Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

16 Dec, 2024

By Garrett Hering and Susan Dlin

US installations of large-scale lithium-ion battery storage stations continued to proliferate in record volumes in 2024, surpassing last year's capacity additions with weeks left in the year and large volumes in final testing, under construction and preparing to break ground.

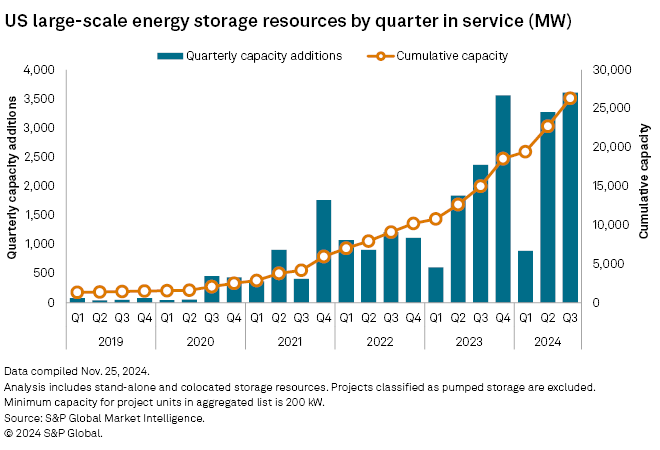

Developers completed 3,610 MW of battery power capacity in the third quarter, a 52.5% increase from a year ago and pushing cumulative installed non-hydroelectric storage resources to 26.3 GW, according to S&P Global Market Intelligence data.

Following the third quarter, another 1,407 MW entered commercial operations in the fourth quarter through Nov. 25, putting 2024 capacity additions at 9,185 MW so far, Market Intelligence data shows. That beats the industry's prior high of 8,372 MW of large-scale energy storage resources added in 2023.

The vast majority of US large-scale battery systems in operation are designed to discharge energy for one to four hours, and many charge directly from colocated solar farms.

Quinbrook Infrastructure Partners Pty. Ltd. and its affiliate Primergy Solar LLC in July announced full commercial operations at the Gemini solar-plus-storage project in Clark County, Nevada, consisting of the 690-MW Gemini Solar Project and the 380-MW/1,416-MWh Gemini Battery Storage Project. It delivers power to NV Energy Inc., an affiliate of Berkshire Hathaway Energy, under a 25-year contract.

Several other such hybrid large-scale solar-battery assets entered operations in the third quarter, including Enlight Renewable Energy Ltd.'s 360-MW Atrisco Solar Project in Bernalillo County, New Mexico, colocated with the 300-MW/1,200-MWh Atrisco Battery Storage Project. The project has a 20-year offtake agreement with TXNM Energy Inc. subsidiary Public Service Co. of New Mexico.

14 GW under construction

During the third quarter, developers added 18 battery projects or major phases with power storage capacities of at least 100 MW, and another 28 projects or phases sized between 1.5 MW and 75 MW.

However, developer timelines often track well behind actual commissioning dates.

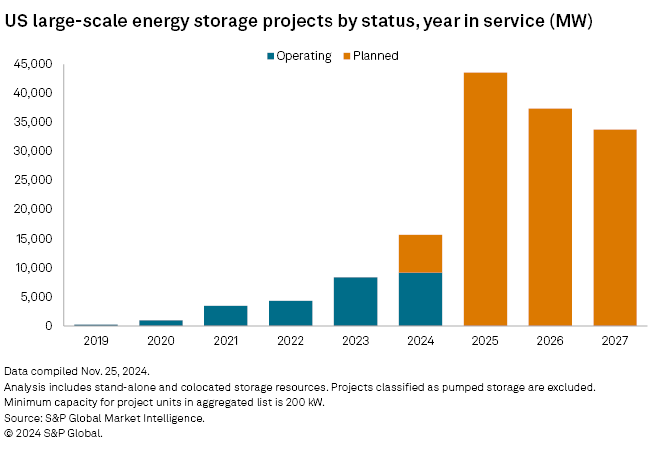

Market Intelligence data shows a roughly 143 GW pipeline of non-hydro energy storage resources planned to come online through 2030, including an ambitious 43.6 GW in 2025, 37.3 GW in 2026 and 33.8 GW in 2027.

Southwest remains epicenter

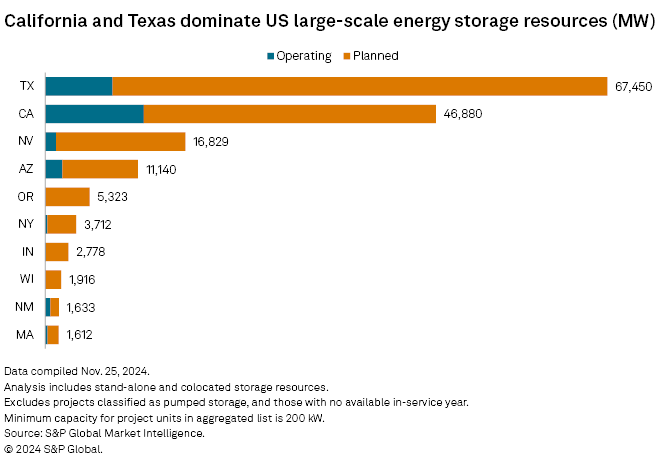

California continues to lead installed US battery capacity with 11.9 GW online as of Nov. 25, mostly in the California ISO's service territory, followed by Texas with 8.1 GW, Arizona with 2.1 GW and Nevada with 1.3 GW, according to Market Intelligence data.

No other state has over 1 GW of installed battery power storage capacity.

Texas leads in terms of planned non-hydro energy storage resources with 59.3 GW, ahead of California with 35 GW. Nevada has 15.5 GW of planned storage, followed by Arizona with 9.1 GW and Oregon with 5.3 GW.

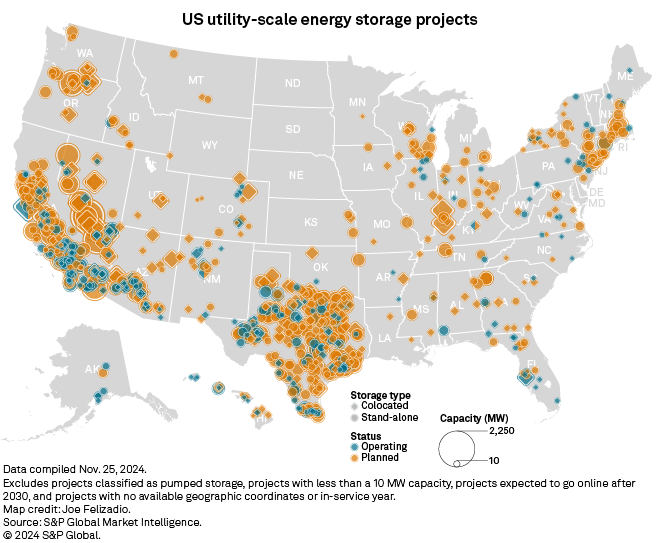

Both the pipeline of future projects and completions so far in 2024 reflect healthy volumes of standalone and colocated facilities.

Of the nearly 9.2 GW of battery resources brought online this year as of Nov. 25, about 6 GW were standalone projects and 3.2 GW were hybrids, mostly coupled with solar farms.