S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

18 Jan, 2021

By Sanne Wass and Rehan Ahmad

Paying a negative interest rate on your deposit account is becoming a reality for Mr. and Mrs. Denmark, as the average Danes are called in Danish.

Some banks in the country are now charging negative interest on retail deposits above 100,000 kroner — or just over $16,000 — and other lenders are likely to follow in 2021 as they seek to weather the impact of a prolonged negative rate environment, according to analysts.

Danish banks' success in imposing negative rates is good news for investors, as it supports earnings and is a useful tool with which to counteract potential future central bank rate cuts, said Sydbank equity analyst Mikkel Emil Jensen. Denmark could serve as a model for other European lenders facing similar challenges, he said in an interview.

Herd effect

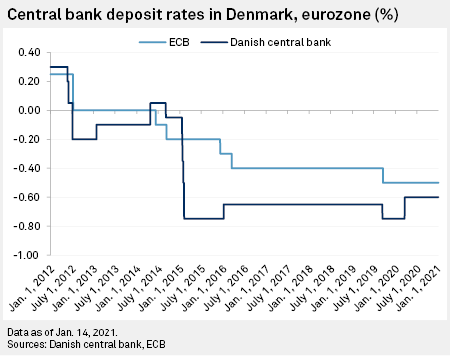

Central bank interest rates have been steadily dropping for years, driven by factors including a desire by authorities to stimulate slugging economies. This has put pressure on commercial banks to follow suit.

Today, almost all banks in Denmark charge a negative interest on retail deposits over a certain threshold. Jyske Bank A/S was the first to introduce this on deposits above 750,000 kroner, in December 2019, with peers following. In May 2020 it further lowered this so-called exemption limit to 250,000 kroner, which has since become the market standard, with other large banks such as Danske Bank A/S and Nordea Bank Abp adopting the same limit as of Jan. 1, 2021.

Sydbank A/S and some smaller lenders have even gone so far as to lower the threshold to 100,000 kroner. Above the exemption limit, most charge the same interest rate as the Danish central bank — negative 0.6%.

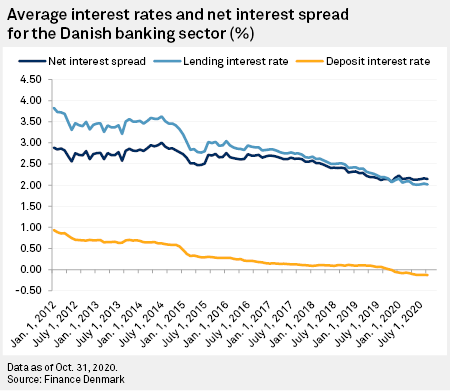

Banks have faced consistent pressure on net interest spreads and margins since the central bank first lowered its policy rate below zero in 2012, essentially making their deposit offerings a loss-making business. Meanwhile lending volumes and margins have declined, and this worsened during the coronavirus crisis, according to banking association Finance Denmark.

Deposits affected

Many Danes will be hit by negative rates.

Of the roughly 4.8 million retail depositors in the country at the end of 2018, about 730,000 had more than 250,000 kroner deposited at the bank, while 1.5 million people had more than 100,000 kroner, according to Statistics Denmark. It may be that not all of these depositors are paying negative rates, as the deposits might be spread over different banks or account types, the public statistics agency noted.

But, applying the figures to recently released deposit data from the Danish central bank, Jensen estimates that between 40% and 50% of the approximately 1 trillion kroner worth of total retail deposits in Denmark are above the general exemption limit of 250,000 kroner and therefore subject to negative rates.

This is in line with figures reported by Jyske Bank, which said about 35 billion kroner of its retail deposits would be affected by negative rates, all things being equal, with the 250,000 kroner exemption limit in place. That is about half of the bank's retail customer deposits, and a good representation of the impact on the deposit market as a whole, Jensen said.

Earnings impact

The policy is having a direct positive impact on Danish banks' earnings.

Jensen estimates that Jyske could add about 200 million kroner in net interest income annually with its current rates and limit, corresponding to a net profit boost of about 7%, based on 2019 earnings. However, it may not be directly visible on future results as such, given the bank's lending margins are still declining, he said.

Nevertheless, the introduction of negative rates for retail deposits has helped Jyske "repair and stabilize" the development of its net interest margin, said Per Groenborg, an equity analyst at SEB. If it had not acted, its earnings "would have continued to fall sharply," he said in an interview.

Danske Bank, the country's largest lender by assets, was the last of its peers to introduce negative rates on retail deposits, and originally imposed an exemption limit as high as 1.5 million kroner, before announcing in November that it would follow the market and lower it to 250,000 kroner.

It said its negative rate initiatives are expected to contribute 500 million kroner annually to its net interest income, all else being equal. About 400 million kroner of that will come from retail depositors, according to Jensen's estimate.

This figure is not very significant given Danske's size, but lowering the exemption limit was still important, Per Grønborg, an equity analyst at SEB said, adding that it provided comfort to equity investors who had been asking why Danske was behind peers on this front, given its sluggish earnings in recent years.

It was the "low-hanging fruit" that Danske Bank had failed to pick for a very long time, Grønborg said.

Negative rates on deposits are also likely to have a positive indirect impact, for example on fee income, as they may prompt Danes to move cash into investment products, Jensen said.

Positive customer reactions

Negative reactions from business and retail customers have been limited, Grønborg said. Certain customers may have reallocated some deposits to avoid being charged, but have largely maintained existing banking relationships.

Customers generally understand the reasons for the changes, Jensen said, and with Danish banks demonstrating both positive customer reactions and effects on earnings, other European banks may consider similar tactics, he said.

Some have already been passing on negative rates to retail depositors, but only on a selective basis and generally with a cap of €100,000 that impacts a small percentage of customers, said Vitaline Yeterian, senior vice president of global financial institutions at DBRS Morningstar. This includes a growing number of banks in Germany.

Yeterian told S&P Global Market Intelligence it is not yet clear how such moves could impact customer relationships and whether this cap could be lowered, as demonstrated in Denmark. Some banks may face political and legal constraints, she said. Others may be better placed to offset the negative impact of ultralow rates in other ways, for example through investment banking revenues.

Meanwhile, banks in Denmark will continue to expand their negative rate regime for retail depositors in 2021, Grønborg said. They could do so either by lowering the exemption limit further or by increasing the negative rate charged, he said. The latter strategy has not been widely used yet.

Grønborg and Jensen agree that most Danish banks are likely to lower the exemption limit to 100,000 kroner, and both believe it is a possibility that banks will at some point get rid of it altogether.

However, it may take a while before banks take such a step as they weigh considerations around possible negative customer sentiment and the risk of losing competitiveness in the market, Jensen said.

As of Jan. 15, US$1 was equivalent to 6.15 Danish kroner.