S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

20 Aug, 2021

By J. Holzman

U.S. coal shipments to China leaped more than 30-fold in the second quarter, as miners took further advantage of the Asian powerhouse's prolonged trade dispute with Australia.

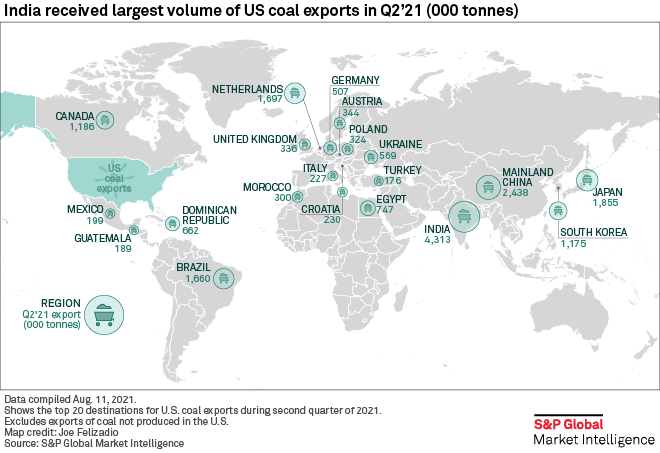

Deliveries surpassed 2.4 million tonnes compared to just 75,000 tonnes a year earlier, according to an S&P Global Market Intelligence analysis of industry data. The surge fueled a 53% jump to 20.6 million tonnes in U.S. coal exports, along with rebounds in India, Japan, Brazil and most other major markets following 2020 pandemic slowdowns.

But perhaps the most significant shift in the U.S. coal export market came from China. The move by the Chinese government to block coal shipments from Australia truly has turned a large coal consumer into a top destination for the American coal.

China has transformed into the second-largest market for U.S. coal exports, behind only India, after restricting coal imports from Australia in 2020 amid political tension. U.S. miners such as Warrior Met Coal Inc., Consol Energy Inc. and Alpha Metallurgical Resources have also benefited from China's surging appetite for the fuel: Global Energy Monitor said Aug. 13 that China announced plans to build 18 new blast furnace projects and 43 new coal-fired power plant units during the first half of the year.

|

"All of that created more export opportunities for thermal and in metallurgical coal for the U.S. coal industry," Ben Nelson, global lead analyst for coal at Moody's Investors Service, told Market Intelligence.

As the trade dispute lingers indefinitely, U.S. coal producers have been telling investors they might have a customer in China through the rest of 2021 and potentially beyond.

During the second quarter, Warrior Met Coal sold 600,000 tons to China, while Consol Energy reported selling its first coal shipment to China since 2018. Meanwhile, Tennessee-based producer Alpha Metallurgical Resources has sold approximately 1 million tons of coal to China this year so far, with a "significant possibility of more to come," Senior Vice President of Sales Daniel Horn said on an Aug. 6 earnings call.

"It's impossible to predict how long this window of opportunity will last, but we will continue to evaluate this new market for us and sell additional tons if it makes sense," Horn said.

Arch Resources Inc. expects opportunities to sell met coal into the Chinese market persisting through at least the end of the year, Senior Vice President and COO John Drexler said on a July 27 earnings call. The company entered into a term supply deal in China that will last through the first quarter of 2022 and "we've seen additional opportunities to put vessels into China," Drexler said.

"We'll see where things continue to play out, but the volumes that we've been selling into China have been well received."