S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

16 Aug, 2022

By Karl Decena and Anna Duquiatan

| Coal is prepared for shipping at a mine near Cumberland, Ky. Coal exports increased in the second quarter amid a tight market driven by the global energy crisis. Source: Scott Olson/Getty Images News via Getty Images |

U.S. coal exports rose in the second quarter as demand and prices remained elevated amid a global energy crisis.

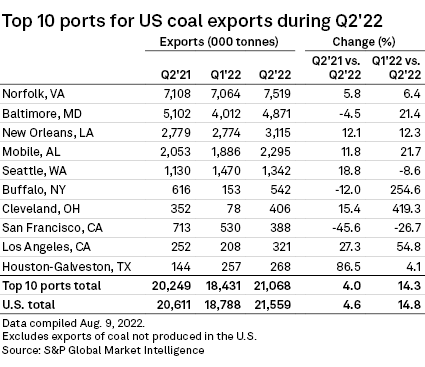

Shipment volumes increased 14.8% quarter over quarter to 21.6 million tonnes and climbed 4.6% year over year, according to S&P Global Market Intelligence data.

The global coal market has become tight as several countries shunned supplies from Russia following its Feb. 24 invasion of Ukraine. High natural gas prices and the lack of new project investments have also pushed up coal prices. However, rail transportation constraints, weakening demand in China and fears of a global recession pose risks to the sector.

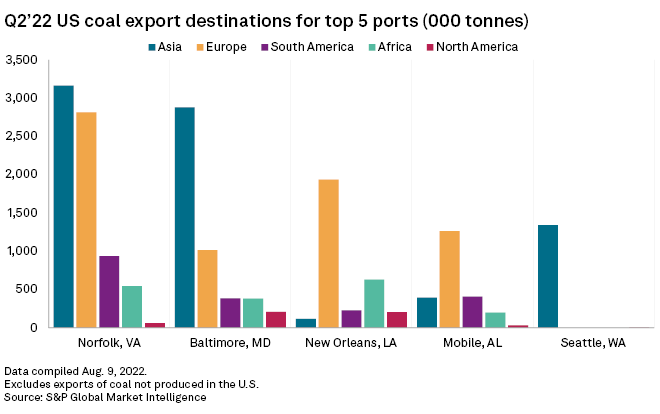

Asia and Europe received the most coal shipments from the five largest ports in the U.S.: Norfolk, Va.; Baltimore; New Orleans; Mobile, Ala.; and Seattle. Other destinations for U.S. coal exports included South America and Africa. All coal shipped through Seattle during the second quarter went to Asia.

Seven of the top 10 U.S. ports for coal exports recorded higher shipments year over year, while coal exports from eight ports grew from the previous quarter. Exports from Norfolk, which ships more coal abroad than any other U.S. port, increased 5.8% year over year and jumped 6.4% compared to the first quarter. The ports in Buffalo, N.Y., and Cleveland booked significant increases quarter over quarter, soaring 254.6% and 419.3%, respectively.

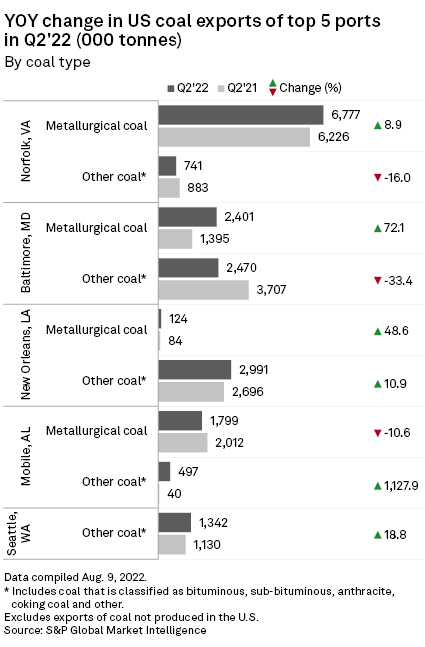

Metallurgical coal accounted for most of the shipments from Norfolk and Mobile, while coal exports from Baltimore, New Orleans and Seattle largely consisted of other coal products.

The U.S. Energy Information Administration expects U.S. coal exports to reach 87 million tonnes in 2022 and 98 Mt in 2023, up from 85 Mt in 2021. U.S. coal production is projected to increase by 21 million tonnes year over year to 599 Mt in 2022, climbing to 601 Mt in 2023.

However, U.S. coal consumption is forecast to decline in 2022 and 2023 due to coal mine closures, transportation challenges and a drop in natural gas prices.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.