Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

19 Feb, 2021

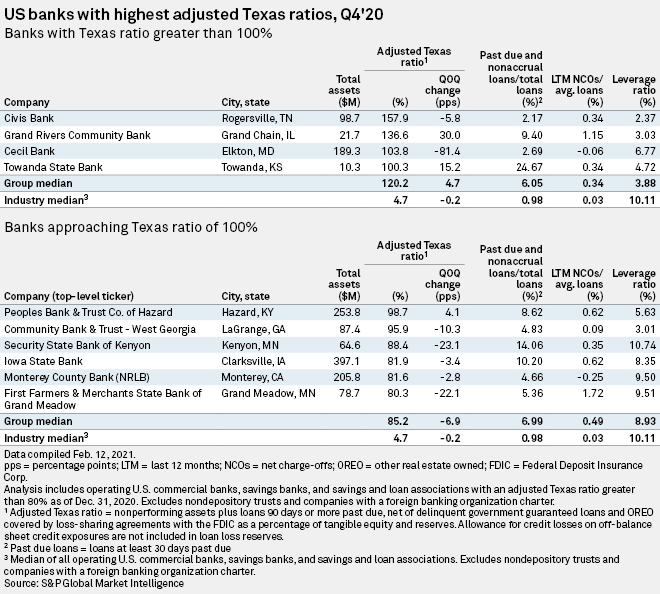

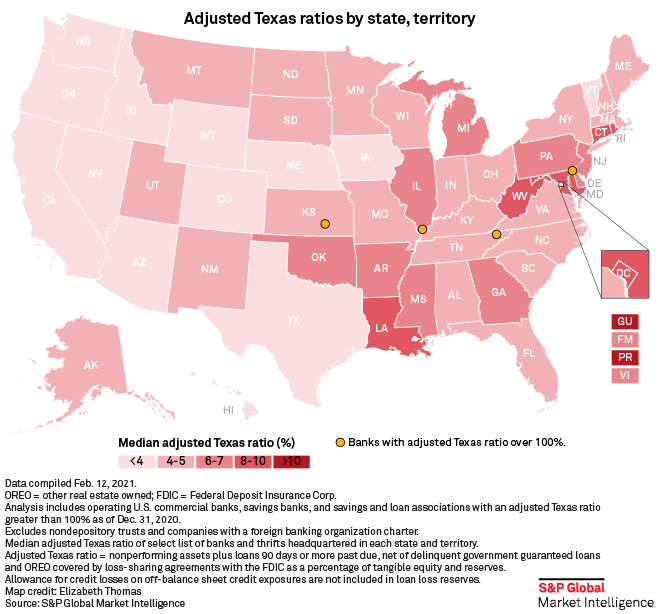

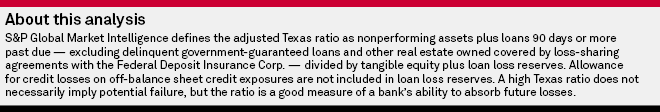

At the end of 2020, four U.S. banks and thrifts posted an adjusted Texas ratio above 100%, down from nine in the third quarter and 13 in the year-ago quarter.

Meanwhile, the median adjusted Texas ratio for the U.S. banking industry fell to 4.7% as of Dec. 31, 2020, down from 5.0% in the linked quarter and 5.3% at the end of 2019.

Rogersville, Tenn.-based Civis Bank had the highest adjusted Texas ratio in the country at 157.9% at year-end 2020, although that was a 5.8-percentage point improvement quarter over quarter.

Grand Chain, Ill.-based Grand Rivers Community Bank posted the second-highest adjusted Texas ratio, jumping 30.0 percentage points to 136.6%. The bank's tangible equity dropped 14.2% in the fourth quarter, and its adjusted loans 90 days or more past due almost quadrupled.

Two of the banks that posted adjusted Texas ratios above 100% at the end of September 2020, Fort Walton Beach, Fla.-based First City Bank of Florida and Kansas-based Almena State Bank, failed in the fourth quarter of 2020.