S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

15 Jun, 2021

By Justin Horwath and Krizka Danielle Del Rosario

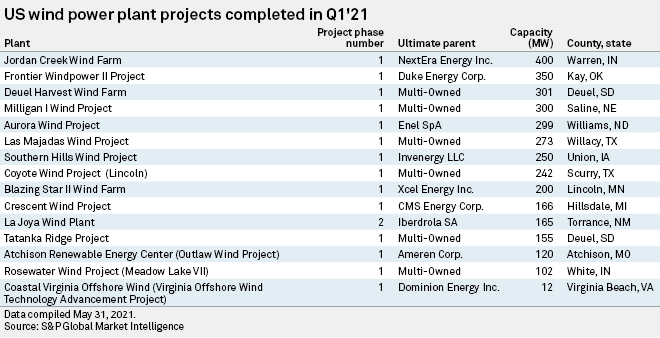

Wind developers connected to the U.S. grid 3,334 MW of capacity in the first quarter of 2021, a 75% increase from the same period in 2020. Most of the new additions occurred in the wind belt in the country's central Plains.

Following the quarter, one of the strongest first quarters for the industry, the U.S. has a cumulative wind power capacity of 124,721 MW, according to S&P Global Market Intelligence data. The strong first-quarter figures come off a record-breaking year in 2020, when the U.S. added 13.8 GW of wind power capacity.

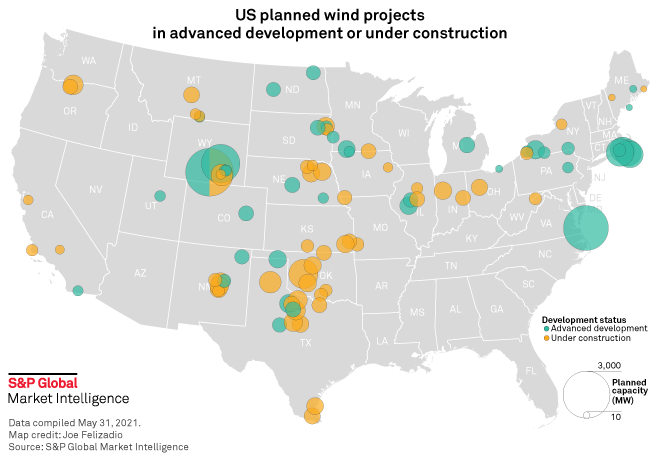

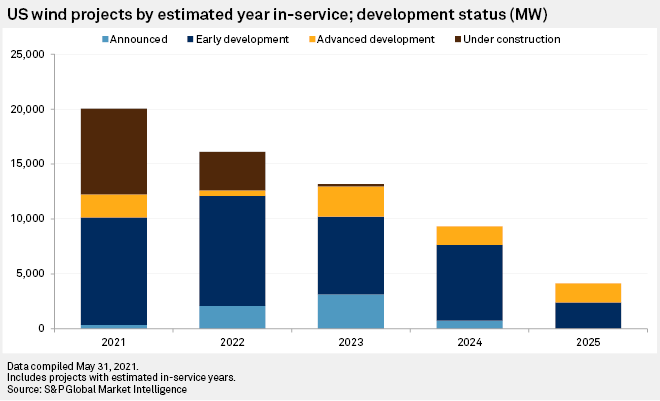

Looking ahead, the U.S. project pipeline through 2025 stands at 62,788 MW. Of that, 20,275 MW are in advanced development or under construction.

Some of that capacity comes from massive projects that have spent many years in development. Wyoming leads the way with projects in advanced development or under construction, with a pipeline of 5,748 MW. Construction has begun on a portion of The Anschutz Corp.'s 3,000-MW Chokecherry and Sierra Madre Wind Energy Project. Earlier in June, Anschutz, through its TransWest Express LLC transmission development entity, launched an open season for up to 3,000 MW of transmission capacity on a planned line from Carbon County, Wyo., to end points in Utah and near Las Vegas.

Viridis Renewable Energy Corp's planned 1,870-MW Little Medicine Bow Wind Farm (Viridis Eolia Master Plan) is in advanced development as well.

