Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

7 Jul, 2021

By Sam Clark

The U.K. government's plans to "level the playing field" between broadcasters and video-on-demand services are unlikely to curb the growth of U.S. streamers in the country, analysts told S&P Global Market Intelligence.

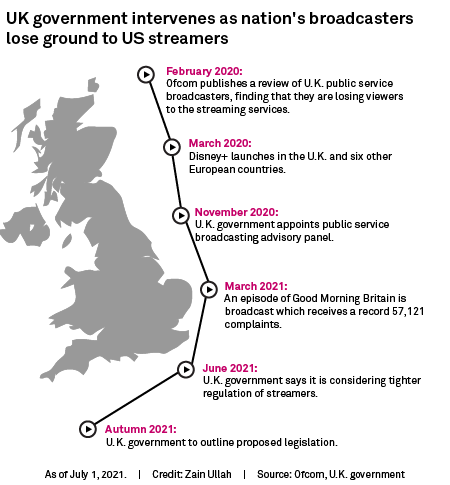

The government on June 23 said it is looking into whether tighter regulation of streaming services could help domestic broadcasters such as the BBC, ITV PLC, Channel Four Television Corp. and Comcast Corp.-owned Sky to compete with the likes of Netflix Inc. and Amazon.com Inc.

The broadcasters are subject to rules on impartiality, accuracy and age ratings — with certain content only permissible after 9 p.m. — but these do not currently apply to all streamers. As well as Netflix and Amazon, the government suggested Disney+ and Apple Inc.'s TV+ could be covered by the rules, which are implemented by U.K. regulator Ofcom.

"The main issue [for streamers] is going to be that it's more regulation in a separate territory so it's going to increase the compliance burden … the current on-demand rules are very few and between," John Davidson-Kelly, a partner at law firm Osborne Clarke, told S&P Global Market Intelligence.

|

While a new regulatory regime could increase compliance costs for streaming firms, it would not address the real reason traditional broadcasters are struggling to compete — the resource imbalance.

"It is going to be hard for regulation to make life tougher for [streamers]," said Sarah Simon, an analyst at Berenberg. "The problem for the broadcasters in the end is that they have limited budgets and the streamers have enormous budgets."

Netflix said in its most recent quarterly report that it expects to spend more than $17 billion on content in 2021, compared with ITV's plans to spend £1.1 billion in 2021.

Regulation ready

Analysts also noted that as Netflix, for example, is regulated in the Netherlands, where it is headquartered, it already has the necessary infrastructure and compliance teams in place. It voluntarily carries British Board of Film Classification age ratings and — like other streamers — has a feature that allows parents to lock certain content so it cannot be accessed by children.

"These are not cowboy operators who are suddenly going to be taken to task for what they are doing," said Tom Harrington, head of television at Enders Analysis. "There will [just] be bits around the edges."

|

Additionally, Ofcom figures show that a significant proportion of viewer complaints — and therefore investigations — are triggered by news and current affairs content, much of it broadcast live. Netflix, Amazon, Disney+ and Apple+ do not have live news offerings.

Putting broadcasters first

One area where government intervention could make a difference is in increasing the prominence of broadcast channels versus streamed content. Internet-connected televisions tend to come with certain apps preloaded and prominently displayed,

There are currently few signs that the government is keen on doing this though, analysts said. It is a difficult area in which to legislate, they said, and forcing smart TV manufacturers, for example, to give prominence to public service broadcasters over big streaming services could make the U.K. a less attractive market for them.

Implementing a "watershed" — the 9 p.m. cut-off point when rules are traditionally eased to allow content unsuitable for children — on streamers may also be difficult, analysts said.

A version of the watershed which applies to the streaming services might result in lower engagement on shows captured by the rules, but so far, there is nothing to suggest the government is seriously considering this, said Matti Littunen, an analyst at AllianceBernstein. Littunen said the watershed puts broadcasters at a disadvantage because programs broadcast later receive less prominence.

The government's plans for streaming regulation will become clearer in the fall, when it is expected to publish a "white paper" — a policy document setting out government proposals for future legislation — on the future of the country's "broadcasting landscape."

More dramatic changes, such as to the prominence rules, "are the sorts of things which might make investors [in streaming] think again, but a slightly increased compliance cost on harmful content is not," Littunen said.