S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

14 Jul, 2021

By Joseph Williams and Stefen Joshua Rasay

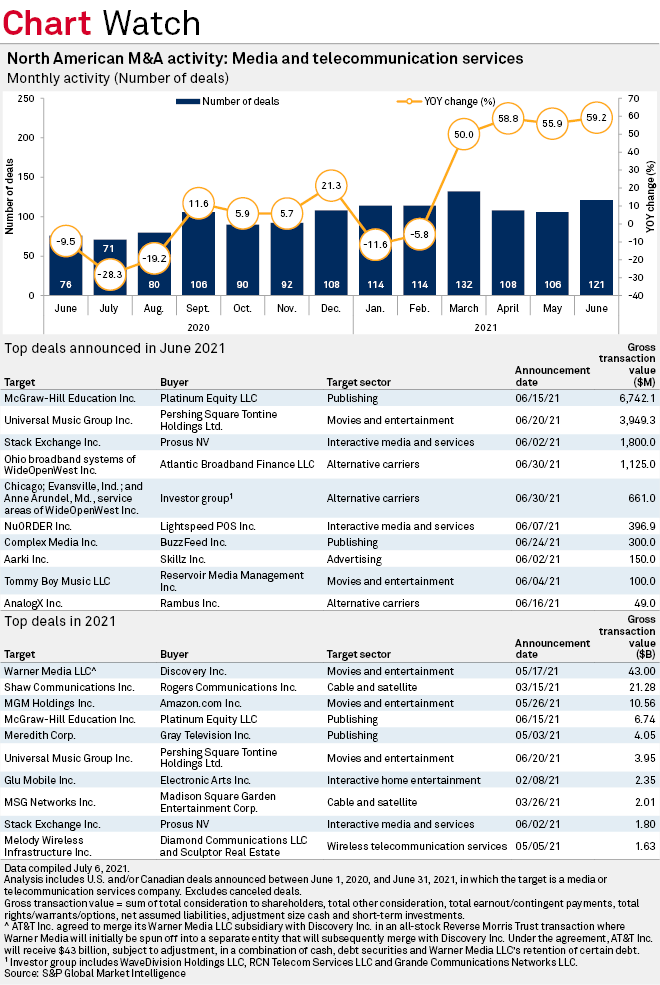

June continued the 2021 recovery in media and telecom M&A, with a headline-making special purpose acquisition company deal accounting for one of the largest transactions announced during the month.

Sector deal announcements totaled 121 transactions in June, up from just 76 deals in the prior-year period. That was not only an improvement over 2020's pandemic era total but also over June 2019.

June's transactions were led by two big announcements, with Platinum Equity LLC's $6.74 billion acquisition of educational media company McGraw-Hill Education Inc. topping the M&A chart. However, commanding a higher total valuation and capturing more headlines was Universal Music Group Inc.'s deal with SPAC Pershing Square Tontine Holdings Ltd.

That transaction, valued at $3.95 billion, comes as Universal Music is moving to public markets. But only a portion of the company will be held by the blank-check firm, as parent Vivendi SE is only selling 10% of its Universal Music holding to Tontine. The deal implies a total enterprise value of about $40 billion for Universal Music, according to S&P Global Market Intelligence.

Vivendi also intends to spin off 60% of Universal Music's share capital to be traded on the Euronext Amsterdam exchange later this year. Tontine shareholders will only receive the acquired Universal Music shares listing on Euronext Amsterdam, according to the companies.

The deal follows similar stake sales. Vivendi recently sold 20% of Universal Music to a consortium of buyers led by Chinese conglomerate Tencent Holdings Ltd. in two separate transactions from 2019 and 2020.

In both those transactions, Vivendi consulted BNP Paribas SA for its advisory services. However, in the SPAC transaction, Vivendi will tap an advisory group from Lazard Ltd., while Tontine will take on Perella Weinberg Partners LP as its financial advisor, and it will pay that firm $10 million in fees and $5 million for a fairness opinion.

In the largest transaction of the month, McGraw-Hill will take M3 Capital Partners and an advisory unit from Bank of Montreal as it changes hands from one private equity firm to another. Apollo Global Management Inc. acquired McGraw Hill in 2012 from its parent, which is now S&P Global Inc. Bank of Montreal advised Apollo on that transaction. There were no other financial advisers listed on the deal with Platinum and no fees were listed for either deal.

However, in a comparable transaction, Meredith Corp. in 2017 acquired Time Inc., now operating as TI Gotham Inc, for $3.14 billion. Morgan Stanley advised the seller on that deal, and it charged $21.7 million for its services as well as a $2.0 million fee for fairness opinion. Alongside Morgan Stanley, Bank of America's Merrill Lynch Pierce Fenner & Smith Inc also advised Time for a fee of $10.9 million and a fairness opinion charge of $1.0 million.