S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

17 Jul, 2023

By Peter Brennan and Umer Khan

US corporations cut costs in the first quarter of the year as rising interest rates and a weakening economy worsened operating conditions.

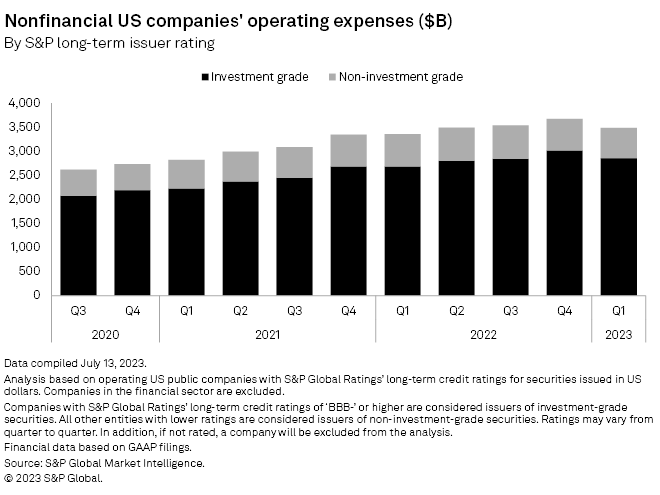

The total operating expenses of companies rated investment grade by S&P Global Ratings fell 5.3% in the first quarter to $2.858 trillion, indicating companies reduced day-to-day running costs such as wages and business travel.

Cost cutting

Companies with weaker balance sheets also trimmed costs. Total operating expenses of non-investment-grade companies fell 3.8% from the fourth quarter of 2022 to $628.71 billion, according to the latest data from S&P Global Market Intelligence.

The energy and consumer discretionary sectors were particularly active in cutting costs with declines of over 13% and 10%, respectively, among the investment-grade tranches. Non-investment-grade companies in both sectors made similar cuts, at 13.4% and 8.6% reductions in operating costs from the previous quarter, respectively.

Ratios

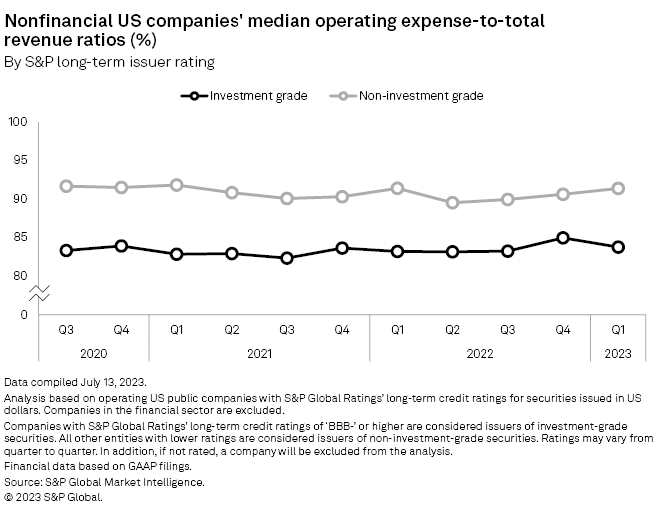

The decline in expenses lowered the median ratio of operating expenses to total revenue for investment-grade-rated companies to 83.8% from 85.0% at the end of 2022.

By contrast, the cuts by lower-rated companies were not enough to lower the median ratio, which rose to 91.4% from 90.6% as revenues were hit harder. The most notable rises in the ratio were in real estate, communication services and information technology.

The energy sector reported the lowest median ratios at 70.6% for investment-grade companies and 71.7% for their lower-rated peers.