S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

20 Aug, 2021

By Yizhu Wang and Zuhaib Gull

More and more leading fintech companies are growing out of the size that banks can digest as potential acquirers, keeping competition between traditional banks and disruptors as healthy as ever.

Large commercial banks have snapped up several fintech companies in recent years, but few deals have been large enough to warrant disclosing a value. Market observers cite several reasons why fintech targets have tended to be smaller, in contrast to a wave of billion-dollar M&A activity among traditional banks.

It's hard for banks to absorb a large fintech company with a disruptive approach that contrasts with traditional banking models. Meanwhile, fintech companies woo customers with lower fees than banks. That poses challenges to banks' existing business lines if they want to acquire those fintech competitors, leading most banks to stick to small fintech deals.

"I'd say it's still really hard" to sell large fintech companies to banks, Steve McLaughlin, the founder and CEO of investment bank Financial Technology Partners LP, said in an interview. "The banks are under a lot of restrictions on what they can do in terms of spending money on investing or otherwise."

"These (fintech) institutions that are coming up from the bottom are going after the highest fee business of the banks," McLaughlin said. "So the banks don't want to cannibalize themselves."

As fintechs have gained scale, they have been able to put real competitive pressure on banks, said Alex Johnson, director of fintech research at Cornerstone Advisors.

The traditional high-cost banking model, especially in terms of branches and staffing levels, leads costs to be relayed to customers in the form of fees, Johnson said. Challenger banks have prompted some incumbents to revisit that approach. In June, incumbent digital bank Ally Financial Inc. said it is eliminating all overdraft fees, and several branch-heavy traditional banks including PNC Financial Services Group Inc. and Fifth Third Bancorp have introduced new alert services to help prevent overdraft fees from occurring, Johnson said.

High valuations, core priorities

There is not a long list of banks who could acquire fintech targets above $500 million in size without having to make big commitments to their investors, said Henry Pinnell, managing director at Barclays' investment banking division. The public market evaluates banks on financial metrics such as book value, or the difference between total assets and liabilities, which can be more accurate than using a bank's earnings. The large amount of goodwill incurred in M&A transactions, particularly for an expensive fintech target, could make the math more challenging for a bank's balance sheet, Pinnell said in a webinar July 29 hosted by S&P Global Market Intelligence.

Even for neobanks with large deposit bases and lending operations — the businesses familiar to incumbent banks — valuations for the most successful firms have outgrown what most bank buyers could handle. FT Partners advised London-based digital bank Revolut Ltd. in its latest $800 million funding round announced in July, led by SoftBank Investment Advisers (UK) Ltd. and Tiger Global Management LLC. Revolut grew its post-money valuation by six times to $33 billion from its previous round just 18 months ago. In the U.S., valuations of leading neobanks are climbing rapidly, with Chime Financial Inc. recently hitting a $25 billion valuation.

The unusual economic dynamics of the coronavirus pandemic, when consumers have been flush with cash and bank income from loan interest has contracted, has also led banks to focus on their core business as opposed to making large technology deals at this point, Johnson said. However, he expects banks' M&A appetite in smaller fintechs to increase, since there is a larger variety of potential products that banks can offer by acquiring a small startup than there used to be.

That M&A interest could also be pushed along as forming partnerships with fintechs is getting more competitive, Johnson said. If a fintech does not partner with a bank exclusively, a full acquisition could let the bank corner that company's offering.

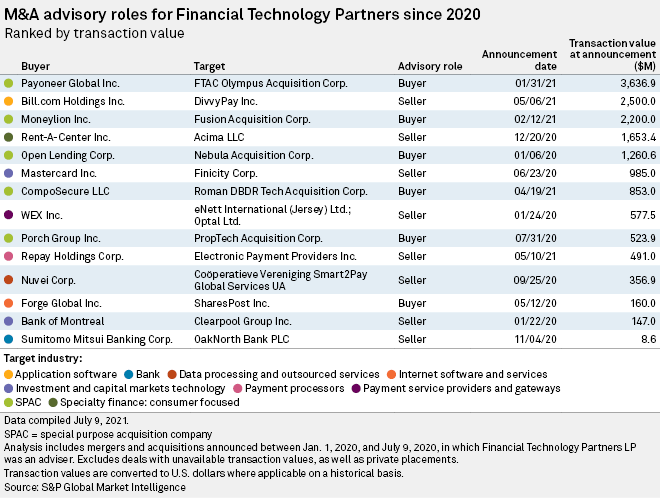

McLaughlin's FT Partners has helped fintechs navigate ever-larger private fundraises and valuations in M&A discussions. The firm acts as the "arms dealer" for fintechs, supporting founders and entrepreneurs through capital raises, M&A and IPOs, he said. Among neobanks and alternative lenders, FT Partners advised Upgrade Inc.'s series E in August led by Koch Disruptive Technologies LLC; Moneylion Inc.'s SPAC merger in February; and GreenSky Inc.'s IPO in 2018.

It also advised on British neobank OakNorth Bank PLC's secondary stake sale in September and October 2020, and it is reportedly representing Cross River Bank, an American bank specializing in fintech partnerships, to raise fresh capital, which could value the company at $2.5 billion.

Banks do appear willing to strike deals for targets that generate assets rather than for technology platforms, Pinnell sad. On Aug. 10, Truist Financial Corp. announced a $2 billion deal for a point-of-sale lender specializing in home construction and renovation loans, Service Finance Co. LLC. Service Finance does not bill itself as a fintech company, but even so, the deal drew mixed reactions from analysts, and some were concerned it would affect the bank's share buyback plans and dilute its earnings per share.

While the Truist deal was sizable, M&A for fintech firms has skewed heavily toward even larger deals since the beginning of 2020. Eight transactions with deal values exceeding $5 billion accounted for over 69% of total global deal value from January 2020 through Aug. 6, according to the latest fintech deal tracker compiled by S&P Global Market Intelligence.