S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Like our content?

By Garrett Hering and Molly Christian

| East Bay Community Energy CEO Nick Chaset, second from left, stands with team members in 2019 at a wind farm on Altamont Pass, Calif. Chaset expects the new Inflation Reduction Act to allow community choice aggregators to cut clean energy costs. Source: East Bay Community Energy |

A piece of the new U.S. climate law enabling tax-exempt entities to tap federal clean energy incentives could boost public development and ownership of renewable energy and other low-carbon technologies, industry sources and experts said.

The policy change puts municipal utilities, electric cooperatives and other tax-exempt public power providers on a more even footing with investor-owned companies that can already claim clean energy tax credits.

"I can't overstate what a significant change this is," said Louis Finkel, senior vice president of government relations for the National Rural Electric Cooperative Association, or NRECA.

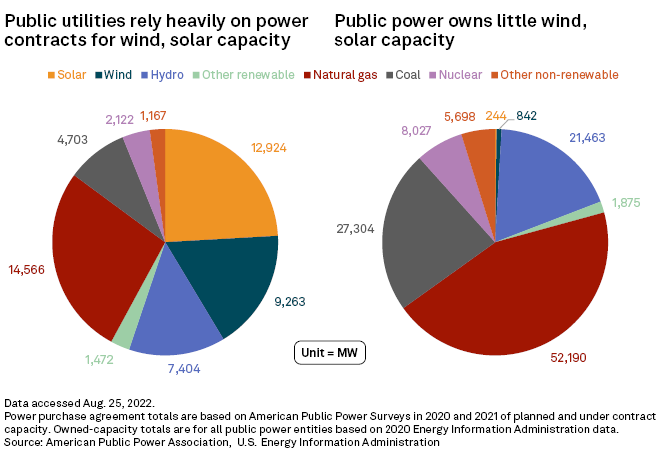

Historically, tax-exempt utilities have not qualified for federal clean energy incentives, forcing them to rely almost exclusively on power purchase agreements with private developers and their partners with tax liabilities to harness wind, solar and energy storage facilities.

But under the Inflation Reduction Act's "direct pay" provision, public power providers can claim the value of those tax incentives through direct cash payments if they own the facilities themselves.

Although the NRECA has not quantified potential capacity additions from the provision, the direct pay option "creates a very natural pathway to more owned [generation]," including renewable resources, carbon capture projects and even small modular nuclear reactors, Finkel said.

The change has been "a long time coming," with tax-free utilities pushing for comparable incentives to those for tax-paying generators for almost 20 years, said Desmarie Waterhouse, the American Public Power Association's vice president of government relations and counsel.

"We do view this as a game changer because it will enable public power utilities to make these investments in clean energy resources without having to do a purchased power agreement," Waterhouse said. "What I hear from our members is they want to own their own generation, and the ability to get these credits makes that very much possible."

Recent surveys conducted by the trade group indicate that publicly owned utilities own only 2% of the non-hydroelectric renewable energy they supply to customers. Power purchase agreements with third-party developers, which frequently rely on an external tax equity partner, account for the other 98%. That ratio could change significantly beginning in 2023, when direct pay rules are scheduled to take effect.

"This will definitely result in an increase in ownership of these resources by public power utilities directly," Waterhouse said.

New opportunities

For Nick Chaset, CEO of East Bay Community Energy, passage of the Inflation Reduction Act has unleashed "expansive" new opportunities for publicly owned electricity suppliers to boost clean energy use while managing costs.

"Suddenly, I don't have to make the choice between being clean and being cheap; we can do both," Chaset said in an interview. Over the past year, that became more challenging for California's local government-run community choice aggregators, known as CCAs, as inflation raised power contract prices with third-party developers of wind and solar.

The direct pay feature has earned wide praise from public power executives around the U.S., stoking excitement about the potential to reduce the cost of decarbonization.

