Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

7 Feb, 2024

By Lauren Seay and Xylex Mangulabnan

US banks' contingent liquidity plans are more important than ever, but creating viable and diverse plans will become a tougher task this year as funding sources are limited or stripped away entirely.

After last year's failures underscored how quickly deposits can move in a digital age, regulators are stepping up their scrutiny of banks' contingent liquidity plans, with a specific focus on the short term. However, short-term liquidity planning will prove more difficult for the industry this year as the Federal Reserve's Bank Term Funding Program (BTFP) comes to an end and Federal Home Loan Bank (FHLB) borrowing capacity faces an uncertain future.

"That review process will even be more stringent now," Michael Boettcher, a director at bank advisory firm Artisan Advisors, said in an interview. "It is something that they are going to look into when they conduct examinations of banks and, quite likely, they'll look deeper into that during upcoming exams than possibly they did in the exam prior, just based on the current operating environment."

'Operating in the dark'

While regulators are increasing focus on lenders' contingent liquidity plans, they have yet to give updated guidance on what banks' plans should look like following the bank failures in March 2023. Acting Comptroller of the Currency Michael Hsu provided a hint in a recent speech, suggesting regulators should introduce a rule requiring large banks to have enough liquidity to cover stress outflows over five days.

Some advisers think that is not short term enough, however, especially after Silicon Valley Bank lost 25.3% of its deposits in one day with another 60.2% in withdrawals scheduled or expected on the day after, according to Federal Reserve data.

"Having five-day liquidity doesn't help me if it's going to be a digital run. It's going to be, 'What do we have day one?'" said Donald Musso, president and CEO of FinPro Inc.

Musso's firm is advising banks to ensure they can access at least 20% of their total deposit base in one day. Musso also suggested banks' liquidity plans should include tiers for what they can access immediately, in one day, one week and one month.

"We are all operating in the dark," Musso said. "[Regulators are] aggressively trying to understand the big liquidity change."

Diversity

As banks wait for clarity on how regulators' short-term liquidity views have changed following the failures, they can still make moves to ensure their plans are diverse and viable.

"You never want to have all your eggs in one basket," said John Geiringer, a partner in the Financial Institutions Group at Barack Ferrazzano Kirschbaum & Nagelberg LLP.

Regulators think it's a red flag if a bank's plans are concentrated in just one or two sources, advisers said.

"The more narrow we view our liquidity positions or backup liquidity positions, the more problems we're going to have," said Bart Smith, partner, managing director and head of risk and regulatory support at Performance Trust Capital Partners. "There are many banks who have not had liquidity issues, don't get concerned about it, feel like they'll just go to Federal Home Loan Bank and they have that one source to look at... Those companies are going to come under scrutiny."

However, banks are hesitant to include some liquidity sources either due to a public stigma attached to those sources or a perceived sentiment toward specific sources by regulators. Since the events of last spring, regulators' views of some liquidity sources — such as brokered deposits — have become more positive. According to multiple advisers, regulators now view those as a more stable source of funding than they did prior to the failures.

But that sentiment has only been communicated privately, and advisers want regulators to be more open about their views on the various funding sources. An opportune time to come out with a statement for what are acceptable sources of funding is when the BTFP ends in March, Musso said.

"Banks want to do the right thing, but we need to know what we can do," Musso said.

Banks have upped their usage of brokered deposits since the second quarter of 2022, with brokered deposits for the industry totaling $1.296 trillion at Sept. 30, 2023.

In addition to diverse funding plans, banks must also show the plan is viable by testing the sources and pledging assets.

"You need to test it in the same way that you test your cybersecurity plans because seconds count," Geiringer said. Banks need to make sure their "break-the-glass approach is accessible, available."

Liquidity sources stripped away

The BTFP ending and the FHLBs potentially limiting their borrowing to banks could create challenges to diversifying liquidity plans.

The Fed recently announced that it will end the emergency lending program created in the wake of the failures as planned in March. Moreover, banks could have less access to FHLB funding in the near future following a report from their primary regulator, the Federal Housing Finance Agency, calling on them to not be "lenders of last resort."

In the wake of the failures, many banks beefed up their liquidity through the FHLB, with advances as a portion of total liabilities reaching a three-year high in the first quarter of 2023 at 3.75%.

