S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

21 Nov, 2024

By Rica Dela Cruz and Xylex Mangulabnan

US banks continued to move loans to the criticized bucket in the third quarter even as they remained optimistic about credit quality.

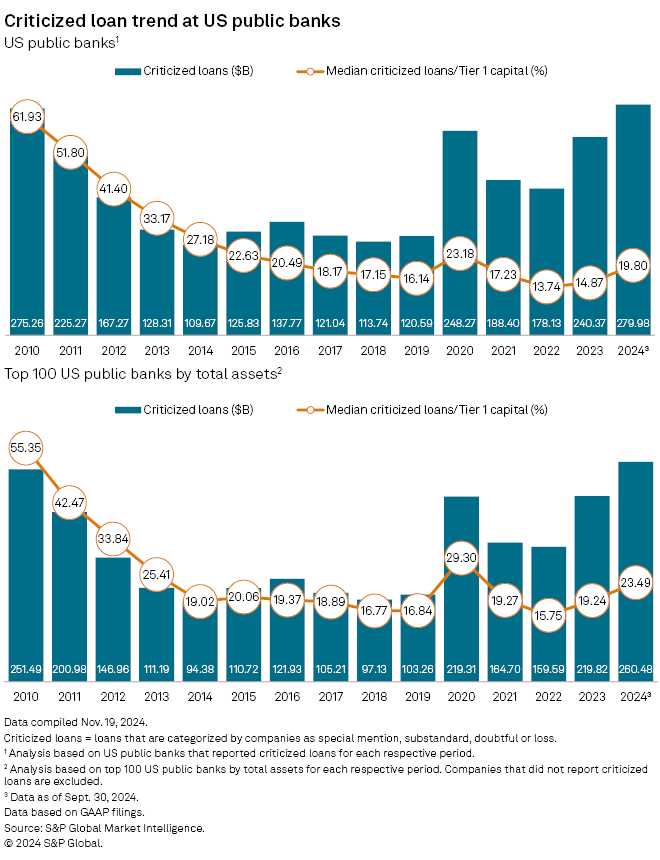

As of Sept. 30, US public banks' median ratio of criticized loans to Tier 1 capital was 19.80%, compared with 14.87% at the end of 2023, according to S&P Global Market Intelligence data. At the 100 largest US public banks, the median ratio was 23.49% as of Sept. 30, up from 19.24% at Dec. 31, 2023. The ratios at Sept. 30 were the highest since 2020.

Criticized loans at public US banks amounted to $279.98 billion, versus $240.37 billion at the end of 2023, and such loans at the 100 largest US public banks totaled $260.48 billion, versus $219.82 billion at 2023-end.

Loans are transferred to criticized status if banks see signs of weakness or risk, though that migration does not necessarily indicate a future loss. While some banks reported a worsening of credit metrics in the third quarter, mostly in the still-pressured commercial real estate (CRE) sector, the pace of degradation held steady, Wedbush Securities analyst David Chiaverini said.

"Credit trends remained directionally negative, but the pace of credit degradation stabilized in the quarter, which we view favorably and attribute to the relief brought on by the decline in interest rates," Chiaverini wrote in a Nov. 5 note.

At the largest banks

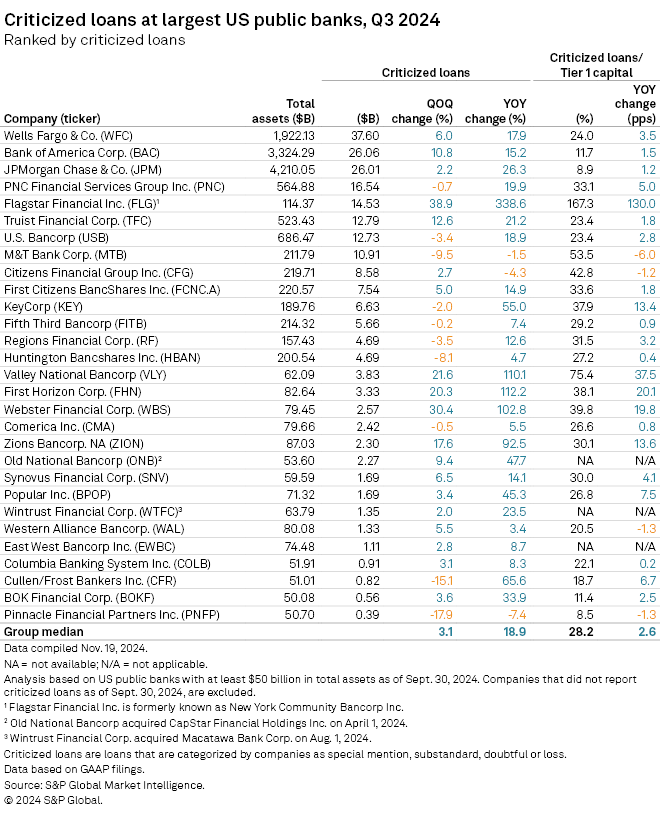

Of the 29 US public banks with at least $50 billion in total assets as of Sept. 30 that reported criticized loans, 19 booked quarter-over-quarter increases in criticized loans and all but three logged higher criticized loans year over year. The ratio of criticized loans to Tier 1 capital rose year over year at 22 banks.

The largest sequential increases in criticized loans were at regional banks with outsize exposure to CRE, led by Flagstar Financial Inc., formerly known as New York Community Bancorp. The company posted $14.53 billion in criticized loans, up 38.9% from the prior quarter, and recorded the highest criticized loans-to-Tier 1 capital ratio among the banks on the list at 167.3%, up 130.0 percentage points year over year.

Flagstar, which is nearly finished with an in-depth review of its large CRE portfolio, expects nonaccrual loans to remain heightened through 2026. "We have been diligently identifying problem loans and working towards resolution," Chief Credit Officer Kris Gagnon said during an Oct. 25 earnings call.

Webster Financial Corp. booked the second-highest sequential increase in criticized loans at 30.4% to $2.57 billion. Negative risk rating migrations are happening as the company monitors credit closely at what it views as a later stage in the cycle, Chairman and CEO John Ciulla said.

"Outside of CRE office, negative migration was generally credit-specific across the portfolio and not driven by one industry sector or asset class, although healthcare-related portfolios continue to show some weakness," Ciulla said on an Oct. 17 earnings call.

– Download a template comparing a bank's financials to industry aggregate totals.

– Download a template for a comprehensive profile on a selected bank or thrift.

– View US industry data for all US banks.

Valley National Bancorp's criticized loans jumped 21.6% quarter over quarter to $3.83 billion. The company reported some migration within its CRE and commercial and industrial loan portfolios due to the effects of elevated interest rates, though it now sees "the underpinnings of stability in terms of criticized and classified migration."

"We absolutely believe that the interest rate environment has shown some easing, and we anticipate that the migration that we've seen over the past year in criticized classified assets should definitely abate with likelihood at some point in 2025, potentially towards the end of the year," Valley National Bank Chief Credit Officer Mark Saeger said during an Oct. 24 earnings call.

Of the public banks with at least $50 billion in total assets, Wells Fargo & Co. booked the largest amount of criticized loans at $37.60 billion, up 6.0% quarter over quarter. Pinnacle Financial Partners Inc. recorded the highest sequential decrease in criticized loans, a drop of 17.9% to $392.2 million.