Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

19 Nov, 2024

By Claire Lawson and Ronamil Portes

Overdraft fee income at US banks rose in the third quarter to the highest level since the fourth quarter of 2022.

Service charges related to overdrafts were $1.50 billion in the third quarter, up from $1.40 billion the prior quarter and $1.37 billion in the third quarter of 2023. After a steep decline in 2022, overdraft charges remained relatively flat through 2023 and the first half of 2024. The near-$100 million sequential rise in the third quarter marks the largest increase since the third quarter of 2021.

US banks' maintenance fees also rose in the third quarter to $1.05 billion, up from $1.03 billion in the second quarter and $1.04 billion a year prior.

ATM fees dipped to $406.1 million from $425.5 million a quarter earlier and $449.86 million in the third quarter of 2023. Consumer deposit fees as a proportion of operating revenue ticked up 3 basis points from the prior quarter and 2 basis points from a year earlier.

– Click here to access S&P Global Market Intelligence's top 20 banks ranked by service fees as a proportion of operating revenue.

– Read some of today's top news and insights from S&P Global Market Intelligence.

Increasing reliance

Of the 20 banks with the highest proportions of consumer deposit fees to operating revenue for the 12 months ended Sept. 30, 11 reported increases in those fees year over year and eight posted decreases.

The top three banks by proportion of consumer deposit fees were once again Woodforest National Bank at 21.7% of operating revenue, Gate City Bank with 14.7% of operating revenue and International Bank of Commerce Oklahoma at 10.6%. All three posted year-over-year decreases in the proportion, and both Woodforest and Gate City decreased quarterly.

Arvest Bank remained the only bank with over $10 billion in assets among the top 20, reporting fees associated with consumer deposits totaling $106.4 million, or 7.8% of operating revenue.

Year over year, Planters Bank & Trust Co. posted the largest total increase in service charges, a 11.5% rise to $5.3 million, followed by First Bank, up 11.0%, and VeraBank NA, up 10.9%.

International Bank of Commerce Oklahoma reported the largest year-over-year decrease at 8.3%.

Fees up

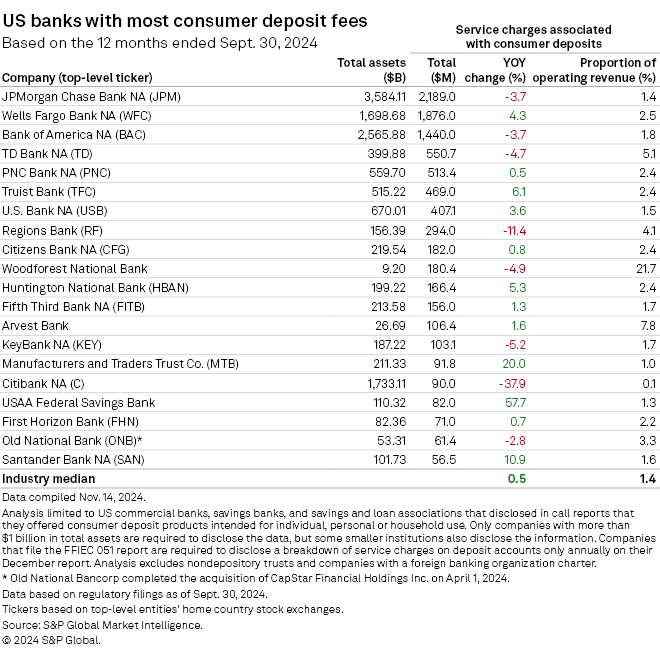

The Big Three US banks — JPMorgan Chase Bank NA, Wells Fargo Bank NA and Bank of America NA — reported the highest aggregate consumer deposit fees. Of them, Wells Fargo collected more fees year over year and JPMorgan Chase and Bank of America gathered less.

More than half of the top 20 banks by total consumer deposit fee income posted year-over-year increases in that income, with 12 reporting year-over-year bumps. The industry posted a median increase of 0.5% during that period.

USAA Federal Savings Bank reported the biggest jump in total consumer deposit fees in the group, up 57.7% year over year, while Citibank NA had the biggest drop of 37.9% year over year.