S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

13 Sep, 2021

|

A truck hauls coal across a large surface mine in the Powder River Basin. Stock prices of U.S. coal producers have been rising in recent weeks alongside improving demand and higher prices. |

U.S. coal companies' stock prices have rallied in 2021, and producers of the bulk commodity could book significant positive free cash flow in the second half of 2021 and in 2022.

Coal demand from power producers and steelmakers has been rebounding from lows hit during the beginning of the COVID-19 pandemic, in part due to high natural gas prices and expectations of increased infrastructure spending.

In its latest short-term energy outlook, the U.S. Energy Information Administration forecast that coal's share of electricity generation will rise from 20% in 2020 to about 24% in 2021. The agency projected that coal production will increase by 66 million tons to 601 million tons in the same period.

Chance to lower debt

Meanwhile, Moody's Investors Service estimated that U.S. coal producers will create more than $1 billion in positive free cash flow in the second half of 2021 and in 2022, before dividends on a combined basis, compared to less than $100 million generated during the first half of 2021.

"It sets the stage over the next year and a half for the coal industry to potentially reduce a meaningful amount of debt," Benjamin Nelson, global lead analyst for coal at Moody's, said in an interview. "As we move into the end of the year, with companies layering in contracts, we should be able to get a little more certainty around what that free cash flow might look like, but it's going to be quite a bit stronger than what we observed in the first half of [2021]."

With the infusion of free cash flow expected in the coming months, the U.S. coal industry has the opportunity to cut between one-fifth and one-fourth of approximately $5 billion in debt, Nelson wrote in a recent note.

Coal's past struggles

The sector experienced restructuring waves over the past decade, with at least 73 bankruptcy petitions filed by U.S. coal companies since 2012, according to an S&P Global Market Intelligence count. While the coal industry purged much of its debt in restructurings, it also focused heavily on share repurchases and dividends during an upcycle in coal prices in 2017 and 2018. That left many producers in a tight spot heading into a pandemic that disrupted demand and supply chains.

Nelson said this cycle is likely different as companies are expected to lean far more on debt reduction when allocating capital, as risks around environmental, social and governance issues still present a problem for coal producers in the long term. Significant environmental reclamation obligations remain on the horizon, secular decline in domestic demand continues and coal companies still struggle to access capital for new projects, consolidation or refinancing.

"The industry's appreciation of the coming ESG storm was much less present," Nelson said. "I think the industry understands that access to capital is a far bigger challenge than it was even several years ago."

Still, conditions have vastly improved for the U.S. coal sector in recent months. For example, the market signal probability of default for coal producers spiked in the early days of the pandemic but has been substantially lower through 2021 after falling in the second half of 2020. In addition, the probability of default for U.S. coal companies fell below that of the broader energy sector for a few months in 2020 and has again been holding lower since mid-July as demand for the fuel improves.

The measure of default probability is based on a model devised by the Credit Analytics branch of S&P Global Market Intelligence and represents the average of the one-year probability of default scores for U.S. public companies within each sector that trade on the NYSE, Nasdaq or NYSE American. The scores are based primarily on share price volatility and incorporate country- and industry-related risks.

S&P Global Ratings analyst Vania Dimova said coal companies have already been signaling debt repayment as priority number one as they brace against potential difficulties in finding new sources of capital.

"This is basically a long-term effect, and it's slowly changing the industry towards lower leverage, towards alternative sources of financing and towards more conservatism," Dimova said.

S&P Global Ratings has stable outlooks for some coal producers such as Alliance Resource Partners LP and Consol Energy Inc. Still, none of the publicly traded U.S. coal companies covered by S&P Global Ratings held an investment-grade credit rating as of Sept. 6. Canadian coal producer Teck Resources Ltd. is rated BBB-, but it is also diversified into other sectors including copper mining.

Metallurgical coal focus

The recent rise in coal prices could be particularly useful to coal producers in the process of transitioning to a focus on metallurgical coal for steelmaking and away from the thermal coal sold to power generators to make electricity, Dimova said.

Amid higher prices, several U.S. companies are poised to increase metallurgical coal production in the coming months. Peabody Energy Corp. recently struck a labor deal that could restart a mine in Alabama, and Warrior Met Coal Inc. could increase production if it resolves a strike at its operations in the state. Arch Resources Inc. is starting up a mine in West Virginia that would serve steelmakers, while other metallurgical coal producers such as Alpha Metallurgical Resources and Coronado Global Resources Inc. have indicated that production levels are increasing.

Metallurgical coal "has been one of the best-performing commodities over the last several months" and continues to show "compelling supply/demand fundamentals," B. Riley FBR analyst Lucas Pipes wrote in a Sept. 2 note.

"We see a more balanced market in 2022 and 2023," Pipes wrote. "However, given the lack of major supply projects, depletion, permitting challenges for new projects and lack of investor appetite for new mine developments, we believe that the supply side could underperform and prove our price deck overly conservative."

Despite a sharp recovery in metallurgical coal prices, coal producer equities are lagging those improvements, creating some "excellent value" in the space, Pipes wrote. The analyst also outlined increased target prices for Arch, Ramaco, Peabody, Warrior, Alpha and Teck.

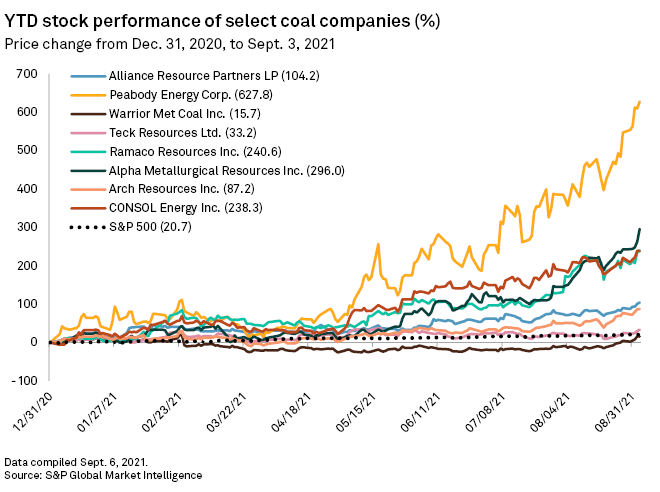

Peabody's stock rose over 627.8% from the beginning of the year to Sept. 3, while the S&P 500 climbed just 20.7%. Ramaco Resources Inc., Alpha and Consol stock prices increased by 200% to 300% in the same period.

This S&P Global Market Intelligence news article may contain information about credit ratings issued by S&P Global Ratings. Descriptions in this news article were not prepared by S&P Global Ratings.