S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

25 Feb, 2021

Enterprises across industries have been undergoing a digital transformation. That has been true for some time, but the COVID-19 pandemic has made the process more lumpy, pressuring some companies to rethink their digital priorities and potentially exposing others to competitive risks.

A recent survey by 451 Research, an offering of S&P Global Market Intelligence, underscores the impact of COVID-19 on the enterprise shift to digital tools and media. 451's "Voice of the Enterprise: Digital Pulse, Budgets & Outlook 2021" study revealed "very uneven" trends associated with the pandemic period, according to lead analyst Simon Robinson. Many companies are pushing additional funds to their IT departments to both prioritize digital strategies in the pipeline and add technologies that cater to a new normal in the global workforce. But some are being forced to cut information technology budgets for the new year, the research shows, which could cause them to lag their peers in efficiency and market position.

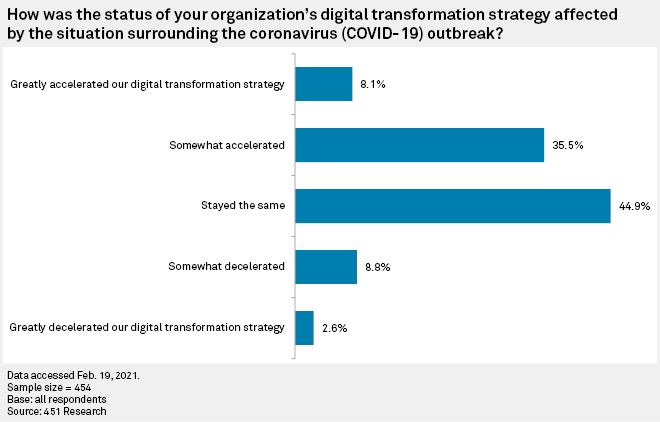

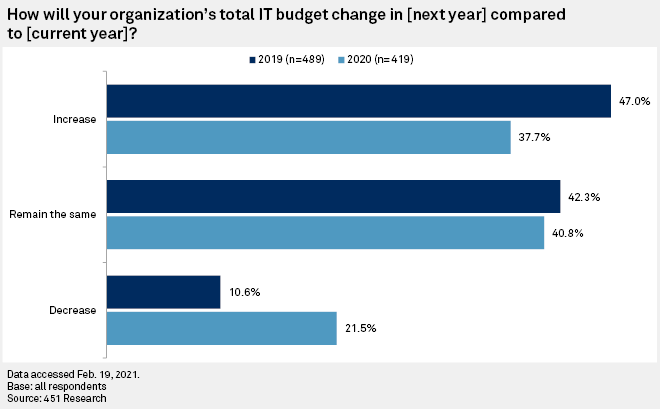

The plurality of IT business leaders that participated in the survey fall into the first camp. As many as 44% see the pandemic as a catalyst to their digital transformation efforts rather than a roadblock, and 38% said they expect the pandemic to drive more IT spending in 2021 versus the prior year. Only 11% cited the pandemic as decelerating their digital transformation efforts, and 17% said they expect COVID-19 to cause year-over-year reductions in IT spending in 2021.

However, the negative impact on IT budgets falls into relief when compared to similar questions asked in a 2019 survey. For 2021, 22% of respondents said they expect IT budgets to decrease in the coming year, double the percentage from a year ago. And where 38% said they expect budgets to increase in 2021, 47% expected higher budgets a year earlier.

Robinson highlighted the fact that at the same time almost 40% of companies expect the pandemic to increase IT spending, double the percentage of companies versus a year ago expect a lower IT budget for the coming year.

"There are winners and losers. The winners are winning a lot and the losers are losing a lot," he said in regards to the pandemic's divergent impact. "If you're hit, you're hit hard."

For those firms experiencing a negative impact, spending on new technologies may not be an option, he said. "New projects and other essential upgrades may simply need to be placed on hold," he added.

Whether their IT budgets grow or shrink, many companies will be wrangling a shift in priorities through 2021. The shift to public cloud networks, like Amazon.com Inc.'s Amazon Web Services or Microsoft Corp.'s Azure, was already underway, but 2020 accelerated that strategy for many enterprises. In the most recent survey, 78.6% of respondents said public cloud networks are an important part of their IT strategy, whether hybrid public and on-premises cloud or exclusively public cloud, compared to 70.7% in last year's survey.

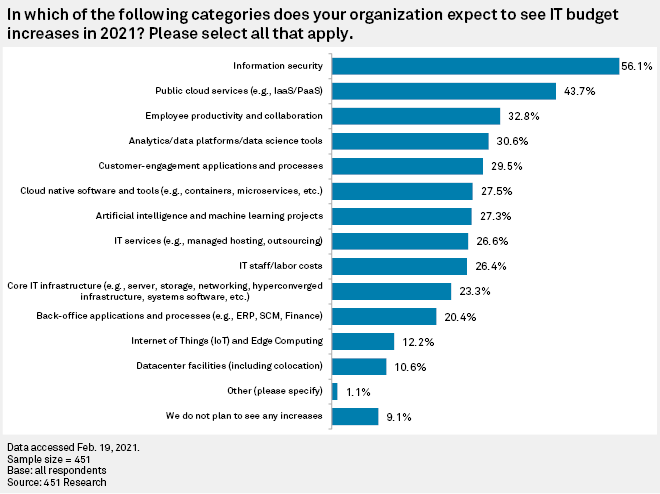

Public cloud, information security and customer-engagement applications and processes were among the biggest areas for IT spending increases for 2021. Cloud and cybersecurity were already central to many digital transformation strategies, but in the most recent survey, employee productivity and collaboration tools became a third major area of spending increases as more workforces became remote in 2020 due to pandemic stay-at-home policies. Many organizations expect their workforce to be increasingly remote for the foreseeable future.

In terms of engaging with customers, businesses are adopting more digital experiences, such as online ordering and curbside pickup services.

The largest areas of budget decrease also reflect the shift to remote work and public cloud environments, with on-premises priorities like proprietary data centers, infrastructure and staffing cited as the areas most targeted for budget decreases.

Budget constraints remain a headwind for IT leaders: 55.1% say they are in the execution phase of their organization's digital transformation strategy, but 72.3% report some degree of budget limitation on that execution.

"COVID-19's influence will loom large over IT strategy and spending, as almost all organizations continue to adjust their strategies in response to the pandemic," Robinson said in a report on the survey's findings. "Although the impacts vary widely, it's clear that some organizations will be tightening their IT spending belts over the coming year."