Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

22 Feb, 2021

By Harry Terris and Rucha Khole

Deposits have continued to pile up on balance sheets, prompting banks to adopt pricing strategies and even to set balance limits for individual commercial clients in an effort to steer away funding they do not need amid soft loan demand.

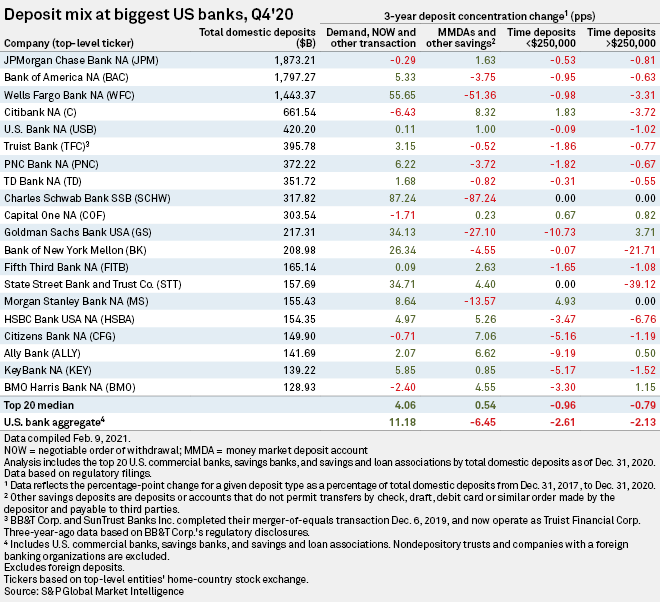

Total deposits across the industry in the U.S. grew 3.9% sequentially to $16.287 trillion in the fourth quarter of 2020, according to data from S&P Global Market Intelligence. The increase was led by a 32.6% jump in transaction balances — traditionally banks' core low-cost funding base — to $4.727 trillion.

Overall, deposits surged 23.2% from the end of 2019, and transaction balances more than doubled, as corporations built up cash cushions amid uncertainties created by the pandemic and consumers used federal relief payments and an involuntary break from expenditures on traveling and dining out to add to savings. Meanwhile, after corporations drew down bank lines of credit but subsequently paid them off by issuing bonds, bank loan balances have been drifting down for about nine months.

|

The growth has been concentrated among commercial depositors, where balances are up 40% since the beginning of the pandemic, according to Peter Gilchrist, executive vice president at the bank analytics and advisory company Novantas. "In terms of the excess or non-operating funds, [banks] are absolutely looking for ways to limit that accumulation," Gilchrist said.

A Novantas survey of 40 large commercial banks found that 72% had taken steps to actively discourage commercial deposit growth, with many using "reverse tiering," or lower interest rates or rebates against treasury management fees as balances grow. About 26% said they had imposed strict balance limits on clients, and 16% said they had suggested that clients place deposits at other banks. Those sorts of steps are "generally reserved for higher-end commercial" clients with sophisticated treasury operations, Gilchrist said.

"It's a basic balance sheet management issue," Gilchrist said. "There's nowhere to put [the excess deposits]." Including fees banks assess for deposit insurance, the surfeit of liquidity has led to slightly negative effective interest rates for some large clients, Gilchrist said.

"What it essentially comes down to is relationship management for a lot of these banks," said Tom Hunt, director for treasury and payments services at the Association for Financial Professionals. "[The need for banks to protect] their net interest margin certainly pushes back on all that cash that the corporates have."

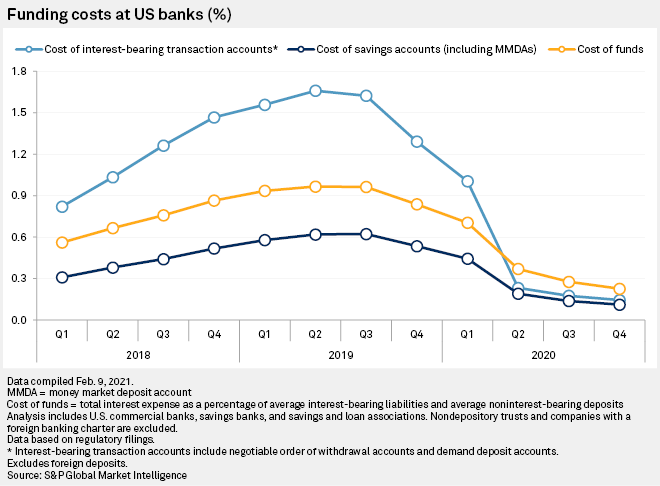

Across the industry in the fourth quarter, funding costs ticked down even further from already near-zero levels, with the cost of savings deposits hitting 11 basis points, according to S&P Global Market Intelligence data. Savings balances, which account for the majority of deposits, actually dropped 3.9% sequentially to $10.038 trillion in the fourth quarter.

|

Another factor that could propel large banks to drive away deposits is the pending lapse of a pandemic-related break on supplementary leverage ratio, or SLR, requirements. In response to balance sheet growth fueled in part by the Federal Reserve's actions to support financial markets and the economy, Treasurys and reserves have been temporarily excluded from the measure. Unless the exclusions are extended past March 31, JPMorgan Chase & Co. has argued that the SLR could become its binding constraint and compel it to shunt deposits elsewhere.

Bank of America Corp., by contrast, has said it has room under the SLR and emphasized that it has no interest in rejecting new customers seeking to open accounts, but it does not seek short-term deposits in general. "It's not like we have a lot of, here's a few billion dollars, can you put it on your balance sheet and give us yield?" Chairman, President and CEO Brian Moynihan said on an earnings call in January. "We turned that down already."

Broadly, banks are intent on adding new commercial customers, focusing on clients that sign up for multiple services, even as they work on "off-loading the excess deposits," Gilchrist said.

At Wells Fargo & Co., under unique pressure because of an asset cap imposed by regulators over consumer abuses, President and CEO Charles Scharf said in January that the wholesale team is "trying to be very smart about operational versus non-operational where our customers have other choices."

Throughout the pandemic, as with all "times of uncertainty, the treasurer's greatest tool is building liquidity and shoring up their ability to weather the storm," Hunt said. It's unclear when businesses will revert to pre-pandemic cash levels, but some less-affected sectors and companies have already been moving distinctly in that direction.

Although cash levels remain sharply higher for the year across most investment grade U.S. industrials, they did broadly decline in the fourth quarter of 2020, according to a Feb. 12 report by credit analysts at BofA Global Research. In the fourth quarter, for example, The Coca-Cola Co. more than reversed increases of about $10 billion of cash and gross debt in the first three quarters of 2020.

|