S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

11 Mar, 2022

By Camille Erickson

| An intermediate form of uranium known as yellowcake is pictured on the conveyor belt at a uranium facility. Platts spot uranium price increased to $52.35 on March 8, 19% higher than Feb. 24, the day Russia invaded Ukraine. Source: Pallava Bagla/Corbis News via Getty Images |

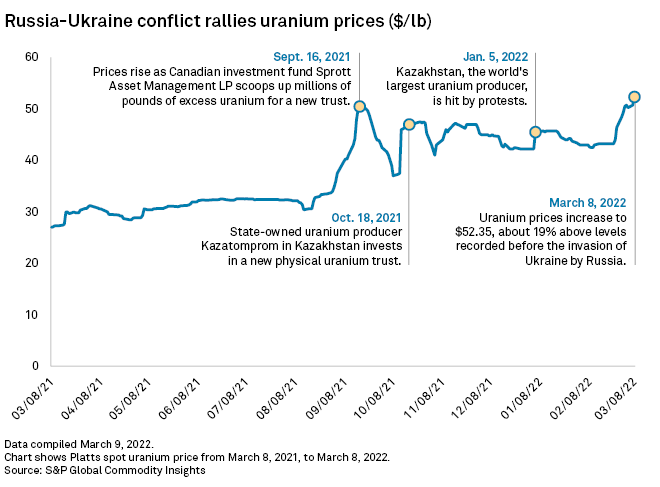

Russia's invasion of Ukraine has threatened to rattle uranium supply chains and spurred a wave of investor buying in the market, pushing uranium prices above $50/lb for the first time in 10 years.

Uranium spot prices gained ground in the weeks following the invasion of Ukraine by Russia, a leading uranium producer, with the Platts spot uranium price increasing to $52.35 per pound on March 8, 19% higher than Feb. 24, the day of the invasion of Ukraine. Toronto-based hedge fund Sprott Asset Management LP, a subsidiary of Sprott Inc., helped jolt the uranium market by purchasing excess supply of the metal

"The uranium spot market has really been driven by investor speculation," said Jonathan Hinze, president of UxC LLC, a leading research publication focused on uranium. "That's been a real driver since the start of the war. It has been heavily driven by Sprott and some of the other financial entities, but mainly Sprott."

As of March 9, Sprott reported that its trust held 50.4 million pounds of U3O8, a common uranium compound, up 13.8% from its holdings Feb. 4. Sprott did not return a request for comment.

"Purely from an investment perspective, this is something that big institutions normally do when there are uncertainties in the supply chain," said Siddharth Rajeev, head of research at Fundamental Research Corp. "They jump in and buy commodities and then keep them to get exposure. If there's a supply disruption, they benefit."

Jeff Hryhoriw, director of government relations and communications at Canadian uranium producer Cameco Corp., said the uranium spot price rally could be linked to uncertainty sparked by the conflict between Russia and Ukraine, as well as Sprott's recent uranium buying spree.

"It's hard to say for sure what proportion of the spot price gain has been caused by which set of circumstances, but they are most likely all having some inflationary effect on the market," Hryhoriw said in a March 8 email.

Supply chain jitters

The U.S. federal government has dealt Russia several rounds of sanctions, including on oil and gas, while uranium has so far been spared. Yet the option to curtail Russian uranium exports is still on the table, and the uncertainty has left uranium markets jittery.

Russia was the sixth-largest producer of uranium worldwide in 2021, producing about 7% of the total, according to S&P Global Commodity Insights data. Russia's close neighbor Kazakhstan is the No. 1 producer of uranium in the world, and Ukraine is among the top 10 producers.

"We believe [Russia and Kazakstan] have strong ties and that Russia may be able to influence, to an extent, Kazakhstan and potentially disrupt the uranium supply chain, especially after it helped Kazakhstan to restore order during civil unrest," Rajeev said.

Some nuclear companies have voluntarily elected to avoid doing business with Russian uranium producers. Swedish nuclear energy company Vattenfall AB announced Feb. 24 that it would halt planned deliveries of nuclear fuel from Russia to its plants and not place new orders until further notice.

The Nuclear Energy Institute, a trade group representing U.S. nuclear utility companies, declined to comment on its position regarding Russian uranium or steps members were taking in response to the Ukraine-Russia conflict but said it backs the development of a domestic nuclear fuel supply chain.

"U.S. utilities contract with a worldwide network of companies and countries for their fuel requirements to mitigate the risks of potential disruption," Nima Ashkeboussi, senior director of fuel and radiation safety with the NEI, said in an emailed statement.

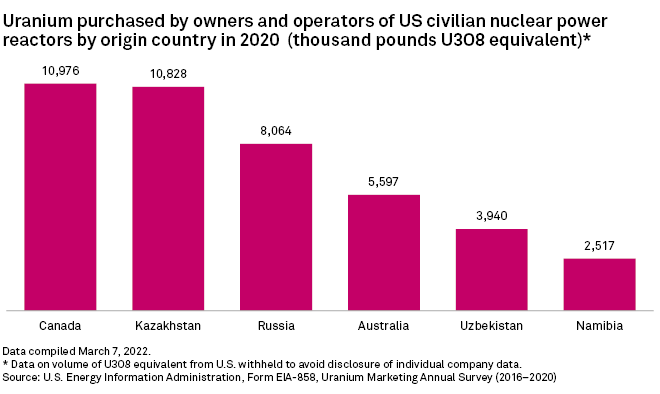

In 2020, about 47% of the total uranium bought by U.S. nuclear power reactor owners and operators came from Kazakhstan, Russia and Uzbekistan, according to the U.S. Energy Information Administration. Russian state-run uranium company Rosatom controls Russia's uranium production.

Push to diversify supply

Russia's invasion of Ukraine and the potential supply insecurity could pressure uranium buyers to diversify their sourcing and look toward places with more stable governments and infrastructure, including North American producers, industry experts said.

"Russia's aggression in Ukraine highlights the danger of relying on the Kremlin and its allies for strategically critical energy supplies and minerals," Scott Melbye, president of Uranium Producers of America and executive vice president of U.S.-headquartered Uranium Energy Corp., said in a Feb. 25 statement.

Uranium prices had been low for over a decade since Japan's Fukushima Daiichi reactor accident chilled interest in nuclear energy. But Sprott's moves, along with a renewed interest in nuclear power by world governments seeking to reduce their emissions, seem to be motivating a revival in uranium markets.

North American uranium producers have been toying with restarting mines as geopolitical unrest drives up uranium prices and increases the value of supply from politically stable countries.

"Suffice to say, Cameco is in a very strong position to offer utilities an alternative source of uranium and conversion feedstock should sanctions on Russia affect their short-term security of supply and as country-of-origin becomes a greater priority going forward," Hryhoriw said in an email. "If the uranium price continues to improve to the point where we feel the market is calling for increased production on a sustainable, long-term basis, Cameco is well-positioned to respond — but our decisions here will be based entirely on market signals."

Higher prices could encourage significant new uranium production, according to Rajeev. "Uranium prices need to be at least $50/lb just for the developer, meaning the pre-production guys, to start looking at a project [and] potentially advancing," Rajeev said.

Cameco has five suspended uranium sites in North America under care and maintenance, which the company took offline due to deflated uranium prices. Before Russia invaded Ukraine, Cameco announced plans Feb. 9 to restart a suspended Canadian mine and mill in response to improving market conditions and growing interest from utilities for long-term contracts.

S&P Global Platts is an offering of S&P Global Commodity Insights. S&P Global Commodity Insights is owned by S&P Global Inc.