S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

5 Jan, 2022

By Jon Rees, Mohammad Abbas Taqi, and Francis Garrido

The U.K.'s banks go into 2022 well-prepared for an uptick in bad loans and well-placed for additional mortgage lending, in an environment where further interest rate rises are expected.

More rate rises may come

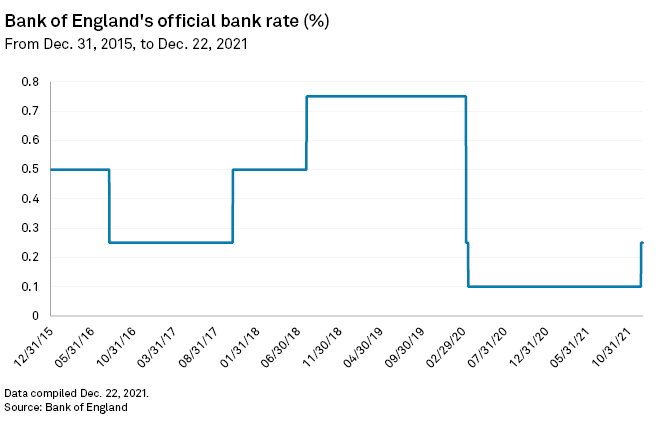

The Bank of England increased the base rate for the first time in three years on Dec. 16, 2021, to 0.25% from 0.1% as it attempted to tackle surging inflation.

"I think [the rate rise] will be a helpful tailwind to their net interest margin, indicating further rises to come," Osman Sattar, an analyst at S&P Global Ratings, said in an interview. "I think the BoE will move quite cautiously on interest rates, but we're predicting two small rises in 2022."

Generally low base rates are likely to persist for some time, despite higher-than-anticipated headline inflation, S&P Global Ratings wrote in a Dec. 14, 2021, research report. It warned that the risks of a disorderly exit from the COVID-19 pandemic are rising.

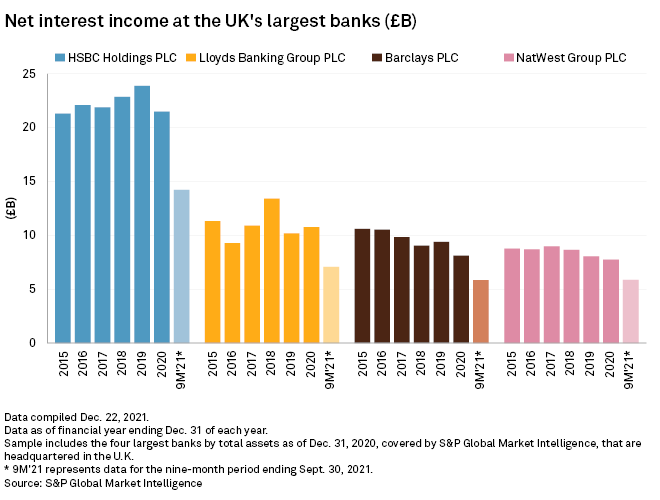

Net interest income decreased at HSBC Holdings PLC, Barclays PLC and NatWest Group PLC in 2020, although it increased slightly at Lloyds Banking Group PLC.

"We expect another 25 basis points increase so that should be positive for net interest income," said Christian Scarafia, senior director at rating agency Fitch, in an interview.

Rising interest rates may be good for net interest income but sharp, frequent rate rises also put pressure on borrowers who are unable to cope with sudden rises to repayment costs.

"A lot of quick rate rises to chase runaway inflation is a bad thing since what you may gain on net interest income you may lose on higher loan losses," said Fahed Kunwar, an analyst at brokerage firm Redburn, in an interview.

Strong buffers against impairments

British banks booked some of the largest loan loss provisions — funds set aside to cover future loan losses — in Europe at the start of the pandemic. But when losses failed to materialize at expected levels they were among the first to start releasing them.

Provisions as a proportion of total assets was -0.08% for NatWest in the second quarter, and -0.03% in the third, as the bank released provisions. HSBC, Barclays and Lloyds have also released provisions, and more releases are expected in the fourth quarter, according to S&P Global Ratings' Sattar. That said, loan loss provisions will still be above pre-pandemic levels and banks are expected to be able to absorb further credit losses if they occur.

"We'll see some uptick in loans going bad but the provisions will already be there to cover those loans," Sattar said.

Major U.K. banks have added "post model management overlays," additional credit loss provisions that can help if modeling scenarios are not adequate. At the end of the third quarter, NatWest held post-model adjustments of £700 million, or 16.4% of total impairment provisions.

With the uncertainty surrounding the effects of the latest COVID-19 variant, this provides banks with a further buffer.

"U.K. banks, compared with their European peers, have been quite aggressive in building allowances for potential loan losses and these overlays can be used if there are problems because of the variant," Scarafia said. "But if all's well they can be released, which boosts earnings."

Fitch expects U.K. banks' impaired loan ratio to increase from about 1.6% on average to just below 2% on average in 2022, but at such levels they should remain "easily manageable and below the banks' through-the-cycle averages," it said.

Mortgage market growth solid

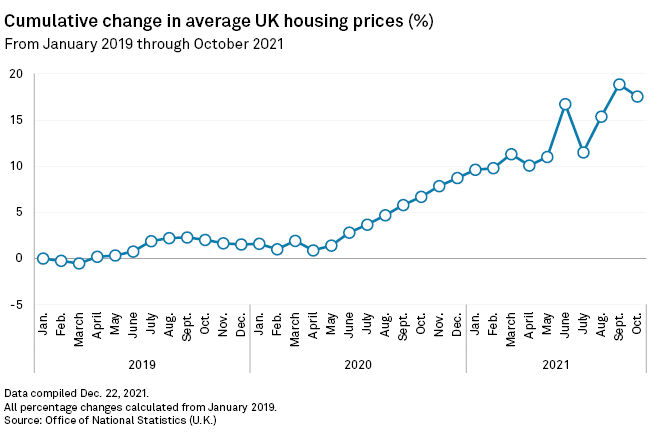

During the pandemic the U.K. government cut housing taxes as part of its economic support measures, feeding into a property price boom. House prices rose by 11.8% in the year to September 2021, according to the Office for National Statistics, and by 8.2% in the year to November, according to Lloyds, although it predicts a range of flat to 2% growth for the year ahead.

British banks have maintained margins on mortgage lending by charging interest at higher than central bank base rate levels. These spreads are likely to come under pressure from returning competition in the market, said Fitch in a note to investors, while profitability is set to return to normal after the higher levels of 2021. Mortgage volumes are likely to moderate following the surge in transactions seen over the past 18 months, said Fitch.

Retail banks are well capitalized, partly down to their being ring-fenced from groups' investment banking arms following the global financial crisis. The U.K. banking sector's common equity Tier 1 capital ratio increased by 0.2% in the third quarter to 16.5%, far above regulatory requirements.

The Bank of England indicated in its Dec. 13, 2021, financial stability report that it was happy banks were not exceeding guidelines on the level of borrowing customers took on when applying for mortgages. It also indicated that further stipulations that banks ensure mortgage borrowers could cope with a sharp rise in interest rates might be withdrawn.

"So there is some scope to actually lend to a wider segment of the market if that affordability restriction of the BoE does fall away," Sattar said.

Corporate lending in the 2022 is likely to be restrained, however.

"We saw a very significant uptick in corporate credit last year as corporates took advantage of very low rates [and] government-guaranteed loans to build up liquidity," Sattar said. "Normally as the economy grows you expect an uptick in corporate loans, but this time round we're not expecting that to happen."