Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

9 Sep, 2022

By Iuri Struta

U.K.-based software provider The Sage Group PLC has stepped up its M&A activity in the past 20 months as it seeks to bolster its competitive position.

Sage, which sells payroll, accounting and enterprise resource planning, or ERP, solutions to small and medium-sized companies, closed its acquisition of Lockstep Network Inc. at the end of August. According to 451 Research, the company has announced five tech or telecom deals since the start of 2021, including the acquisition of Brightpearl Ltd., a retail ERP software company, for $299 million in January.

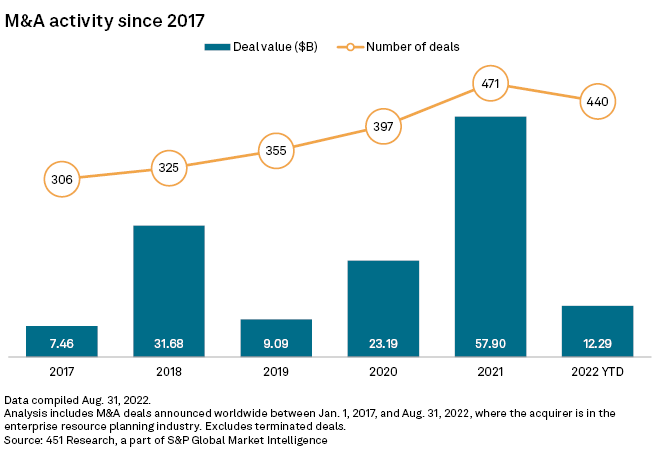

The number of deals announced in 2022 by ERP software companies worldwide is on track to meet or exceed recent highs, though the size of the announced deals is getting smaller.

In the first eight months of 2022, sector acquirers announced 440 transactions, versus 471 in full-year 2021, according to data from 451 Research as of Aug. 31. The average deal in 2021 was valued at $771 million, nearly three times higher than the average for deals announced this year to date.

Historically, Sage has taken a conservative approach to its spending, prioritizing profitability over growth. By comparison, Sage's competitors have invested heavily in research and development and acquisitions.

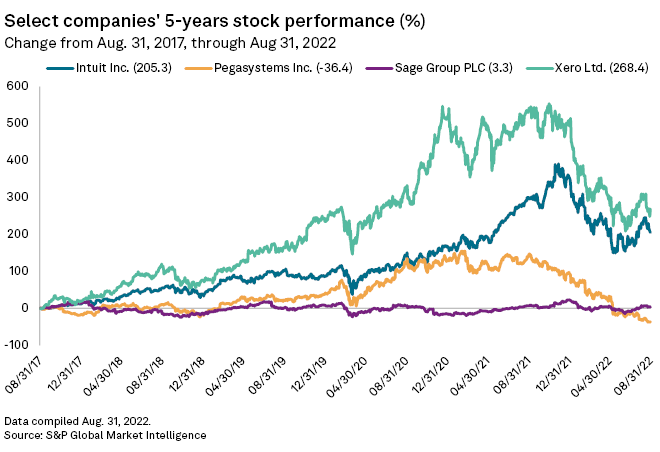

Sage's stock price has remained rather flat over the past five years, while competitors Intuit Inc. and Xero Ltd. gained more than 200%.

Xero, which has seen the most share price growth among its peers, has also been the highest R&D spender, allocating between 23% and 32% of revenue to R&D in the five years through 2021.

Sage seems to be shifting its strategy to follow a similar playbook. The company gradually ramped up its R&D spending, from $244 million in 2017 to $407 million in 2021, as it transitioned to a cloud subscription model. Still, Sage's proportion of R&D expense to revenue remains low compared to peers, at 16.1% versus Xero's 31.4%.

451 Research is part of S&P Global Market Intelligence.