S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

19 Apr, 2022

By Umer Khan

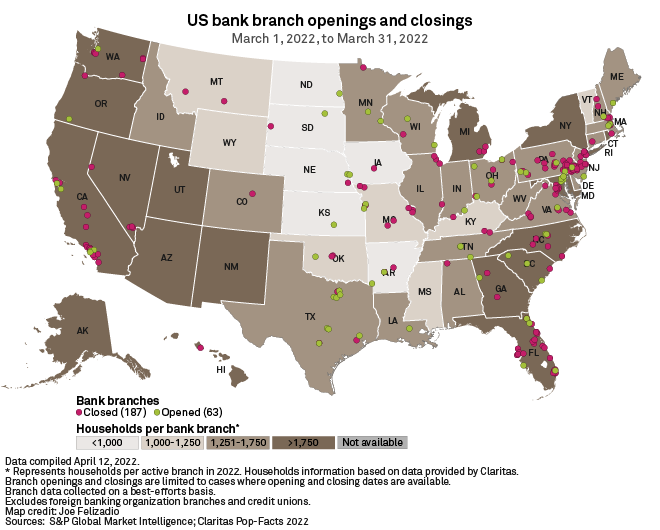

U.S. banks and thrifts opened 63 branches, while closing 187 during the month of March, according to S&P Global Market Intelligence data.

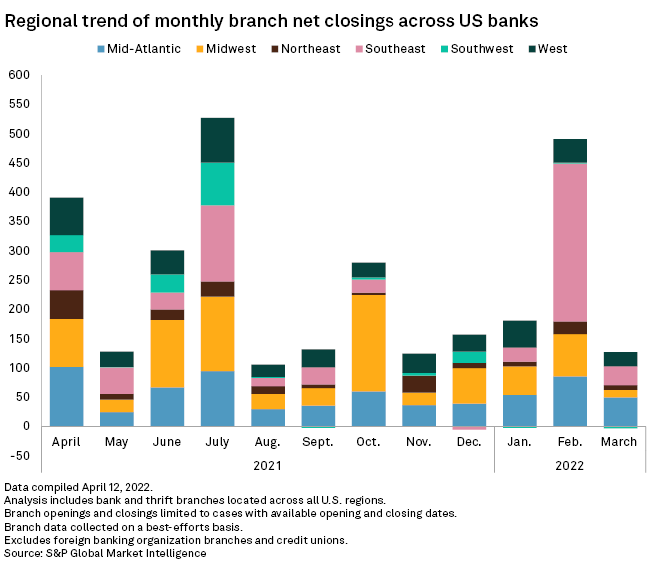

The number of closures marks a slowdown when compared to the trailing 12-month average, which stood at about 335 offices March 31. By the same measure, the openings were also slower in March as the industry on average added 90 new branches in the last 12 months.

Overall the banking industry has closed 4,015 branches and opened 1,080 in the last 12 months, pushing the total number of active branches for banks down to 80,040.

Top banks by openings and closingsJPMorgan Chase & Co. has been the largest net opener for the third month in a row with 13 in March, based on 15 new branch openings and two closings. The bank was last recognized as the largest net closer of U.S. branches back in December 2021.

Bank of America Corp. was the largest net closer of the month with 61 closings and three openings, attributing 32.6% to the industry's total branch closures during March. Meanwhile, WSFS Financial Corp. was responsible for 12.8% of the industry's total office closures in March. The bank closed 24 offices while opening none.

Mid Penn Bancorp Inc. had the fourth most net closures of 16 in March as it shrank its branch network significantly to just 45 offices at the end of the month.

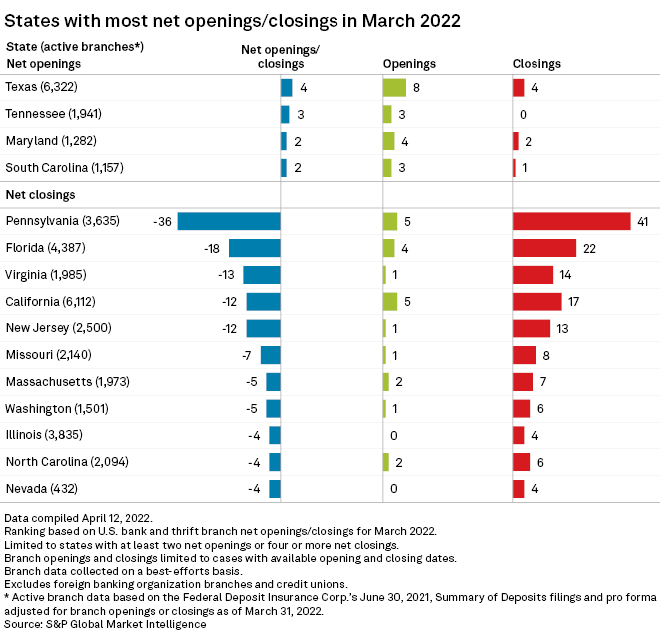

The Mid-Atlantic region saw the most net closures in March at 50, followed by the Southeast region at 32. While the Southwest region previously followed the general trend of closings, this time around it bucked the trend with three net openings.

At the state level, Texas, Tennessee, Maryland, and South Carolina had the most net openings at four, three, two, and two, respectively. On the other end of the spectrum, Pennsylvania, Florida, Virginia, and California had the most net closings at 36, 18, 13, and 12, respectively.

Click here to access a template containing bank branch openings and closings for March 2022.