S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

22 Sep, 2021

| A worker operates a piece of underground machinery at an Illinois Basin coal mine. Some coal producers have recently cited hiring issues as a challenge to meeting a recent increase in demand. Source: S&P Global Market Intelligence |

Coal demand and prices are booming as natural gas prices soar, but U.S. mining companies have not ramped up production to meet the new market conditions.

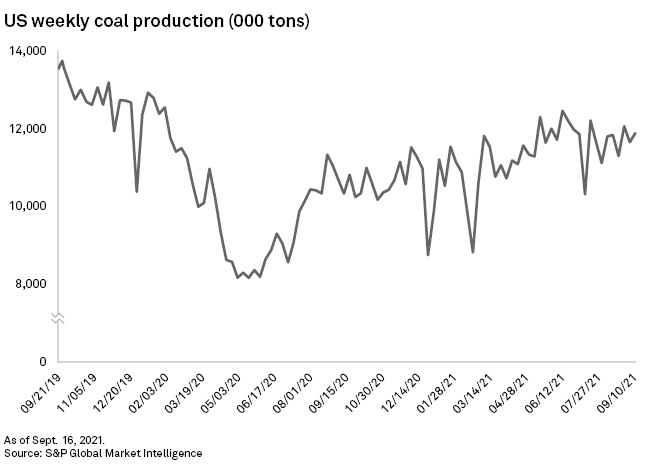

Since climbing from a sharp drop in the early weeks of the COVID-19 pandemic, the overall U.S. coal supply response has been conservative. There are numerous reasons mines in the long-struggling sector have not ramped up production, including limited access to capital, uncertain demand outlook, labor shortages and the time it takes to increase supply.

The U.S. Energy Information Administration recently said it expects coal demand from the U.S. electric power sector to increase by 100 million tons in 2021 and export demand to rise by 21 million tons compared to 2020. However, the agency also warned that constraints in capacity and transportation will limit the ability of producers to meet that demand.

S&P Global Platts assessed Powder River Basin 8,800 Btu/lb coal at $16.90/ton, the highest price for that grade of coal in over 15 years. Central Appalachia Basin and Illinois Basin coal prices have also been on the rise.

Coal supply faces obstacles

During the pandemic, overall electricity demand plummeted, and natural gas generation took a bite out of the nation's coal plants' share of electricity generation. As a result, coal producers took production capacity offline.

With gas prices on the rise, coal supplies are tight as producers have adjusted to lower demand over the years and the COVID-19 pandemic and other issues have made increasing production volumes difficult, according to American Electric Power Co. Inc. spokesperson Scott Blake.

"We are doing everything we can to maintain supply levels at our facilities," Blake said in an email, noting that American Electric is working with its suppliers to ensure coal is available.

While high gas prices are boosting the economic case for burning coal, "it turns out that the coal producers are very much limited in what they can do," said Matt Preston, research director for North American coal markets at Wood Mackenzie.

"There is no extra coal out there to get," Preston said of the current market. "There's literally no more coal to squeeze out of the system."

Whether for making steel or generating power, "coal demand is incredible right now," both domestically and abroad, Alan Shaw, executive vice president and chief marketing officer at railroad company Norfolk Southern Corp., said during a Sept. 10 transportation conference.

"However, the mines aren't bringing on a lot of additional production because they're not sure how long this lasts," Shaw said.

Long-term contracts with power generators remain elusive in the sector, leaving many miners reluctant to invest in coal that may not have a buyer in the future. While the forward prices for natural gas remain high for the winter, buyers do not want to get caught with too much coal if gas prices decline, Preston said in an interview.

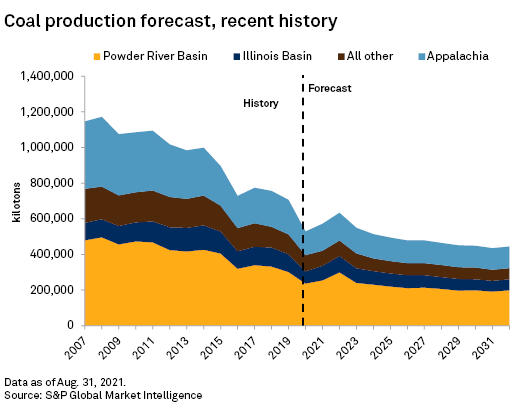

The coal market was built around long-term contracts that supported the infrastructure investment needed to mine coal, said Seth Schwartz, president of consultancy Energy Ventures Analysis. With so much capacity recently cut, producers can not rapidly increase coal production "overnight" to match the demand.

"People aren't going to just put in big new coal mines for the spot market," Schwartz said. "Especially when they see the long-term outlook being to retire and replace coal plants."

Alliance Resource Partners LP President, Chairman and CEO Joseph Craft said on a July earnings call that long-term contracts would help the industry assure workers about the future, as a recent lack of miners complicated the response to higher demand. While coal production has increased from a low reached in the second quarter of 2020, employment in the sector has continued to decline, according to an analysis of U.S. Mine Safety and Health Administration data.

"Nobody's increased staff, even though there's a very, very strong signal that the demand is exceeding supply," Preston said. "You can understand why people might be reluctant to get back into an industry that's really gone through the wringer over the last five, six years."

Short-term constraints on coal deliveries to electric power generators are "not the result of any inherent shortage of coal," Michelle Bloodworth, president and CEO of coal advocacy group America's Power, wrote in an email. External pressures have led many owners to retire coal plants early and scale back long-term fuel purchases because they are uncertain how long the plants will be in operation, Bloodworth added.

"Low levels of forward contracts for coal delivery coupled with thin on-site inventory leave very little slack in the system," Bloodworth said. America's Power called for the nation's grid operators to incentivize the storage of on-site fuel.

Even if a company could find employees and wanted to boost production, many still struggle to access affordable sources of capital for new supply projects. That is partly due to a rising focus on environmental, social and governance-focused investing leading many financial service providers to avoid coal producers.

Long-term view still grim

Schwartz said the market would most likely be corrected by a drop in demand brought on by lower gas prices, not more coal supplies.

"The coal market is not going to come back into balance from increased production," Schwartz said. "If you look around the world, there are not many places you can increase production."

Steve Piper, director of energy research at S&P Global Market Intelligence, said it is possible that there are constraints on U.S. production, while also believing that there may be "quite a bit of excess production capacity in the market."

Recognizing that lower summer demand slowed gas-to-coal switching that may have otherwise occurred, Piper said if fuel economics remain supportive, it could lead to increased coal shipments.

"Coal has been going deeper and deeper in the money as natural gas prices have just continued their unabated rise," Piper said. "If you look at the forward strips, from an in-the-money perspective, coal is going to have a huge year next year."

However, other challenges do remain on the horizon. For example, Piper noted that Pennsylvania's recent decision to enter into the Regional Greenhouse Gas Initiative will likely significantly increase costs in the coal power-heavy state. Union Pacific Corp. President and CEO Lance Fritz said at a Sept. 14 conference that the increased demand is likely a transitory phenomenon.

"In a secular sense, it's still declining," Fritz said. "There's still a lot of pressure on removing coal as a primary source or even a meaningful source of power in the United States."

S&P Global Market Intelligence and S&P Global Platts are owned by S&P Global Inc.