Texas has 3,794 MW of such projects, while Virginia has 2,640 MW. Putting the state on the map is Dominion Energy Inc.'s planned 2,640-MW Virginia Beach Offshore Wind Project (Coastal Virginia Offshore Wind), which is in advanced development. A 12-MW pilot project began operating in the first quarter, and three phases of 880 MW each are planned.

S&P Global Market Intelligence classifies a project in advanced development when it meets two of five criteria: financing is in place; a power purchase agreement is signed; turbines are secured; required permits are approved; or a contractor signed on to the project. A project is considered under construction when construction of the actual facility has begun; site preparations do not qualify.

Most of the projects completed in the quarter are in the middle of the U.S., where winds are strong. Global investment drove many of the additions. Three projects jointly owned by France's EDF Group subsidiary EDF Renewables Inc. and United Arab Emirates-based Masdar came online in the quarter. They are the 300-MW Milligan I Wind Project in Nebraska; the 272.6-MW Las Majadas Wind Project in Texas, and the 242-MW Coyote Wind Project (Lincoln) in Texas. None of the three projects has a known power purchase agreement.

"As the second-largest renewable energy producer in the world in terms of installed power capacity, the U.S. offers considerable scope for further growth, and with President Joe Biden having made clean energy investment a key priority for his administration, we clearly anticipate greater opportunities in this market," Masdar CEO Mohamed Jameel Al Ramahi said in a February statement announcing its financial close for a 50% stake in a 1.6-GW renewable energy portfolio in the U.S. from EDF Renewables' North American division. Masdar is wholly owned by Mubadala Investment Co., the strategic investment company of government of Abu Dhabi.

NextEra Energy Inc. subsidiary NextEra Energy Resources LLC completed the largest project of the quarter, the 400-MW Jordan Creek Wind Farm in Warren County, Ind., a coal-heavy state whose political leaders are grappling with the energy transition. The output is committed to local utility Northern Indiana Public Service Co., which aims to shut down its coal-fired generating capacity by 2028.

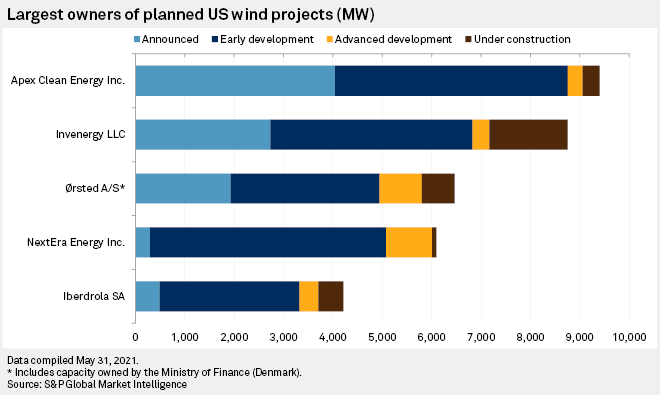

Privately held developers Apex Clean Energy Inc., with 9,400 MW, and Invenergy LLC, with 8,754 MW, have by far the largest project pipelines. Apex continues to capitalize off partnerships with corporations looking to go green. McDonald's Corp., for instance, is Apex's largest single offtake entity and corporate buyer, with 546 MW under contract.

Invenergy on March 24 said it completed construction financing for the 999-MW Traverse Wind Energy Center (North Central Energy Facilities). That project is one of three in Oklahoma Invenergy is developing for American Electric Power Co. Inc. The other two, the 287-MW Maverick Wind Project (North Central Energy Facilities) and the 199-MW Sundance Wind Project (North Central Energy Facilities), reached financial close at the end of 2020.

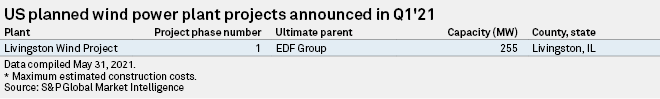

The only project announced in the quarter was EDF's proposed 255-MW Livingston Wind Project in Livingston County, Ill. The $433.5 million project is expected to come online in October 2024, according to S&P Global Market Intelligence data.