S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

6 Oct, 2021

| Duke Energy brought its Asheville combined-cycle natural gas plant fully online in early 2020. The company sees the plant as an important part of a diverse fleet that can offset market volatility. Source: Duke Energy Corp. |

Soaring U.S. natural gas prices have prompted power plant owners to evaluate whether to ramp up other sources of generation, such as coal, and provided a short-term boost for renewables.

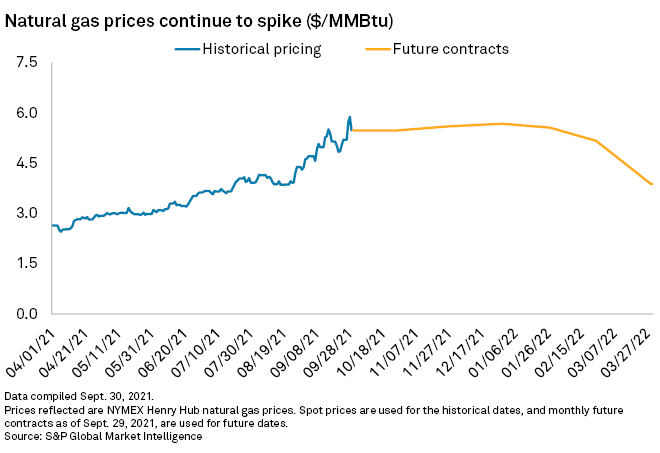

Rising demand as the U.S. economy rebounds from the coronavirus pandemic and tight supply exacerbated by Hurricane Ida in the Gulf Coast have driven Henry Hub natural gas prices to nearly double over the past four months and almost triple from a year ago, closing September at $5.87/MMBtu. With Europe facing a major supply crunch, industry observers have raised concerns that the fuel's prices will continue in the $5/MMBtu range in the U.S. this winter with the potential to hit $10/MMBtu if weather conditions change sharply.

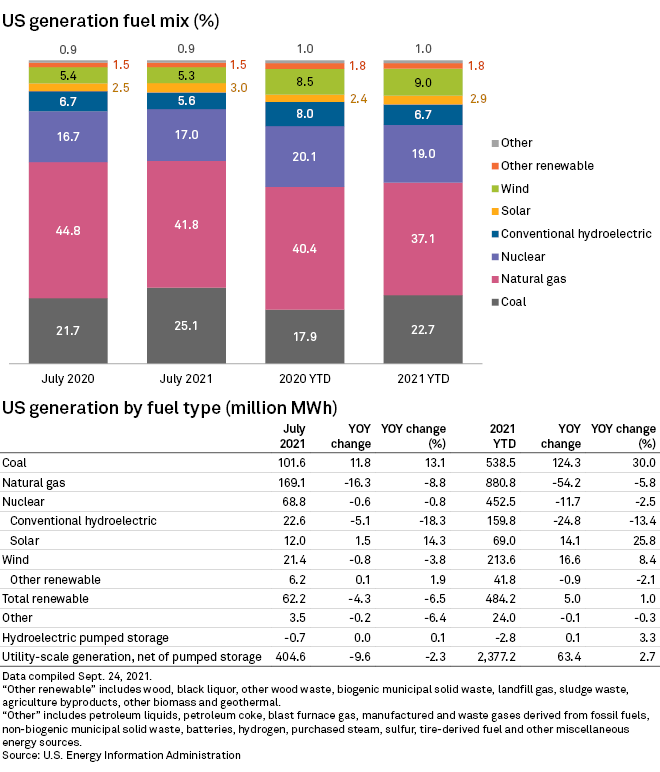

As a result, America's power mix in 2021 so far reflects lower gas use, a comeback year for coal, continued rapid expansion of solar and modest growth for wind. Natural gas generation was down 5.8% through the first seven months of 2021 compared with last year, according to the U.S. Energy Information Administration's most recent data. That decline came even as conventional hydroelectric generation shed 13.4% over the period stemming from extreme drought conditions across much of the Western United States — conditions that would seem ripe for more gas, not less.

Instead, the country's coal generation jumped 30% through July, while solar output rose nearly 26% and wind power increased 8.4%.

"Certainly, increasing gas prices are going to help pump demand for solar, no question," Kevin Smith, Lightsource BP Renewable Energy Investments Ltd.'s CEO of the Americas, said in an interview. "Stand-alone solar and solar with storage are extremely competitive right now against natural gas."

The renewable energy venture of oil and gas giant BP PLC, with a U.S. solar portfolio of nearly 10,000 MW, is seeing some customers pivot toward solar based purely on price, especially in southeastern states lacking renewable energy mandates, Smith added.

Looking to 'other options'

Utilities acknowledge they are leaning more on other resources amid 2021's inflating gas prices.

"We do see some switching from natural gas to coal on the margins for our dispatch," Nelson Peeler, senior vice president of transmission and fuels strategy and policy for Duke Energy Corp., told S&P Global Market Intelligence.

