S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

24 Aug, 2022

By Beata Fojcik

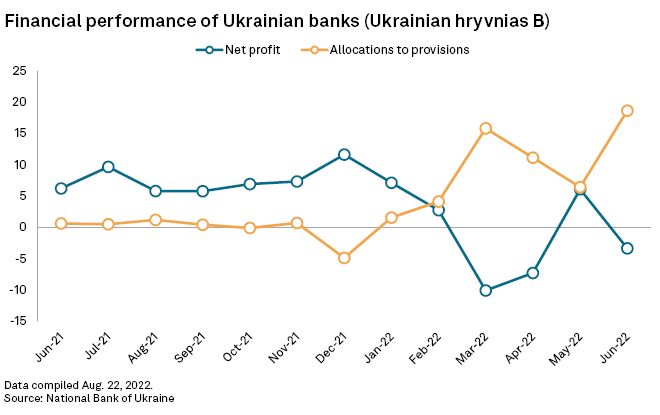

Losses in the Ukrainian banking industry deepened in the second quarter as lenders ramped up provisions for bad loans, a trend that the country's central bank expects to continue amid the war with Russia.

Banks in Ukraine posted an aggregate net loss of 4.5 billion hryvnia in the second quarter, pushing the first half losses to 4.6 billion hryvnia, the National Bank of Ukraine said. Provisions for losses expected due to the war reached 57.9 billion hryvnia at June-end, of which 52.1 billion hryvnia was allocated in the second quarter.

JSC KREDOBANK, the systemically important local unit of Poland-based PKO Bank Polski SA, posted a net profit of 2 million zlotys for the second quarter. Its aggregated net profit of 8 million zlotys for the first half of 2022 was down 86% year over year.

PKO set aside more than 200 million zlotys in the first quarter against its direct exposure to Ukraine following the launch of the invasion. These provisions are sufficient for now, PKO Bank Chief Risk Officer

About 20% of Kredobank's loan portfolio is located in, or close to, areas where hostilities are underway. Of this, 4% is in areas that are currently occupied by Russia or facing active combat operations, a bank spokesperson told S&P Global Market Intelligence.

Raiffeisen Bank International AG posted a net loss of €28 million for its Ukrainian operations in the second quarter, against a loss of €41 million reported for the previous quarter. Impairment losses on financial assets grew 17.3% quarter over quarter to reach roughly €201 million as of June 30.

"Assuming no expansion of current battlefields and situation remaining largely 'stable,' we do not expect significant additional risk costs in H1'22. Rather we feel that we are more or less done for this year," a spokesperson for RBI said.

OTP Bank Nyrt., the owner of Ukrainian systemically important lender Joint-Stock Company OTP Bank, posted an adjusted after-tax profit of 146 million forints in Ukraine for the second quarter, having reported a 34-billion-forint net loss in the first quarter. The bank booked additional provisions for loan losses in the second quarter, but these were significantly lower than the 47 billion forints allocated in the previous quarter.

OTP sees "some signs of stabilization in the Ukrainian economy despite the ongoing high-intensity military conflict," a spokesperson said. The bank's Ukrainian arm has been "cautious and prudent when forming its loan loss provisions, yet it remains to be seen whether this is also true for the general banking sector in Ukraine," the spokesperson said.

Client deposits crucial

While the war has had a negative impact on Ukrainian banks' net interest income and net fees and commissions income, their aggregate operating result remains positive, the central bank noted. The sector's pre-provision operating profit increased to 33.5 billion hryvnia in the second quarter from 23.5 billion hryvnia one year ago.

OTP Bank CFO László Bencsik said during the Hungarian lender's Aug. 11 earning call that the operating performance of its Ukrainian unit was boosted by the central bank's June rate hike to 25% from 10%, which allowed the lender to earn on deposits placed with the Ukrainian regulator. This secured "a decent operating profit" for the Ukrainian unit, allowing it to absorb a relatively high level of risk costs without making the bank loss-making, Bencsik said.

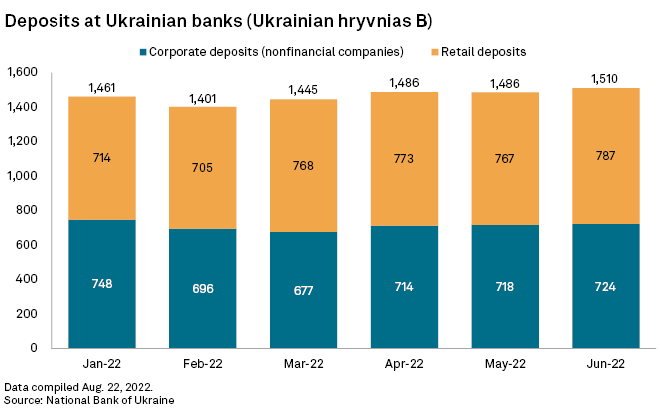

The inflow of deposits was visible across the Ukrainian banking sector. Hryvnia retail and corporate deposits rose 6.4% and 4.3% quarter over quarter, respectively. Foreign currency corporate deposits increased 14.4%, but foreign exchange retail deposits dropped quarter over quarter.

Client deposits remain the main source of funding for banks, with their share in total bank funding exceeding 88%, the central bank said. RBI's deposit portfolio in Ukraine increased 12.9% quarter over quarter, while OTP Bank's book grew 3%, taking into account foreign-currency adjustments.

Uneven lending growth

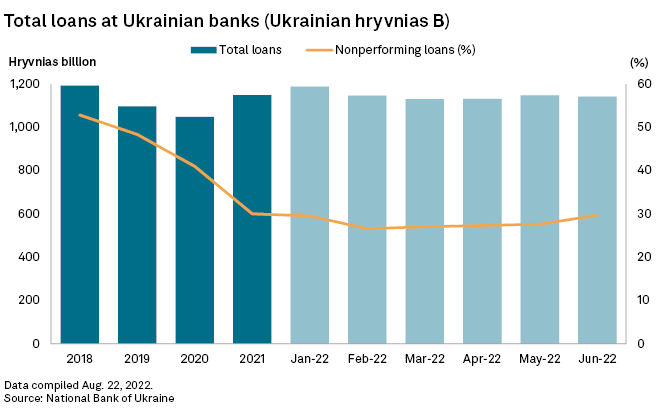

Ukrainian banks' assets grew 3.3% quarter over quarter, but lending dynamics were distributed unevenly across the sector, according to the central bank. The sector's hryvnia loan portfolio expanded, driven by corporate lending provided by state-owned banks. Loan demand from households declined 11.1% quarter over quarter in wartime conditions.

"After martial law was imposed, loans were made only to finance the current needs of customers, while mortgage and car lending virtually came to a halt," the central bank said.

While bolstering provisions for their performing retail portfolios, banks also gradually started recognizing corporate nonperforming loans, which resulted in the sector-wide NPL ratio growing by 2.6 percentage points in the second quarter to 29.7% as of June 30. Nonperforming exposures are expected to increase in the second half of 2022, RBI told Market Intelligence.

Despite the increase, the nonperforming loan ratio is still below its pre-2021 levels when the sector was plagued by low borrower assessment standards and related-party lending.

As of Aug. 23, US$1 was equivalent to 36.69 Ukrainian hryvnia and 4.77 Polish zlotys.