S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

2 Nov, 2022

By Rica Dela Cruz and Zuhaib Gull

U.S. bank stocks made gains in October after two consecutive months of negative returns amid the Federal Reserve's aggressive monetary policy tightening.

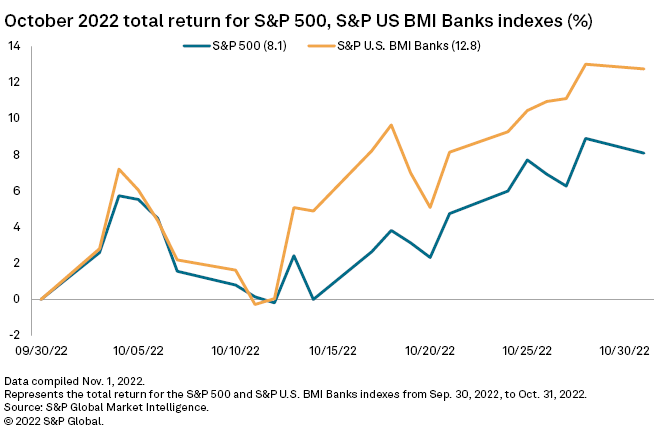

Major exchange-traded banks had a median month-to-date return of 8.6% in October, compared to a negative 4.3% in September and a negative 1.7% in August, according to an S&P Global Market Intelligence analysis. The S&P U.S. BMI Banks index returned 12.8% in October, while the S&P 500 booked a return of 8.1%.

The U.S. stock market rallied in October after enduring several straight months of losses, leading to optimism that the end of the bear market may be in sight. The Federal Reserve is almost certain to raise interest rates by another 75 basis points this week. Fed observers will be closely watching for any sign of a policy pivot or indication of a slowdown or pause in rate hikes at the December Federal Open Market Committee meeting.

Most U.S. banks reported third-quarter earnings in October, with many raising their provisions for credit losses amid continued strong loan growth and a worsening macroeconomic outlook.

Silvergate Capital once again among worst performers

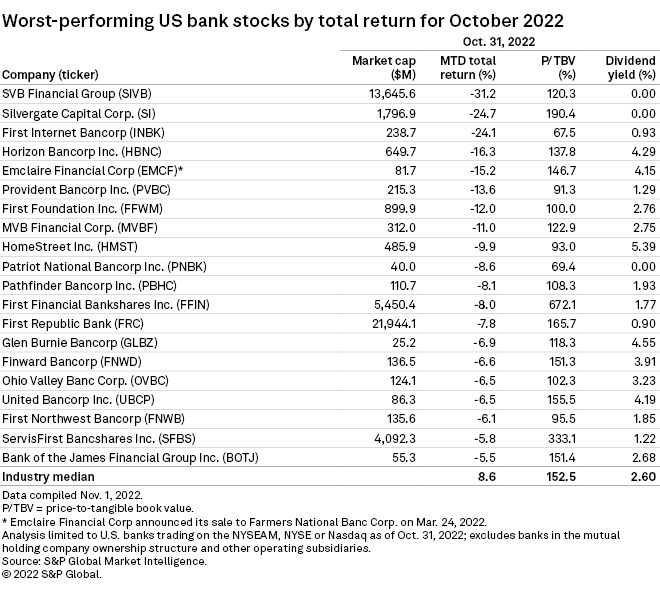

SVB Financial Group lagged the entire U.S. banking sector in October with a return of negative 31.2%.

Janney Montgomery Scott analyst Timothy Coffey downgraded the Santa Clara, Calif.-based company to "neutral" from "buy" in the same month, saying its cash burn rates could remain heightened, driving lower spread income, margin compression and further drops in noninterest-bearing deposits.

Silvergate Capital Corp., also one of the worst performing stocks in September, saw its stock price plunge after reporting third-quarter EPS that missed the consensus estimate. The La Jolla, Calif.-based company's stock ranked second on the October worst performer list with a negative return of 24.7%.

* View index prices at the Index Summary page in S&P Capital IQ Pro.

* Create custom stock market charts using the Chart Builder in S&P Capital IQ Pro.

* Set email alerts for future Data Dispatch articles.

First Internet Bancorp was the third worst-performing bank stock with a negative 24.1% return.

The Fishers, Ind.-based company's shares were under pressure after announcing disclosing "higher-than-expected" deposit betas that fueled "significant" net interest margin compression in the third quarter, according to Keefe Bruyette & Woods analyst Michael Perito. The analyst lowered his rating on the company to "market perform" from "outperform."

The stock of San Francisco-based First Republic Bank returned a negative 7.8% in October. Analysts on a third-quarter earnings conference call questioned the bank's funding for its loan growth, which it continued to push for even as rising interest rates put pressure on funding costs. First Republic Bank's shares tumbled about 15% Oct. 14 after the company released its third-quarter financials.

Mergers propel pair of bank stocks

Louisville, Ky.-based Limestone Bancorp Inc. topped the list of best-performing stocks in October, the same month the company announced its sale to Marietta, Ohio-based Peoples Bancorp Inc. in an all-stock transaction valued at about $215.6 million. Limestone posted a month-to-date return of 31.0%.

Doylestown, Pa.-based HV Bancorp Inc. also ended the month as one of the best-performing stocks after inking a deal to merge into Mansfield, Pa.-based Citizens Financial Services Inc. HV Bancorp's stock returned 23.8%.