Duke Energy's diverse fleet of power plants and renewables allows the company to utilize this generation "switching" to help offset the higher gas prices, which have nearly doubled since January, Peeler said.

"So, when the different prices of those different types of resources change, then the order in which we use them changes," Peeler said. "What that essentially means [is] if natural gas prices rise, then we would use more of the other [sources] because they would become more economic typically. In the case of natural gas rising this year, for the most part, it means that coal is more competitive on a marginal basis."

A spokesperson for Dominion Energy Inc. pointed out that about half of the company's generation mix is tied to natural gas. The Richmond, Va.-headquartered utility also touts the diversification of its fleet, including four nuclear plants, as key to offsetting price volatility.

"When natural gas spikes, we've got other options that we can leverage," Dominion spokesperson Rayhan Daudani said, adding that the Virginia utility operates in a regulatory environment that allows it to smooth out higher fuel prices over time.

In such times of price volatility, PacifiCorp relies on certain hedging strategies to mitigate the impacts across its six-state service territory in the Western U.S., David Eskelsen, a spokesperson for the Berkshire Hathaway Energy affiliate, said in an email. Eskelsen declined to say whether this years' volatile gas prices were resulting in heavier reliance on coal, citing confidential information.

Resource plans largely 'locked in'

In order to keep the lights on, however, many market participants believe the grid will remain largely reliant on gas, especially during times of peak demand, until battery storage and other new peaking alternatives reach higher levels of market penetration and overcome some early operational challenges.

"You're locked in with the resources you have right now," said Erica Bowman, director of the CEO's office at Edison International, parent company of Southern California Edison Co. "In the short term, when you have price bumps in natural gas, you're not just solving for decarbonization. You're also solving for reliability. You want to make certain you're delivering power."

Despite California's blossoming battery storage assets, the state is looking to gas as it grapples with grid reliability since sustaining back-to-back days of rolling blackouts during a region-wide heat wave in August 2020. This August, the California Energy Commission approved emergency rules to fast-track new gas generation to help address an estimated shortfall of up to 5,000 MW in 2022.

Moreover, the State Water Resources Control Board on Oct. 19 will consider effectively extending the lives of three gas-fired units at AES Corp.'s aging Redondo Beach power plant for an additional two years to help further stabilize the state's suspect network reliability. The board gave Redondo a one-year extension in September 2020, while giving a trio of other gas facilities three year extensions.

California's reliance on natural gas for short-term reliability needs, despite this year's price spike, underlines the challenges the Golden State and much of the nation faces in order to further decarbonize its power supplies.

For PacifiCorp, whose service territory extends from the Pacific Ocean to the Rocky Mountains, reliability risks do not override concerns over rising gas prices, according to Eskelsen. "Still, reliability is certainly a factor because of our regulatory mandate to supply service that is safe, reliable and at fair and reasonable prices," he said.

In its latest integrated resource plan, filed in early September, PacifiCorp detailed plans for large new volumes of renewable, energy storage and other carbon-free resources, as well as retiring coal generation. But it also plans to convert some coal to natural gas.

While the pivot to cleaner energy resources is likely to be boosted by federal and state policy efforts, utilities expect the near-term benefits for coal from rising gas prices to be short-lived.

"It's not as though coal has been increasingly economical," Dominion's Daudani said.

Duke's view is similar.

"Our long-term plans are carbon reduction, renewables and coal retirements," Peeler said. "Natural gas is an important component, but this doesn't really change that mix at all even at the current prices."

Production to ramp up

With prices up and demand strong, utilities widely anticipate natural gas producers to respond by increasing production.

"This looks like a temporary thing to most folks. We think so too," Peeler said.

"The straight-up economics would kind of say at some point if the demand and price stay strong, the producers will produce more," the executive added. "Today, that production just seems a bit behind. It's slow reacting."

"[I]f you look at the other markers that are out there, I think it's a lot easier to build a bear case for gas prices than a bull case," CenterPoint Energy Inc. President and CEO David Lesar said at the company's recent analyst day in Houston, highlighting that the futures price of natural gas is back down to $3 at the start of 2022.

Lesar also noted that rig counts are up with increased production likely to follow.

PacifiCorp also expects natural gas production to rebound with strong growth in 2022 and 2023. But unexpected supply disruptions or weather-related demand spikes can always "whipsaw prices for short periods of time," the utility said in its resource plan. The company added that managing long-term boom and bust cycles is not as crucial as managing shorter-term market perturbations given North America's long-term low-cost natural gas resources.

And while higher gas prices this year have helped drive increased renewables demand, offsetting rising prices for wind and solar, Smith of LightSource BP does not expect America's appetite for solar to crater if gas production rebounds and prices reverse course.

"Regardless of what happens with natural gas prices and electricity prices, you're looking at solar coming in at fixed prices for 15-20 years," the executive said. "That's a pretty compelling position to be able to lock in at relatively low prices even with the recent upticks."