S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

25 May, 2021

|

U.S. coal mine production jumped in the first quarter as the pressure from pandemic-related lockdowns eased, but employment levels continued a slow decline in the quarter. |

U.S. coal production in the first quarter of 2021 continued the industry's recovery from a significant drop the previous year, but the sector's employment levels are still suffering as the U.S. moves away from coal and embraces lower emission options.

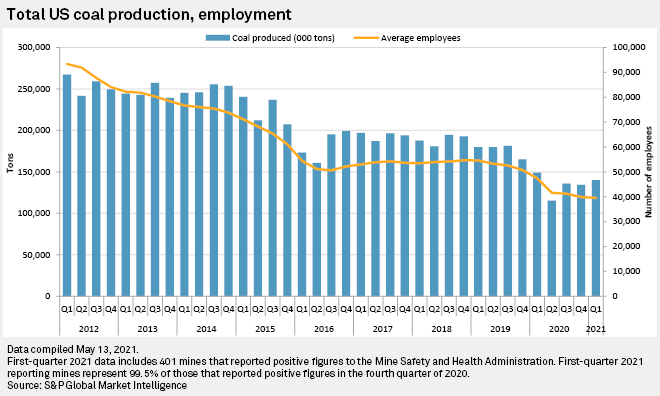

While coal production during the first quarter of this year remained 6.0% below levels seen in the same period in 2020, it continued a recovery off of a historic low in the second quarter of 2020, an S&P Global Market Intelligence analysis showed.

U.S. coal production totaled 534.3 million tons in 2020, the lowest annual total since 1965, data from the U.S. Energy Information Administration shows. Quarterly production dropped to just 115.1 million tons in the second quarter of 2020 as pandemic-related factors weighed on demand.

Despite the uptick in production over the last three quarters, sector employment has continued to slide. Average coal mine employment numbers for the first quarter slumped 16.7% year over year to 39,507, according to the U.S. Mine Safety and Health Administration.

The MSHA figures analyzed do not include many other workers who depend on the coal sector, including contractors, transportation services and other parts of the coalfield economy.

"If you look over the last 10 years, without significant climate change policy, we have seen a significant decrease in coal production, largely due to a transition toward natural gas as a power producer," said Brian Anderson, director of the National Energy Technology Laboratory. "That occurred because of a technology change that occurred because of market principles."

Anderson was recently named executive director of the Biden administration's Interagency Working Group on Coal and Power Plant Communities and Economic Revitalization. The group is working to provide recommendations that would encourage economic activities in impacted regions and support energy workers in fossil fuel sectors impacted by the country's transition to less emissions-intensive energy resources.

READ MORE:

"I think that one of the biggest challenges that we have in navigating the energy transition is, in fact doing it to where we're not leaving folks behind," Anderson told Market Intelligence.

Average quarterly employment in the coal sector has fallen 57.7% since the first quarter of 2012, when the industry reported an average of 93,391 workers. Production has declined 47.5% over the same period.

A recent Market Intelligence analysis found that the outlook for coal is improving somewhat in 2021, in part due to higher natural gas prices and utilities rebuilding inventories coming out of winter. Still, electric sector demand for coal declined from 559 million tons in 2019 to 464 million tons in 2020 and will likely fall to 460 million tons in 2021, the report states. However, due to a rise in export volumes, total coal production is expected to end the year at 548 million tons, 3.6% higher than 2020, but well below 2019 levels of 706 million tons.

Some U.S. coal producers have been highlighting a pivot to export markets or a strategy of leaning more on metallurgical coal used in steelmaking as domestic power producers increasingly transition away from using steam coal to generate electricity.

"Ongoing erosion of the domestic steam coal market due to the retirement and economic displacement of coal-fired generation makes it unlikely that production will again approach 600 million tons per year," said Steve Piper, director of energy research at Market Intelligence. "While some producer margins will be made up in increased production of higher-value steam and metallurgical coal for export, these volumes are small compared to the steam coal customers producers have lost."

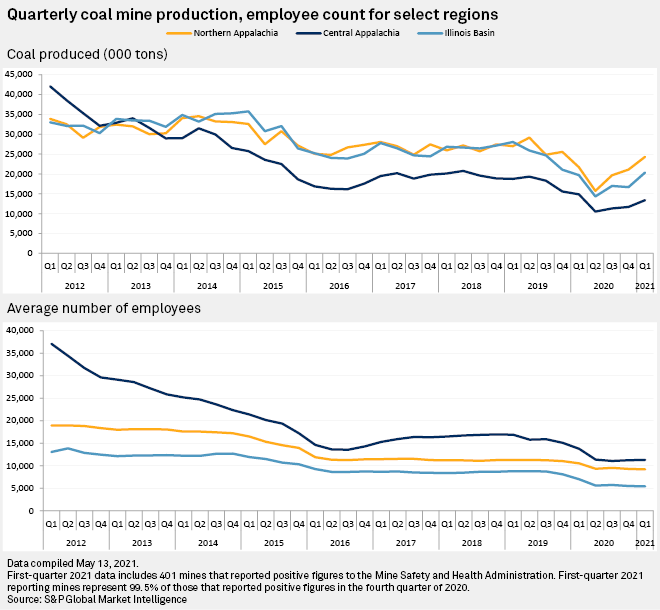

Average employment levels held relatively flat in the Northern Appalachia, Central Appalachia and Illinois Basin regions, but production ticked upward in the first quarter of 2021. Miners in all three of those regions can often tap into seaborne coal demand, and some of those in the Appalachia regions are becoming more focused on metallurgical coal. Miners such as Pennsylvania-based Consol Energy Inc. has reported recent success in expanding coal sales in export markets while Arch Resources Inc. and Alpha Metallurgical Resources, both companies that have historically also mined thermal coal to sell to power plants, are increasingly pushing a focus on metallurgical coal.

Across the Powder River Basin, the largest coal mining region in the United States, production continued to decline in the first quarter. Mines in the region, located primarily in Wyoming, produce coal predominantly sold to U.S. power generators and have relatively few options for economically exporting the product abroad.

In the Powder River Basin, Arch is currently winding down operations at its Coal Creek mine and has announced plans to do the same at the Black Thunder mine, the second largest coal producing operation in the country.