Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

10 Jan, 2022

| A worker holds an intermediate form of uranium. Some North American uranium heavyweights, many with mothballed facilities, are already stepping up to the plate if supply in Kazakhstan is compromised, or utilities look for new suppliers. Source: Pallava Bagla/Corbis News via Getty Images |

North American uranium producers are toying with restarting mines as volatility in Kazakhstan drives up yellowcake prices and increases the value of supply from politically stable countries.

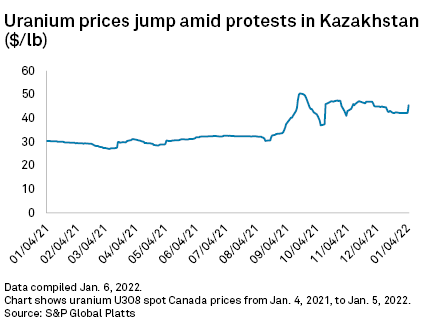

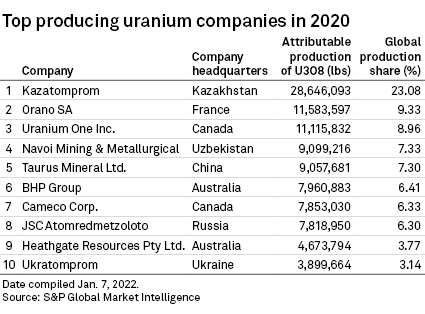

Kazakhstan, which produces almost half of the world's uranium, has been embroiled in a week of protests, with civilians rebelling against soaring fuel prices, corruption and economic disparities. The volatility in the country has not yet disrupted shipments, but prices have responded. S&P Global Platts assessed the month spot price of U3O8 to Canada at $42.25/lb on Jan. 4 and $45.75/lb on Jan. 6, an 8.3% jump.

The price is lower than highs set in fall 2021, but a sustained price hike and turmoil at a major producer could have long-term consequences if uranium buyers decide to turn to more stable geopolitical climates for their nuclear fuel supply, industry analysts said. As shares for Kazakhstan's state-run uranium company Kazatomprom tumbled, North American producers of uranium gained ground.

"In conversation with some market participants, the perception of Kazakh uranium now has a little bit more of a risk premium to it," Jonathan Hinze, president of UxC LLC, a nuclear fuel research firm, said in an interview. "With that in mind, some are maybe going to look more towards other sources of supply outside of Kazakhstan, which would involve, those in Canada, Australia, Namibia, and other suppliers."

In anticipation of any potential demand shifts, some North American uranium heavyweights are already stepping up to the plate, saying they are ready to supply utilities with uranium in case products from Kazakhstan are compromised by political instability.

"Any disruption in Kazakhstan could of course be a significant catalyst in the uranium market," Canadian uranium company Cameco Corp. wrote in a Jan. 6 statement. "If nothing else, it's a reminder for utilities that an over-reliance on any one source of supply is risky."

Cameco has five suspended uranium sites in North America under care and maintenance, which it took offline due to low uranium prices. The operations include the McArthur River mine, Key Lake mill and the Rabbit Lake facilities in Canada, as well as the Smith Ranch-Highland in Wyoming and the Crow Butte mine in Nebraska. Together, these assets offer about 24 million pounds annual productive capacity of uranium concentrate, over three times what the company produced in 2020, and almost as much as Kazatomprom's total 2020 output, according to S&P Global Market Intelligence data. However, before any of the assets are brought back online, several conditions would have to be met, the company noted.

"A restart of any facilities would require an improvement in the commodity price to the point where the market is once again calling for increased production, along with having a home for that increased production" outside the spot market, Jeff Hryhoriw, Cameco's director of government relations and communications, told Market Intelligence by email. "At present, we can't comment with any certainty on the length of time it might take to resume production at any of these facilities."

U.S.-based uranium miner Energy Fuels Inc. said it had the capacity to produce between 2 million and 2.5 million pounds of uranium in as little as 18 months to 24 months. Reviving production at mothballed mines or mills hinged far more on market conditions than the political situation in Kazakhstan, Curtis Moore, vice president of marketing and corporate development at Energy Fuels told Market Intelligence on Jan. 7.

"Whether it's unrest in Kazakhstan or something else, if prices go up and utilities make long-term purchase commitments, that's when we'll ramp up," Moore noted. Nevertheless, prices would have to be "moderately higher" than current spot prices to justify restarting mines, the company said.

Sid Rajeev, head of the research department at Fundamental Research Corp., said uranium prices could continue heating up depending on how the turmoil in the world's No. 1 producer plays out.

"We believe the recent developments are promising for spot uranium prices even though Kazatomprom has stated that their production and exports have not been impacted," Rajeev said.

Kazakh supply intact so far

The Nuclear Energy Institute, a U.S. policy organization representing nuclear companies, said supply had not been disrupted in Kazakhstan, as of Jan. 7, but U.S. utilities were keeping an eye on the situation.

"Kazatomprom has publicly stated it is operating normally with no impact to contracted deliveries," said Nima Ashkeboussi, senior director of fuel and radiation safety at the Nuclear Energy Institute. "U.S. utilities diversify their uranium supply, working with multiple suppliers in multiple countries."

U.S. utilities source about 22% of their uranium supply from Kazakhstan, buying from several companies, Ashkeboussi added.

French uranium miner Orano SA's operations in Kazakhstan have been left unscathed by the protests and remain operational. Orano is in a joint venture with state-run uranium company Kazatomprom.

"At this stage, the activity is not suspended on the Katco sites, which are very isolated [and] far from the places of the demonstrations," Gwénaël Thomas, Orano's press office manager, said over email.

To Hinze of UxC, it's premature for the market to panic or make big changes given the protests have reportedly not disrupted existing nuclear fuel operations. What's more, a move by utilities to diversify supply would take time.

"Utilities and others that are the main buyers are now just starting to consider what they have to think about when it comes to whether it's still safe to buy uranium from Kazakhstan," Hinze said.