S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

16 Dec, 2024

By Beata Fojcik

A higher bank profit tax could hamper lending and strain capital adequacy ratios in some Ukrainian banks as the sector adopts a new, EU-compliant capital structure.

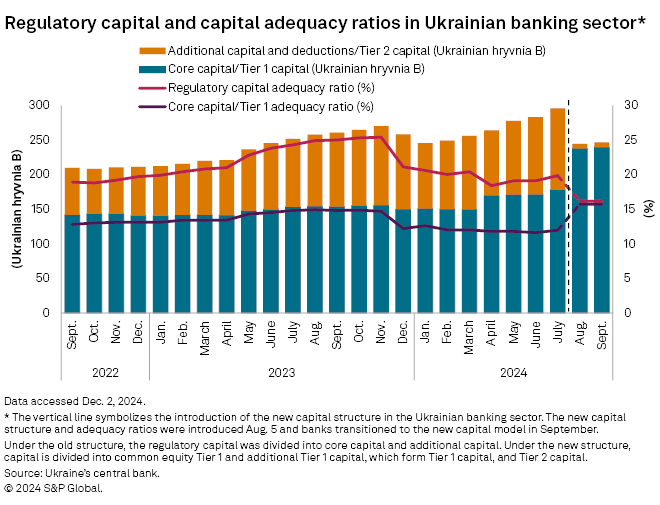

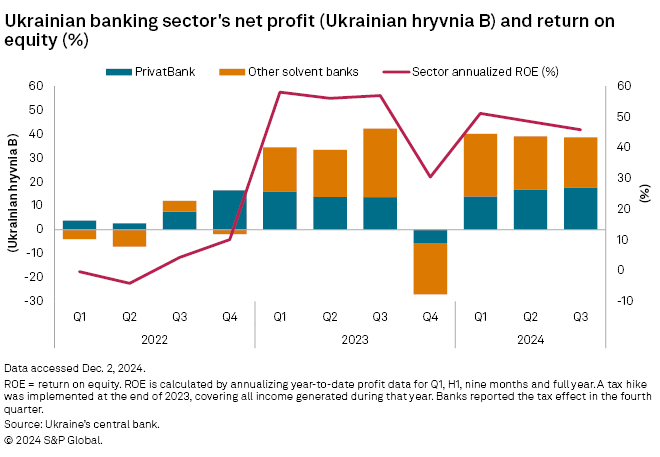

In November, Ukraine's president signed a law introducing a 50% tax rate on banks' profits generated in 2024, increasing it from 25%. This comes just after the country's banks switched to a new, three-tier capital structure aligned with EU standards, which prompted a 50 billion hryvnia drop in regulatory capital across the sector.

The tax hike will dampen capital adequacy and limit the banking sector's lending capacity and profitability, and a few banks may temporarily violate the required ratios, according to the National Bank of Ukraine (NBU).

The country's central bank declined to comment which banks could have problems meeting the capital ratios after the tax hike. However, First Deputy Governor Kateryna Rozhkova stated in the local press in September that two state-owned banks — JSC Sense Bank and JSC The State Export-Import Bank of Ukraine (Ukreximbank) — could require a 3 billion hryvnia recapitalization following the introduction of the higher tax rate.

Sense Bank and Ukreximbank did not respond to S&P Global Market Intelligence's requests for comment.

Capital changes

In September, Ukrainian banks switched to a new capital structure that forms "part of our commitments to international partners on our course of EU accession," the NBU told Market Intelligence via email. "At the same time, we are convinced that this step also boosts resilience of individual banks as well as of the sector overall to probable adverse scenarios," it said.

Bank capital is now divided into common equity Tier 1 (CET 1), additional Tier 1 and Tier 2 capital, with minimum CET1 and Tier 1 ratios set at 5.625% and 7.5%, respectively. The minimum regulatory capital ratio — or total capital adequacy ratio — was reduced to 8.5% from 10%, but it will gradually return to that level by July 2025. The transition period aims to ensure European requirements are implemented in a balanced manner and to preserve the banking system's lending potential, according to the central bank.

Ukrainian banks' regulatory capital decreased to roughly 246 billion hryvnia as of Sep. 30, from 296 billion hryvnia as of July 31, with the regulatory capital ratio declining to 16.2% from almost 20%, according to the NBU's November Banking Sector Review. The drop was caused by a change in composition of eligible capital components under the new rules and a new requirement for local lenders to cover market risk with capital, the central bank said in its email.

Of this total, CET1 capital was almost 240 billion hryvnia, up from the 178 billion hryvnia in core capital prior to the changes. CET1 capital is the closest equivalent of core capital under the previous structure. The central bank attributed the CET1 capital increase to banks being able to include retained profits, instead of classifying them as additional capital under the old rules. The Tier 1 capital adequacy ratio was 15.7% at the end of September.

The NBU plans to gradually introduce additional capital-related requirements for domestic banks, the central bank told Market Intelligence.

Big swings

The adequacy of Tier 1 capital and regulatory capital ratios remained the lowest for state-owned banks after the switch to the new structure, and the highest amid foreign-owned banks. The average ratios across all bank groups were above the minimum requirements as of September-end, the central bank said in its November Banking Sector Review.

Among Ukraine's systemically important banks, the local units of BNP Paribas SA and Crédit Agricole SA experienced the largest declines in regulatory capital, dropping roughly 52% and 34%, respectively, Market Intelligence data showed. In both cases, however, the capital ratios were above 20% as of Nov. 1.

OTP Bank Nyrt.'s local unit and state-owned Ukreximbank recorded the most significant increases in regulatory capital, rising by 26% and 20%. Before the capital structure changes, Ukreximbank's core capital ratio was below the minimum requirement of 7%. The bank was compliant with the required capital ratios under the new rules.

Sense Bank had the lowest regulatory and Tier 1 capital ratios as of Nov. 1, at 9.7%.

In case a bank fails to meet its minimum ratio, "it can submit a recapitalization plan without facing corrective measures," the central bank said.

Position of strength

The changes come amid a period of strong profitability for Ukrainian banks. Aggregate profit in the sector totaled 38.6 billion hryvnia in the third quarter, supported by high operating efficiency and low loan loss provisions. Ukraine's largest lender JSC Commercial Bank PrivatBank accounted for more than 45% of the profit, according to the NBU's November Banking Sector Review.

Fitch Ratings said Nov. 22 that it anticipates earnings will continue to support Ukrainian banks' capital, and that average capital ratios across the sector will remain above the required minimum levels. "The 'neutral' sector outlook reflects our expectation that the core credit metrics of Ukrainian banks should remain reasonably stable in 2025," the rating agency said.

Overall, domestic banks will remain operational and capable of lending despite the tax hike, and most of them will comply with capital requirements "with a good margin," the central bank told Market Intelligence.

Resilience assessment

The central bank will carry out a resilience assessment in 2025 to evaluate the capital adequacy of local banks under the new rules. "Unlike the 2023 assessment, the 2025 resilience assessment will include stress testing under an adverse scenario and an asset quality review by external, independent auditors," the central bank told Market Intelligence.

Stress testing will apply to Ukraine's largest banks by size of retail deposits, risk-weighted assets and retail loans, as well as banks that needed additional capital following the 2023 resilience assessment. Based on early estimates, this approach will involve stress testing roughly 20 banks and provide a sample of more than 90% of the banking system's net assets, according to a Nov. 25 news release by the central bank.

As of Dec. 13, US$1 was equivalent to 41.78 Ukrainian hryvnia.