Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Jan, 2021

By Lauren Seay and Mahum Tofiq

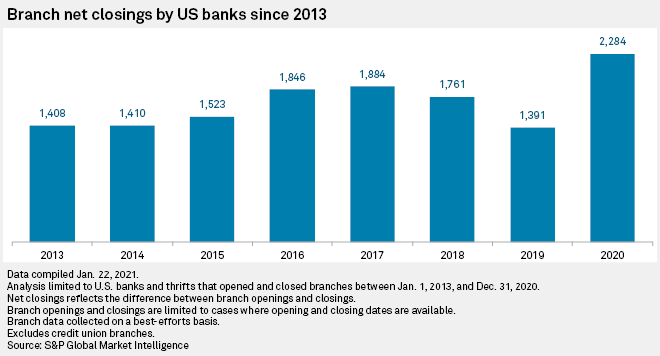

As the COVID-19 pandemic accelerated digital banking adoption and increased opportunities to shutter branches, U.S. banks and thrifts posted a record number of net branch closings during 2020.

While the trend has generally been toward net closures since 2008, U.S. banks and thrifts closed 3,324 branches nationwide in 2020 and opened 1,040, according to S&P Global Market Intelligence data, which does not include temporary bank closures, such as those caused by the pandemic. One industry observer expects the acceleration of branch closures to continue throughout 2021.

"2021 is the year of branch closures. We just simply had a very clear appetizer in 2020," Christopher Marinac, director of research at Janney Montgomery Scott LLC, said in an interview. "Banks realized that they had to evolve. The pandemic just simply put this on warp speed because instead of taking five years to play out, it's going to take probably two years."

|

Marinac expects branch closures to be a hot topic on fourth-quarter 2020 earnings calls for U.S. banks.

"I don't think banks are going to wait too much longer," he said. "Customer behavior is really what's changing. Customers want to do business at 10 p.m. at night. They want to be able to ... file for a loan application digitally. It's just easier, and the banks have to be responsive to that. Otherwise, they really run the risk of losing a customer."

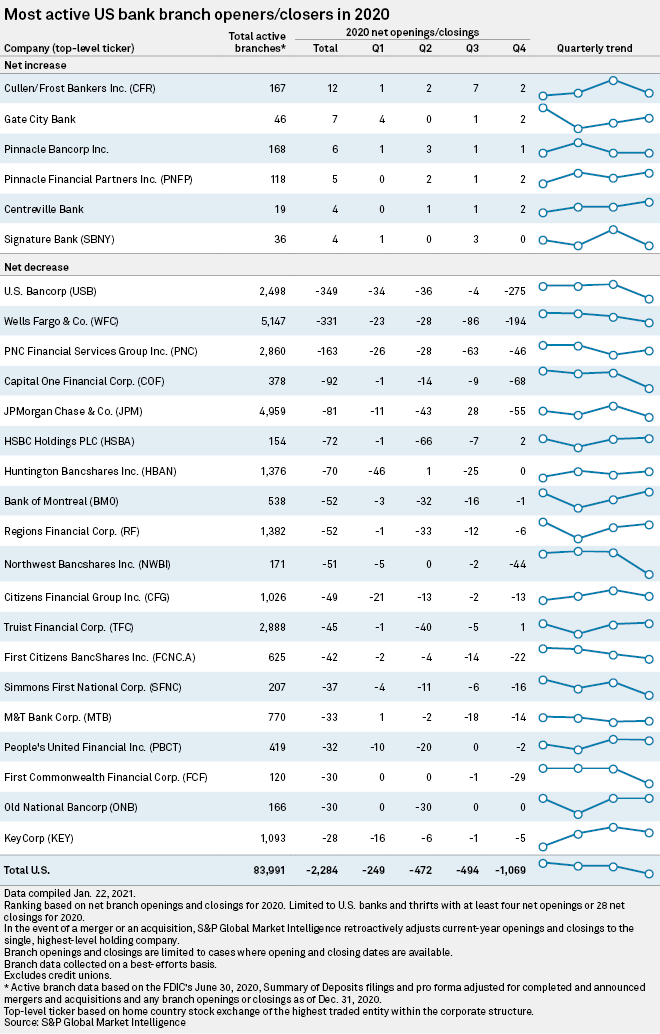

U.S. Bancorp was the most active branch closer among all U.S. banks in 2020 with 349 net closings. Chairman, President and CEO Andrew Cecere was vocal throughout the year about the increased opportunity the pandemic presented to slash the company's branch footprint. The company is working to consolidate up to a fourth of its branches, including plans to close between 10% and 15% of branches announced in 2019 and plans announced on its third-quarter 2020 earnings call to close an additional 15% by early 2021.

Wells Fargo & Co. was not far behind, with 331 net closures in 2020. The San Francisco-based bank is working to bring its efficiency ratio in line with peers through a sweeping expense-cutting initiative.

"Branches are still important, but they're going to be less of a place where people go for transactions and more for advice and consultation," Cecere said at the Goldman Sachs U.S. Financial Services Virtual Conference on Dec. 9, 2020. "Therefore, they don't need to be as many, and they don't need to be as large."

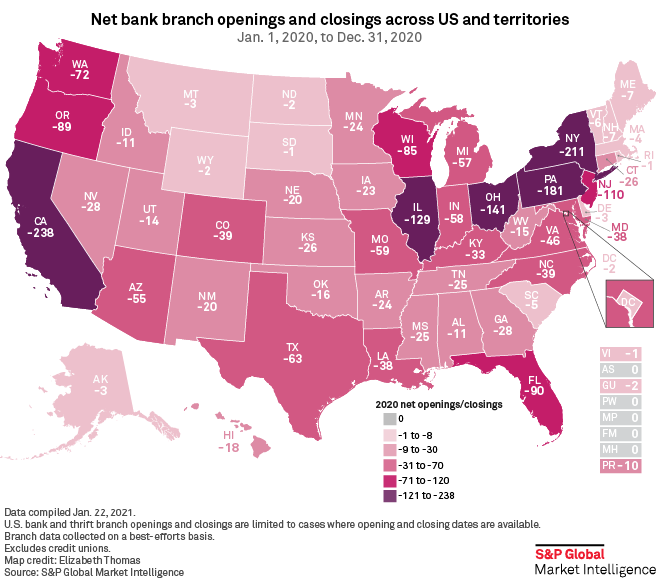

California, New York, Pennsylvania, Ohio, Illinois and New Jersey and had the most net closures in 2020 with more than 100 each.

Some banks opened more branches than they closed in 2020, as they continued to pursue expansion plans. Cullen/Frost Bankers Inc. was the most active branch opener with 12 net openings in 2020. The San Antonio-based bank is working to expand its presence in the Houston market.

Click here to access a template containing bank branch openings and closings for 2020.