UniCredit SpA would reclaim its position as the biggest Italian bank by assets if it successfully takes over midsized peer Banco BPM SpA, S&P Global Market Intelligence data shows.

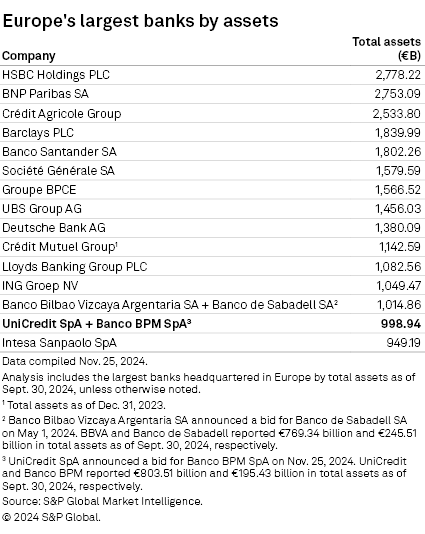

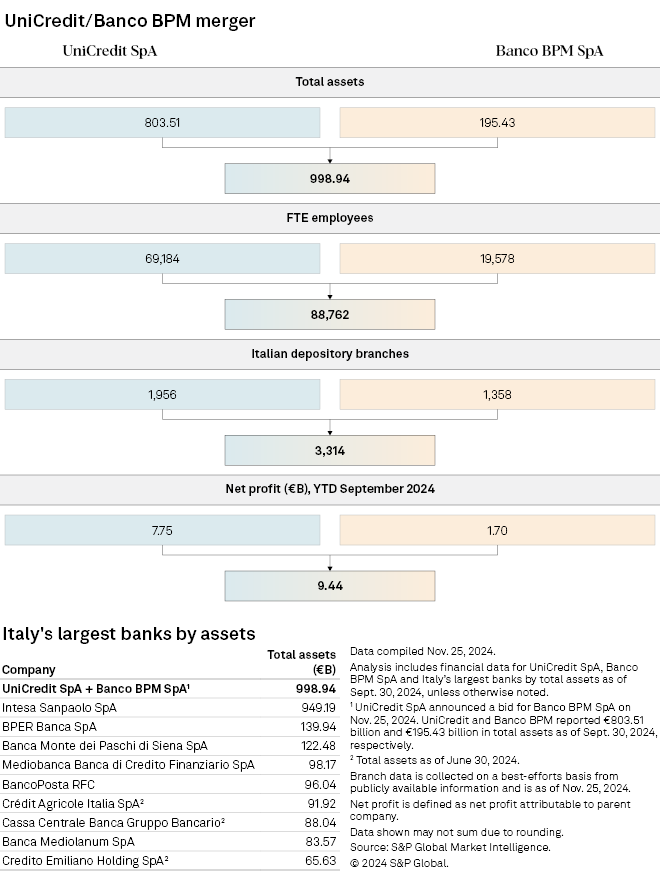

The Milan-based lender's assets totaled €803.51 billion at the end of September. Combining with Banco BPM, which held €195.43 billion of assets, would create a €998.94 billion business and surpass Intesa Sanpaolo SpA. It would also be the 14th-largest lender in Europe, when accounting for the potential merger of Banco Bilbao Vizcaya Argentaria SA and Banco de Sabadell SA.

Intesa overtook UniCredit as Italy's largest bank by assets in 2020 following its acquisition of Unione di Banche Italiane SpA. As of Sept. 30, Intesa's assets amounted to €949.19 billion.

Significant value

UniCredit on Nov. 25 offered to buy Banco BPM in an all-share deal worth roughly €10.1 billion. The bid — 0.175 UniCredit shares for each Banco BPM share — implies a price of €6.657 per share. This represents a premium of about 0.5% to the bank's share price on Nov. 22, and a 14.8% premium to the undisturbed share price on Nov. 6 before its offer to take over asset manager Anima Holding SpA.

Though the offer was surprising, such a transaction would create significant value for UniCredit as it would bolster its position in northern Italy, Equita analyst Andrea Lisi wrote in a research note carried by Dow Jones Newswires. It would also provide the group with potential for further growth, including a possible takeover of Commerzbank AG in Germany, Lisi said.

The combined UniCredit-Banco BPM entity would have more than 3,300 branches in its home country, according to Market Intelligence data.

Banco BPM did not immediately respond to a request for comment on the UniCredit offer.

UniCredit has positioned itself as a key player in European banking consolidation as it looks to become a continental leader in the industry. The Banco BPM bid comes just months after UniCredit built up a holding equivalent to 21% of Commerzbank, Germany's second-largest listed bank and the country's main processor of foreign trade.

UniCredit said discussions with Commerzbank about a merger have been prolonged due to the country's impending election. Its position in the bank remains an important investment that has significant upside potential, it said.

"Europe needs stronger, bigger banks to help it develop its economy and help it compete against the other major economic blocs. Thanks to the work that has been done over the past three years, UniCredit is now well positioned to also answer that challenge," UniCredit CEO Andrea Orcel said in a Nov. 25 statement.

Should the transaction go through, it would be the second-largest European bank merger of the decade behind BBVA's attempted takeover of Sabadell, which is currently under significant regulatory scrutiny.

The deal may be attractive for UniCredit's shareholders but not so much for Banco BPM's because of the limited premium to the latter's Nov. 22 share price, KBW analysts said. The synergies assumed by the offer are also already substantial, the analysts said.

The deal needs at least 66.67% approval from Banco BPM shareholders, but this could be partially waived if UniCredit acquires at least 50% plus 1 share. UniCredit said it expects to complete the deal by June 2025, fully integrate Banco BPM within 12 months and achieve the majority of synergies within 24 months.

Banco BPM has put its own M&A plans into action. Earlier in November it offered to take full control of Italian asset manager Anima in a deal valued at more than €1.5 billion. It also recently acquired a 5% stake in Banca Monte dei Paschi di Siena SpA from the Italian government.

Banco BPM CEO Giuseppe Castagna has said that acquiring Anima would be "transformational" for the lender.

Another party that could have a say in matters is French banking group Crédit Agricole SA. It is Banco BPM's largest investor with a roughly 9% stake through Amundi.

– View the deal profile page for the UniCredit/Banco BPM transaction.

– Access M&A data using the Screener tool.

– Read more about the M&A outlook in the latest Big Picture report.