Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Nov, 2021

By Robert Clark

Financial highlights for U.S. banks and thrifts in the third quarter of 2021 included another negative credit provision, deposit growth again outpacing loan growth and margin expansion for the first time in nearly three years.

The provision for credit losses has substantially impacted bottom-line profitability during the last two years, wildly fluctuating between negative $13.39 billion in the first quarter of 2021 and $62.02 billion in the first quarter of 2020. For the most recent quarter, the provision was negative $4.31 billion. All eight banks with greater than $400 billion in total assets at Sept. 30 reported a negative provision. Wells Fargo & Co. unit Wells Fargo Bank NA led the pack at negative $1.33 billion.

Net income for the industry was $69.49 billion, down 1.2% from the second quarter but up by more than one-third from a year ago. On a pre-provision net revenue basis, profitability reached an eight-quarter high at $82.37 billion.

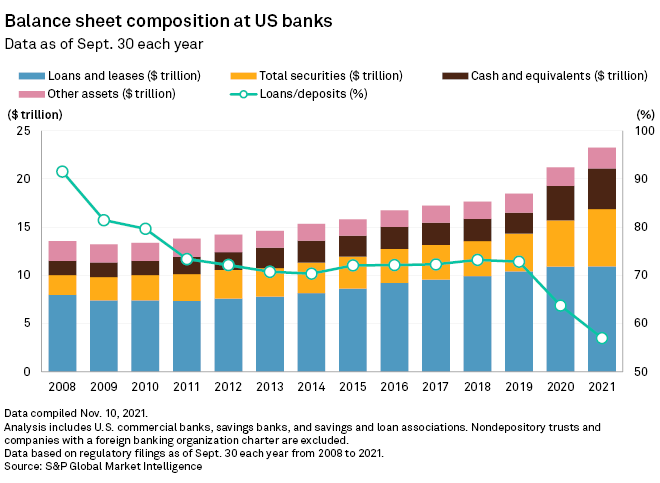

Bigger balance sheets and higher margins drove the pre-provision profitability increase. Total assets were up 2.0% quarter over quarter, and the mismatch between loan and deposit growth widened for the ninth consecutive quarter. While total deposits grew 2.3%, total loans and leases were up just 0.6%. The loan-to-deposit ratio declined to 57.0%.

The net interest margin for the industry was 2.53%, up 6 basis points from the previous quarter. The most recent improvement had been in the fourth quarter of 2018, when the margin was up 3 basis points to 3.44%.

Credit quality was another bright spot across the sector. Net charge-offs, in particular, have plummeted. The NCO ratio fell to 0.19%, down 8 basis points quarter over quarter and 27 basis points year over year.