Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

13 Apr, 2021

By Sophia Furber and Francis Garrido

|

At one point in late March, Hungary registered the worst coronavirus death rate in the world. |

For UniCredit SpA, central and Eastern Europe has been a key growth market in recent years. But countries in the region, particularly Hungary, Poland and the Czech Republic, have been in the grip of a particularly devastating third wave of COVID-19 infections so far in 2021, resulting in new lockdowns.

Industry observers say that while the situation is bleak, the economies of the CEE region should be relatively resilient in the face of lockdowns thanks to their low reliance on the services sector compared to other European countries. Because of this, UniCredit is unlikely to suffer a high level of defaults, even though it currently has a large number of loans under moratoriums.

A motor of growth

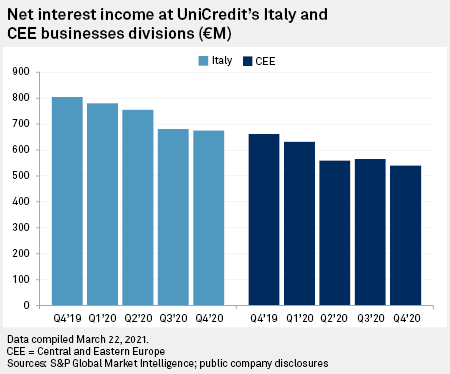

Over the past year, the CEE region has accounted for almost as much of UniCredit's net interest income as its home market, Italy. In the fourth quarter of 2020, the CEE business reported €540 million of net interest income to Italy's €674 million. Before the pandemic hit, the CEE region had been showing considerable resilience to the economic slowdown that hit Western Europe. Hungary reported GDP growth of 4.6% in 2019, the Czech Republic 2.3% and Poland 4.5%, compared with just 0.3% in Italy.

UniCredit's association with the CEE region goes back over 20 years. Then named UniCredito Italiano, the bank bought a stake in Poland's Bank Polska Kasa Opieki SA in 1999, which it went on to sell in 2016. UniCredit's 2005 merger with Germany's HypoVereinsbank, which had a substantial presence in CEE, also grew its footprint in the region.

UniCredit itself described the CEE region as an "important driver of growth" in a 2019 presentation, highlighting rising demand for retail banking, but the portfolio is not without its challenges.

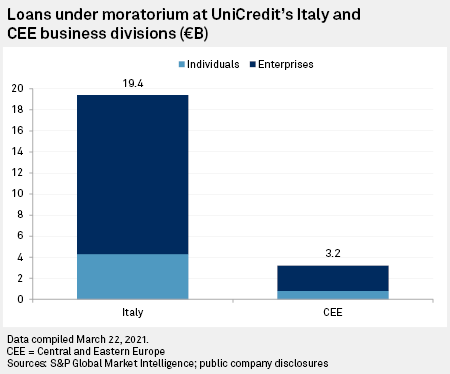

The CEE business accounted for €3.2 billion of UniCredit's total of €22.8 billion loans under moratoriums at the end of 2020. Out of the CEE loans that have been put on ice, 77% were not investment grade, according to a company presentation. Like most of its European peers, UniCredit announced near the beginning of the pandemic that it would give struggling borrowers a grace period on repayment of their loans.

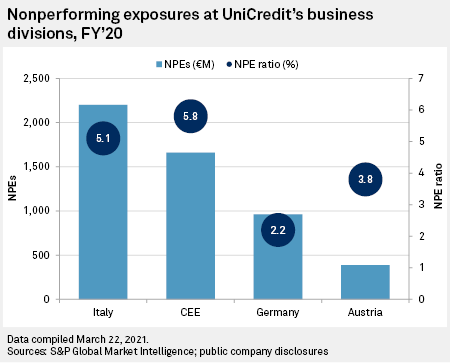

The CEE business also has a high nonperforming exposure ratio relative to UniCredit's other geographies, at 5.8% as of the end of 2020, compared with 5.1% in Italy.

Manufacturing and export

Continued lockdowns are "all but inevitable" into the second quarter of the year and the fortunes of the CEE countries will undoubtedly be affected, said Liam Peach, emerging Europe economist at Capital Economics. But this will not automatically translate into a higher level of defaults in the banking system.

"One reason is that consumer-facing services sectors such as leisure, hospitality and tourism account for a smaller share of output and employment in CEE than in Southern Europe, so lockdowns have had a smaller impact. A second reason is that CEE economies are among the most export-dependent in the world. Strong external demand for passenger cars and non-durable consumer goods during the pandemic has caused CEE exports to boom and this has partly offset the impact of lockdown measures on domestic activity," said Peach.

Lengthy lockdowns could lead to an uptick in unemployment and business bankruptcies. However, government support for businesses in the region has so far staved off mass job losses and helped families to stay afloat. "Support to households and [small and medium-sized enterprises] will be removed only gradually and we don't think there will be wave of debt defaults that weighs on the banking system," said Peach.

Looking ahead, emergency funds from the EU should provide a shot in the arm for the region. The CEE countries are set to receive a "massive inflow" of funds from the EU, according to an April 6 note from the cross asset research team at Société Générale. Under the EU's Recovery and Resilience Facility, the cornerstone of the bloc's financial response to the pandemic, the CEE countries stand to receive €44.5 billion in the form of grants, the note said.

Delayed, not derailed

At one point in late March, Hungary registered the worst coronavirus death rate in the world with 151.4 fatalities per million people in the seven days to March 24.

"The resurgence in cases could delay the economic recovery, but not derail it. Restrictions are likely to last for longer or even tighten because the number of infections and hospitalizations has risen and intensive-care units are under pressure," a UniCredit spokesperson said in an email. The services sector has been hit harder than industry in the CEE and this will remain the case in the coming months, they added.

Paul Gamble, head of emerging Europe sovereign ratings at Fitch Ratings, took a similar view. The rise in cases will set back the CEE's economic recovery, but "not dramatically," he said in an email.