Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Feb, 2023

By Alex Graf and Zain Tariq

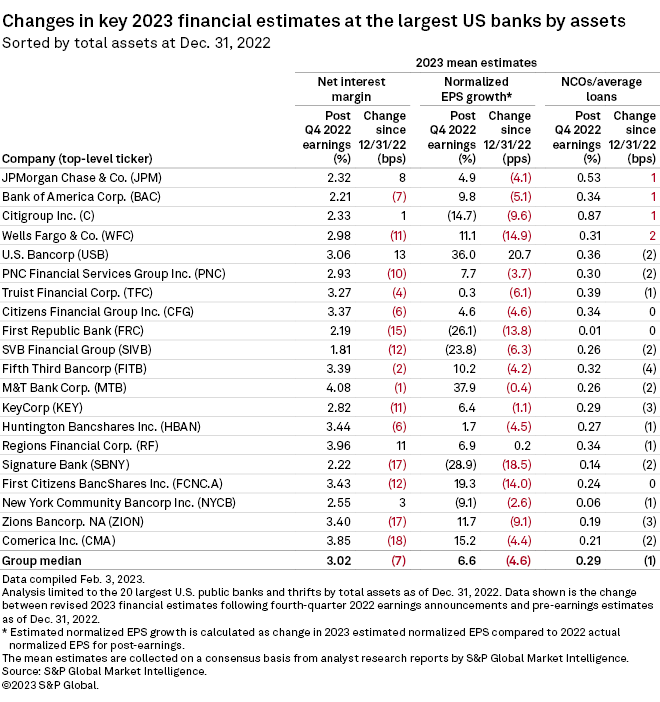

Analysts covering the largest U.S. banks curtailed their earlier expectations for 2023 earnings growth following fourth-quarter 2022 earnings reports.

Mean EPS growth estimates for 2023 were lower for 18 of the 20 largest U.S. banks following earnings season than they were at the end of 2022, according to S&P Global Market Intelligence data. Mean net interest margin estimates were lower for 15 out of the 20 banks.

Changing financial estimates

Analysts' mean NIM estimate fell 18 basis points for Comerica Inc., the largest drop in the group, followed by Zions Bancorp. NA and Signature Bank at 17 basis points each. Among the 20 largest banks, the group median NIM estimate change from Dec. 31, 2022, was a 7-basis-point decline.

Regions Financial Corp. and U.S. Bancorp were the only two banks in the group with a positive change in mean EPS growth estimates. The group median estimate change was negative 4.6 percentage points.

* Download a template to compare a bank's financials to industry aggregate totals.

* Download a tear sheet to run a stress test on banks and thrifts.

* View U.S. industry data for commercial banks, savings banks and savings and loan associations.

Analysts' expectations for credit quality across the group have not meaningfully worsened, with mean estimates for 2023 net charge-offs to average loans ratio rising for only four of the 20 banks. The higher ratios, signaling slightly worsening credit quality expectations, were at the four largest U.S. banks: JPMorgan Chase & Co., Bank of America Corp., Citigroup Inc. and Wells Fargo & Co.

The group median estimate was a negative change in the net charge-offs to average loans ratio of 1 basis point.

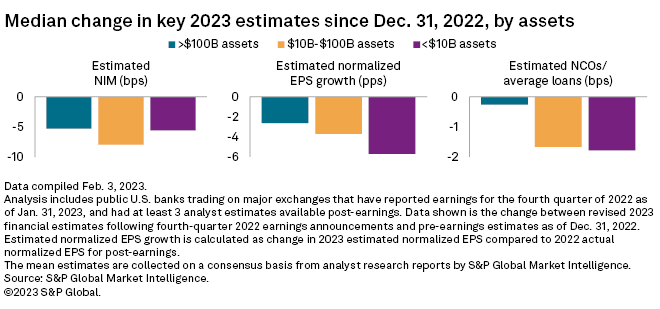

The estimate changes are fairly consistent across banks in all categories, though analysts lowered NIM and net charge-off estimates the most for banks with $10 billion to $100 billion in assets and lowered EPS growth estimates the most for banks with less than $10 billion in assets.

Positivity scores

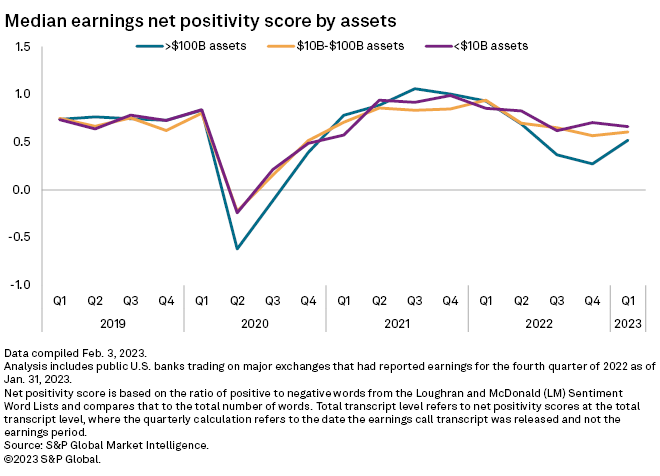

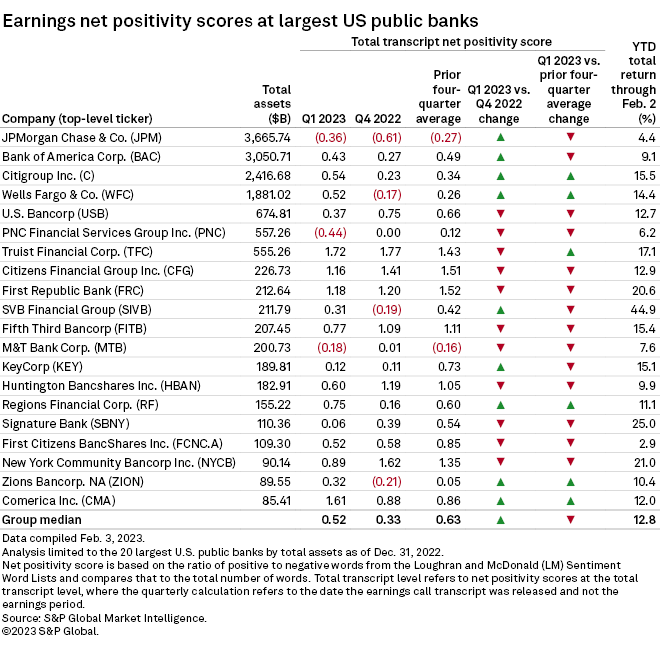

In the first quarter, 11 of the 20 largest U.S. banks by assets had lower transcript net positivity scores based on the words used during earnings conference calls, relative to the fourth quarter of 2022. Compared to the prior four-quarter average, 14 had lower scores in the first quarter, according to S&P Global Market Intelligence data.

The group median net positivity score was 0.52 in the first quarter, compared to 0.33 in the fourth quarter of 2022 and the prior four-quarter average of 0.63. The median positivity score trend from the fourth quarter of 2022 to the first quarter of this year was positive, while the median trend was negative compared to the prior four-quarter average.

The positive trend quarter over quarter was especially pronounced among banks with greater than $100 billion in assets, compared to a moderately positive trend for banks with $10 billion to $100 billion and a slightly negative trend for banks with less than $10 billion in assets.

Still, banks in all three categories had lower scores compared to the first quarter of 2022, and the year-over-year trend was negative for banks in all three categories. The median score was still far above the low point of the second quarter of 2020.