Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 Aug, 2023

By Karl Angelo Vidal and Joyce Guevarra

S&P Global Market Intelligence offers our top picks of real estate news stories published throughout the week.

Office tenants have been committing to less space on average in the second quarter as increasing hybrid work adoption lessens the need for bigger area, The Wall Street Journal reported.

The average office lease size in the US stood at 3,275 square feet, 19% smaller than the average lease size from 2015 to 2019, according to the report, which cited data from CoStar Group.

Businesses see less need for office space as they allow employees to work more from home.

Smaller office leases are seen as another setback for office landlords, as they face a higher risk of loan defaults and delinquencies.

Despite this, US businesses signed new leases for an estimated 97.5 million square feet of space, from 57.4 million square feet of new leases in the second quarter of 2020, at the onset of the pandemic.

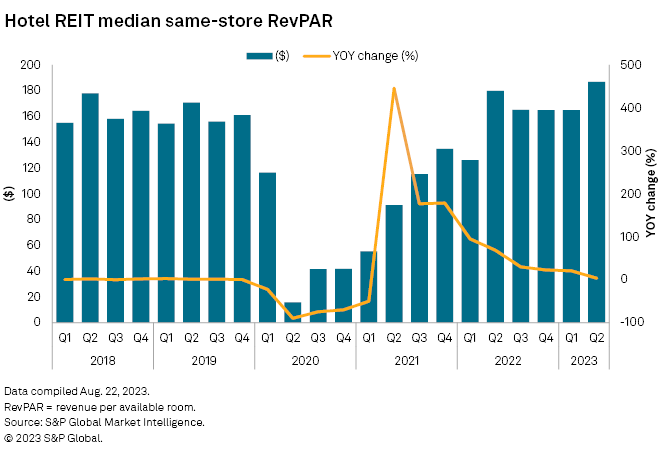

CHART OF THE WEEK: US hotel REITs' RevPAR up in Q2

⮞ Hotel real estate investment trusts saw improving earning metrics in the second quarter on the back of stronger demand from business group travel.

⮞ Hotel REITs booked a 3.8% year-over-year increase in same-store revenue per available room on a median basis in the second quarter.

⮞ Median same-store occupancy stood at 75.6% during the quarter, up 2.7 percentage points year over year.

REIT investments

– Regency Centers Corp. closed the acquisition of Urstadt Biddle Properties Inc. in an all-stock transaction. The combined shopping-center-focused group has a total equity market capitalization of more than $11 billion and a portfolio of 480 properties encompassing more than 56 million square feet of gross leasable area.

– Casino REIT VICI Properties Inc. invested $150 million in resorts and luxury spas operator Canyon Ranch Inc., SGB Media reported. Canyon Ranch operates three resorts in Massachusetts, Arizona and California, and is building another property in Austin, Texas, according to the report.

Top property deals

– Canada-based Northview Residential REIT completed the acquisition of three multifamily portfolios comprising 20 properties for a total purchase price of approximately C$742 million, as part of a recapitalization transaction. The REIT changed its name from Northview Fund after the transaction closed.

– A joint venture of Ares Management Corp. and F&F Realty Partners LLC sold a 45-story luxury apartment property at 727 West Madison Street in Chicago's West Loop neighborhood for about $232 million, The Real Deal reported, citing Cook County records. Ponte Gadea USA, the family office of billionaire Amancio Ortega, was the buyer.

– Ryan Cos. US Inc. agreed to sell a new life science complex in Lafayette, Colo., to Real Capital Solutions Inc. for nearly $190 million, Green Street reported. The 404,000-square-foot property was completed earlier in 2023 and is fully leased to medical device company Medtronic PLC.

– EQT Exeter acquired the Southeast Gateway industrial property in Savannah, Ga., from Conor Commercial Real Estate, a Commercial Property executive reported. The buyer paid $120.4 million for the 1.2-million-square-foot business park, the report said.

See key people moves in North American real estate.

4 US REITs increase dividend payments in July

Majority of REITs top Q2 2023 funds-from-operations-per-share estimates

LaSalle cuts positions in 26 REITs but bolsters Healthpeak Properties in Q2