"We can't expect the 2008-2009 coverage of federal home loan banks like they had or even first quarter last year coverage like they had," Smith said. "It creates a need now to not have the same exclusive reliability on the federal home loan bank that you've had in past."

The idea of possibly stripping away two sources of fast liquidity is troubling for the industry.

"It's a major concern. It's bad enough if one of them went away, but having the potential for both of them happening relatively quickly after each other, it's a prescription for disaster," Musso said.

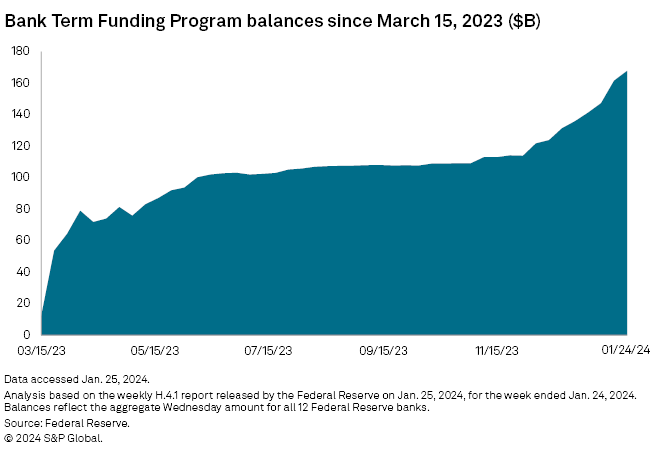

BTFP usage stayed relatively stable between June 2023 and November 2023, but the industry's usage began ticking up in December 2023, and sits over $165 billion as of Jan. 31. However, industry experts don't believe that growth is out of a need for liquidity.

"Borrowing from the facility has continued to trend higher but is not a clear signal of broader bank liquidity stress. We believe higher BTFP use represents banks increasing their liquidity buffer due to recent shifts in regulatory guidance (lower FHLB reliance) and frontloading of activity ahead of BTFP new loan expiration in March 2024," BofA analysts Katie Craig and Mark Cabana wrote in a report.

Shrinking the stigma

Aside from the BTFP and the FHLB borrowing, the Fed's discount window is one option banks can utilize. However, a long-time stigma that borrowing from it is a sign of trouble at an institution holds banks back from using it.

That stigma is more acute for public banks who have their moves scrutinized by investors, analysts and the media, Smith said.

"The discount window has historically been a place that you go if I can't get money from anywhere else," Smith said. "And banks that are publicly traded get a lot of external attention."

Hsu addressed this during his recent speech on liquidity planning, suggesting regulators could help reduce the stigma by offering banks "credit" for their discount window borrowing capacity.

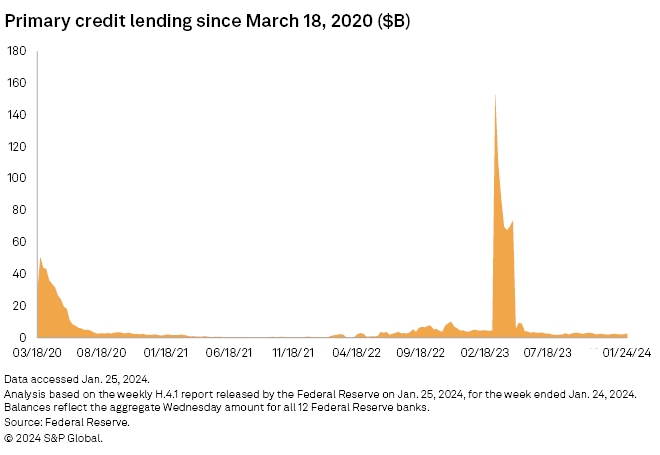

US banks fled to the window in the wake of the March 2023 failures, but quickly lessened their utilization. However, banks may be forced to use that source more once BTFP is gone and if FHLB limited. The end of BTFP and pull back from the FHLBs could mean the discount window will not be "an odd ball or an unusual lending source, but a place that you might go more typically," Smith said.

With BTFP ending and FHLBs potentially pulling back, more banks will likely test the discount window and pledge assets against it in the near future, Musso said. But it's unlikely those banks will draw on that contingent funding anytime soon.

"Nobody wants to be the first to test the reputation risk," Musso said.