"Historically, asset ownership of utility-scale renewables has really been not cost-competitive for ... publicly owned utility suppliers because we lose out on a 30% investment tax credit or a production tax credit," Chaset said. "By allowing for direct pay, we now can monetize it, and so we really can start to think about how to leverage our tax-exempt status and our ability to issue municipal debt to further reduce the cost of renewables."

Using tax-exempt debt as a source of lower-cost capital "is going to just be a sort of structural advantage," Chaset said. "That's just going to reduce the long-term cost of those renewables."

"Public power has never been able to take advantage of those credits because they don't have a tax bill, so there's been nothing to offset it against," added Bob Schuetz, CEO of Energy Northwest, a Washington state agency that supplies power, at the cost of production, to more than two dozen public utility districts and municipalities.

Energy Northwest owns and operates the 1,172-MW Columbia Generating Station nuclear plant and smaller wind, solar and battery storage assets. The public power agency is exploring whether Columbia, as well as the planned up to 320-MW Hanford Nuclear Reservation Project advanced reactor, can qualify for direct pay.

"I have a bunch of people with eye shades trying to do the math now, but we think we will [qualify]," Schuetz said. "We're a nonprofit, so if we get more money, what does that mean? It means it will go back to the ratepayer."

'Baggage' concerns

Energy Northwest already operates a zero-carbon portfolio for the more than 1.5 million customers of its utility members. East Bay Community Energy has a target of providing 100% carbon-free power to its more than 1.7 million customers, mostly in Alameda County, Calif., by 2030.

But where the Inflation Reduction Act can be "really transformational," in Chaset's view, are "places where cheap is the priority and clean is less of an imperative."

Outside of the West Coast, New England and mid-Atlantic regions, U.S. public power utilities rely heavily on natural gas and coal. Access to direct incentives could unlock investment in carbon-cutting technologies in those areas.

In Minnesota, the state's six generation and transmission cooperatives are expanding their owned and contracted renewable capacity, Minnesota Rural Electric Association CEO Darrick Moe said. In addition, three of those six are "very active" in pursuing carbon capture and storage projects, incentives for which the Inflation Reduction Act expanded.

To maximize the benefits of direct pay, developers must meet new prevailing wage, apprenticeship and domestic content requirements that could diminish the economics of building and owning generation, depending on the state and labor market.

"The baggage that comes along with some of these benefits may not be that attractive if you have to completely retool your contractor roster and pay much higher costs," said Dennis Pidherny, managing director of U.S. public finance at Fitch Ratings. "[In] the nonunion states or the states where unions aren't as strong and there's just much lower labor costs, you'd think that could be a challenge."

But those requirements also apply to tax-paying companies building new clean energy without the direct pay option, meaning they would factor into project economics even if public power or cooperatives go the power purchase agreement route.

"We're on a level playing field, and we'd be dealing with these challenges the same way anyone else would," Moe said.

'Virtuous cycle'

Chaset of East Bay Community Energy is exploring how public power can benefit from the Inflation Reduction Act beyond ownership of large-scale renewable energy projects. The CCA may be able to leverage the new tax incentive flexibility to participate in mid-sized solar projects at commercial and industrial sites, a segment of the solar market that has lagged residential and utility-scale installations.

"We could enter an agreement where [a solar developer] would assign the tax credits to us, we would monetize them and then we would basically give some portion of that money back to the developer," Chaset said, describing it as essentially filling the role of a tax equity investor.

After President Joe Biden signed the bill into law, the CCA asked respondents to a recent commercial solar solicitation to add an option where it effectively becomes the tax equity counterparty. Some sites could also qualify for bonus incentives for being in low-income areas.

Additionally, East Bay Community Energy expects to tap the direct pay option to capitalize on up to 30% tax credits for electric vehicle charging stations, with consumer tax credits for electric vehicles and appliances likely to increase the overall demand for clean power by its customers.

"It's a virtuous cycle," Chaset said.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.