Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

10 Dec, 2024

By Maricor Zapata and Hussain Shah

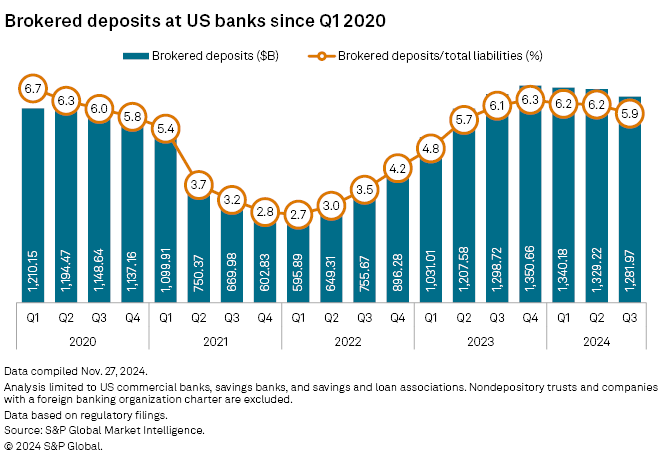

Brokered deposits at US banks fell for the third consecutive quarter in the three months to Sept. 30, a stark contrast to the persistent uptrend in 2022 and 2023.

US banks registered brokered deposits of $1.282 trillion in the third quarter, down from $1.299 trillion a year ago, according to S&P Global Market Intelligence data analysis.

The ratio of brokered deposits to US banks' total liabilities decreased to 5.9% from 6.1% a year ago.

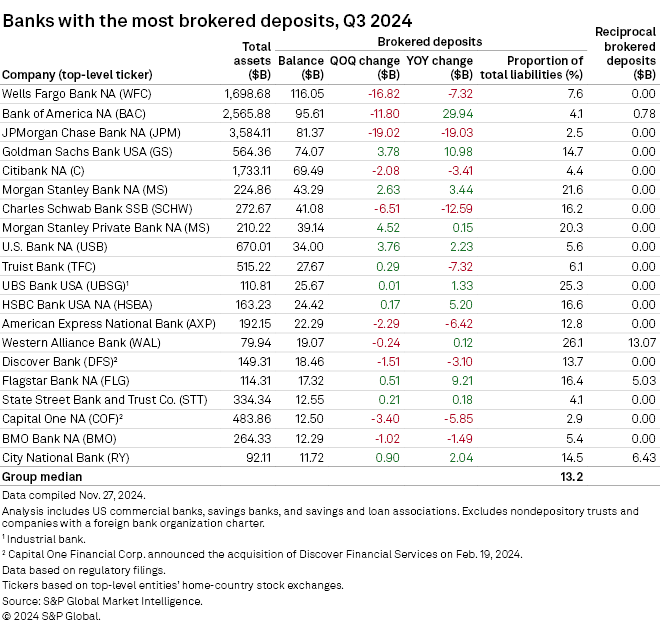

Wells Fargo maintains top billing

Wells Fargo Bank NA again reported the largest brokered deposits, $116.05 billion, in the third quarter, down $16.82 billion compared with the previous quarter and $7.32 billion from last year.

Bank of America NA was in second place with $95.61 billion, $11.80 billion lower than in the previous three months, but $29.94 billion higher than a year ago.

In third place was JPMorgan Chase Bank NA, which booked $81.37 billion in brokered deposits, down $19.02 billion quarter over quarter and $19.03 billion year over year.

It came as the Federal Deposit Insurance Corp. approved and sought public comments on its proposal to count deposits from financial technology firms as brokered rather than core deposits, to mitigate potential liquidity risks.

Rob Nichols, president and CEO of the American Bankers Association, said of the proposal that the "sweeping measure would restrict access to sources of liquidity while penalizing banks for pursuing funding sources that enable them to meet the needs of their communities."

In a LinkedIn post, Phil Goldfeder, CEO of the American Fintech Council, urged the FDIC to withdraw the proposal saying it "threatens to undo years of progress in creating a more inclusive, innovative, and consumer-centered financial system." House Republicans led by Reps. Andy Barr (Ky.) and French Hill (Ark.) also urged the agency to withdraw the proposal.

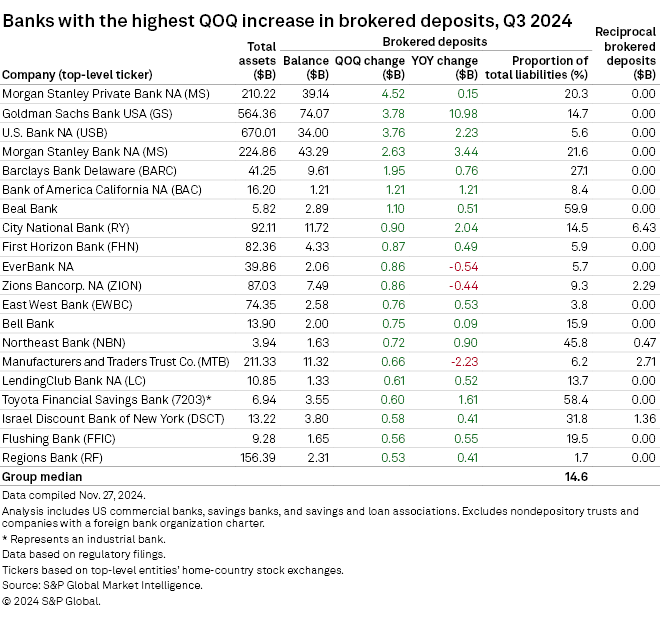

Morgan Stanley posts biggest sequential rise in brokered deposits

An increase of $4.52 billion gave Morgan Stanley Private Bank NA the largest quarter-on-quarter dollar rise in brokered deposits in the third quarter. Reported brokered deposits accounted for more than one-fifth of its total liabilities during the quarter.

Goldman Sachs Bank USA took the second spot with an increase of $3.78 billion. Its brokered deposits in the third quarter accounted for 14.7% of its total liabilities.

US Bank NA was a close third, posting an increase of $3.76 billion compared with the previous quarter. Its brokered deposits were only 5.6% of its total liabilities during the period.