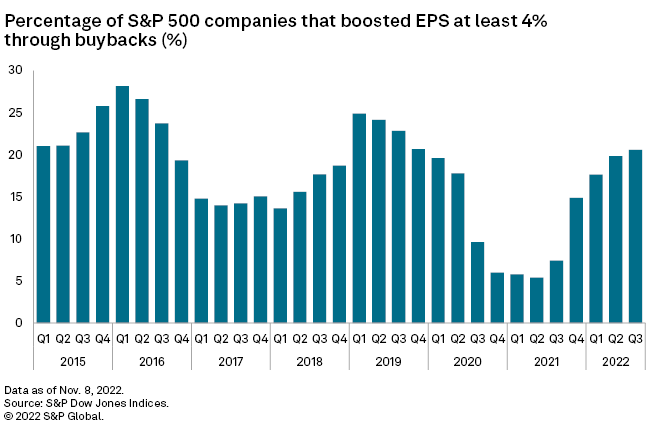

More than one in five S&P 500 companies — 20.6% — increased their earnings per share by at least 4% year over year in the third quarter of 2022 by reducing their share count, the highest level since 2019, according to data from S&P Dow Jones Indices. S&P 500 companies bought $1 trillion worth of their own shares in the year ending in June, a record total for a 12-month period.

Dow Jones Indices expects the pace of buybacks to have slowed in the third quarter to $214.7 billion — down from $234.6 billion a year earlier — but a rebound is expected in the fourth quarter as companies race to beat a new 1% tax on buybacks that comes into force in 2023. The U.S. could also enter a recession in the fourth quarter, and the Federal Reserve's aggressive rate-hike push is making borrowing more expensive as inflation continues to soar.

"The alternatives of spending cash on growth capital expenditures or M&A look less attractive against a weak economic backdrop," said Michael Russell, U.S. equities portfolio manager at Federated Hermes Ltd.

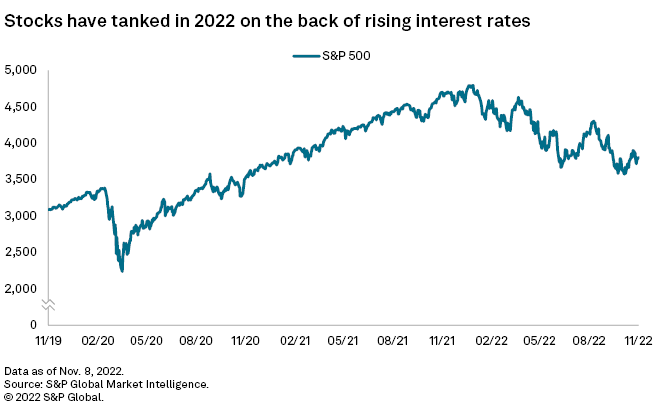

Markets fall

Rising interest rates have hammered stock prices. The S&P 500 is down 20.8% in 2022 and, while that level is up 7% from its mid-October low, lingering inflation continues to add to cost pressures for companies and places a strain on consumers' spending power, suggesting further pressure on stocks.

"Buybacks have the potential to support share prices through reducing the share count and provide a signal to investors that management feel the share price is undervalued," Russell said.

Cash levels have been falling relative to liabilities, yet earnings have not been as bad as some had feared. With the exception of Meta Platforms Inc., the bigger players in the buyback market are still well-positioned to repurchase shares.

"The money is still there and the cash flow is still there" said Howard Silverblatt, senior index analyst

Tech and energy likely to remain strong

Buybacks have been increasingly important for corporate earnings per share as the value of stocks has fallen. The percentage of S&P 500 companies improving their EPS by more than 4% in a quarter through share reduction has grown from a low of 5.4% in the second quarter of 2021.

Dow Jones Indices projects the rate to remain above 20% in the fourth quarter. Strategies will differ by sector.

|

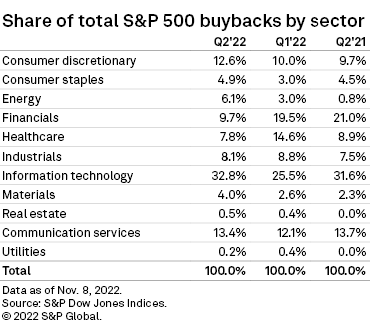

Financials are traditionally a strong source of buybacks, but they pulled back in the second quarter with total buybacks of $21.2 billion, down from $54.7 billion in the first quarter. In the third quarter, JPMorgan Chase & Co., typically one of the main proponents of share repurchases, revealed it did not buy back any shares at all.

"A lot of them are concerned. They're protecting their dividends by not doing buybacks," Silverblatt said.

By contrast, the highly cash-generative tech sector is likely to continue to buy shares through the fourth quarter and into 2023. Apple Inc. is the biggest purveyor of buybacks and has been for a decade, spending $557.39 billion in the 10 years up to the second quarter of 2022, more than the total market capitalization of 494 of the S&P 500 companies.

But the story is not universal.

"It's no secret that Meta is in trouble," said Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown. "As advertising demand slows dramatically, costs mount up and users are lured away by the Pied Piper tunes of TikTok."

Meta bought back $6.24 billion in shares in the second quarter and reported another $6.55 billion in repurchases in the third quarter. That is a slower pace than the $53.27 billion purchased in the 12 months through June. Meta is unlikely to continue purchasing shares at higher volumes as the company announced it was laying off 11,000 of its 87,000-strong worldwide workforce, Silverblatt with Dow Jones Indices said.

By contrast, energy companies are luxuriating in cash as high oil and gas prices have helped boost profits. Exxon Mobil Corp. was the sixth-largest issuer of share buybacks in the second quarter at $3.92 billion, this was up from $0 a year earlier. The energy sector doubled from 3% of total buybacks to 6.1% in that time.

1% tax

The introduction of a 1% tax on buybacks in 2023 has pushed many companies to accelerate buybacks into the fourth quarter to avoid the charge. October was a busy month for shares repurchased, according to Dow Jones Indices.

"The 1% tax that we're going to have next year is not really that much. It's less than half a percentage point on the earnings," Silverblatt said. "The bottom line is it's no more than a trading error on buybacks. A half a percent is 'what time did I buy it?'"