S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

8 Oct, 2021

By Jon Rees and Rehan Ahmad

NatWest Group PLC CEO Alison Rose may be the first woman to lead a major U.K. bank, but female staff at the lender's high street bank division still earn a third less than their male colleagues.

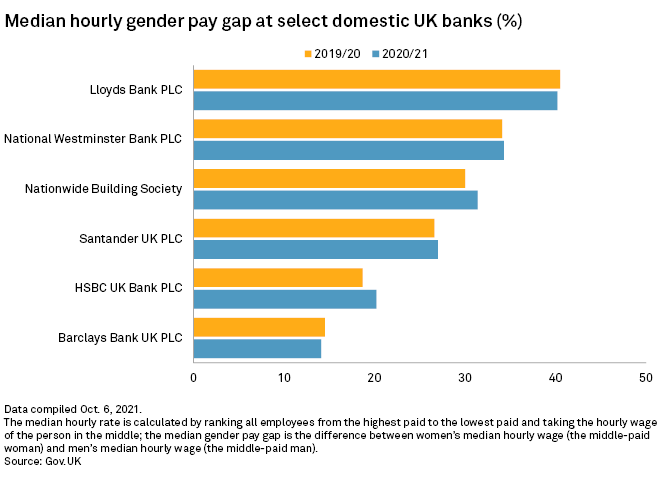

Figures provided by the state-owned bank to the government's gender pay gap survey, delayed because of the pandemic, show that National Westminster Bank PLC's female staff earned 66 pence for every £1 that men earned, or 34.3% lower, on a median hourly pay basis over the 2020/2021 period — a slight increase from 2019/2020. The median is the difference between the hourly pay of the median male and female employees.

At NatWest Markets PLC, which includes the bank's investment banking operations, the picture was less marked, with women's median hourly pay 26% lower than men's. Women in this division earned 52 pence for every £1 that men earned in bonus pay.

NatWest told S&P Global Market Intelligence that 14 of its 15 business areas have 30% or more women in their top three leadership layers, taking the bank to 39% on aggregate, and that it aims to have a fully gender-balanced workforce at all levels by 2030.

More women in junior roles

All employers in Britain with at least 250 staff must report the difference in what they pay their male and female employees.

Lloyds Bank PLC reported the greatest disparity among the leading high street banks. Women earned 60 pence for every £1 men earned, although this was a slight improvement on the previous year. At parent company Lloyds Banking Group PLC, which includes other financial firms like Halifax and Scottish Widows, there was a median hourly pay difference of 33.6%.

A Lloyds spokesperson said the gender pay gap was driven by a higher proportion of women in junior roles and a higher proportion of men in senior roles, and by the fact that, in the past year, more women have worked part time. In the government survey, bonus data is not prorated to account for part-time workers, who are in effect considered full-time workers. Since more women than men work part time, bonus numbers could overstate the gender pay gap for companies.

Barclays Bank UK PLC was the best performer of the U.K. high street banks with a median hourly pay difference of 14.1% for women. But parent company Barclays PLC's own survey of gender pay showed a median gap of 38.1% for ordinary pay among all its U.K. staff while the gap on bonus pay was 49.2%.

The bank said pay gaps were largely driven by differences in seniority between male and female staff, and a spokesperson said CEO Jes Staley believes the bank needs to go further to understand the reasons behind this disparity in roles.

Felicia Willow, CEO at the Fawcett Society, a charity which campaigns for gender equality, called for employers to have detailed plans in place to reduce the gender pay gap.

"It's clear that much more needs to be done to close it and to better value women," Willow told S&P Global Market Intelligence.

Banks with foreign owners

Among U.K. banks with foreign owners, the biggest pay disparity in the sample was at J.P. Morgan Securities PLC, part of JPMorgan Chase & Co. Women's median hourly pay was 50.3% lower than men's, although the gap reduced considerably compared to the year before. The bank said that its own report into gender pay across all its U.K. businesses showed the median hourly pay gap had narrowed to 24.2%, from 25.3% in the previous period, and that 25% of senior roles in the U.K. were now held by women.

At Merrill Lynch International the pay gap widened over the previous year, with the median hourly pay for women 44.5% lower than men's. Bank of America Corp., which owns Merrill Lynch International, said in its 2020 gender pay report that, like other banks, it has a greater proportion of men than women in senior positions and in roles within lines of business that have higher compensation. Across all its U.K. entities, the median hourly pay gap was 29.4%.

At Goldman Sachs International, part of The Goldman Sachs Group Inc., women's median hourly pay was 36.7% lower than men's, with the gap widening year over year.

A spokesperson for the bank pointed to comments made by Richard Gnodde, CEO, in a report to staff earlier this year that the bank paid men and women equally for equal work, but the difference reflected an "ongoing imbalance in gender representation at our most senior levels."