S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

13 Jun, 2022

By Jon Rees and Cheska Lozano

| Banks are reassessing their releases of loan loss provisions ahead of an expected rise in mortgage arrears and possessions. |

British banks are facing a rise in mortgage arrears and property possessions this year as soaring inflation squeezes household incomes.

As interest rates climb and inflation grows, banking industry trade body UK Finance expects mortgage arrears to rise 26% to 102,000 borrowers compared to last year. Possessions are expected to rise 267% to 7,700 this year. Lenders are already reassessing their loan books in expectation of a more challenging economic environment for borrowers.

"Arrears numbers will go up throughout this year primarily because this is the first time that many borrowers will have experienced an interest rate rise coupled with an increase in inflation," Charles Roe, UK Finance director, mortgages, told S&P Global Market Intelligence.

Robust mortgage lending volumes and the release of COVID-19 provisions have boosted banks' profits, said Sophie Lund-Yates, analyst at Hargreaves Lansdown. But the landscape is now shifting.

"If financial institutions find that the macroeconomic outlook has once again worsened, or expect loan defaults to spike, we may well see a rebuilding of bad loan provisions," said Lund-Yates.

Pressure on borrowers

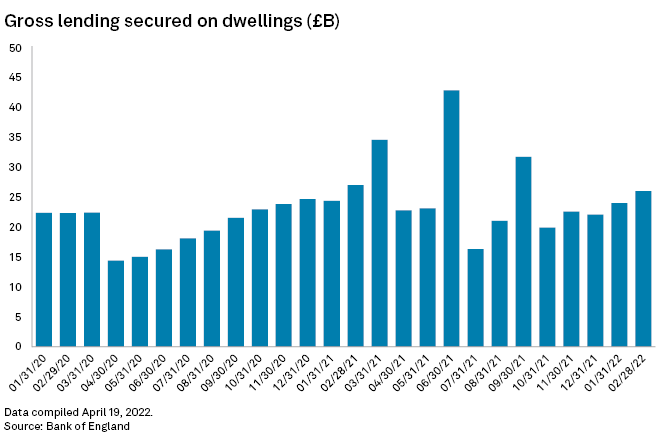

Mortgage lending in the U.K. reached £309 billion last year, the highest figure since 2007, said Roe. The high levels of borrowing came ahead of inflation reaching a 40-year high of 9% in April, more than four times The Bank of England's target. The BoE has increased interest rates four times in recent months, to 1%.

The Office for Budget Responsibility, which provides independent forecasts of public finances, said Britain is set to see the largest fall in living standards since its records began in 1956, with real disposable incomes dropping 2.2%. It expects inflation to peak at 11% in the last quarter of 2022.

Support measures introduced during the pandemic have helped arrears, and possessions have remained low over the past two years. But government support for household incomes ended last September, while mortgage repayment holidays from banks have also closed. These, along with a moratorium on possession proceedings during the Christmas festive season, have led to a backlog of possession cases dating back to before the pandemic, said UK Finance.

"A significant number of mortgage borrowers whose homes would have been possessed have not seen that happen because the court services were closed during the pandemic. We anticipate that it will take another 18 months to clear that backlog," said Roe.

Loan loss adjustments

Banks have begun to make adjustments to their loan loss provisioning models as record inflation takes hold, said Will Edwards, credit analyst at S&P Global Ratings.

"We're seeing banks shift around post-model adjustments from those set aside for the pandemic into provisions resulting from issues around affordability," Edwards said.

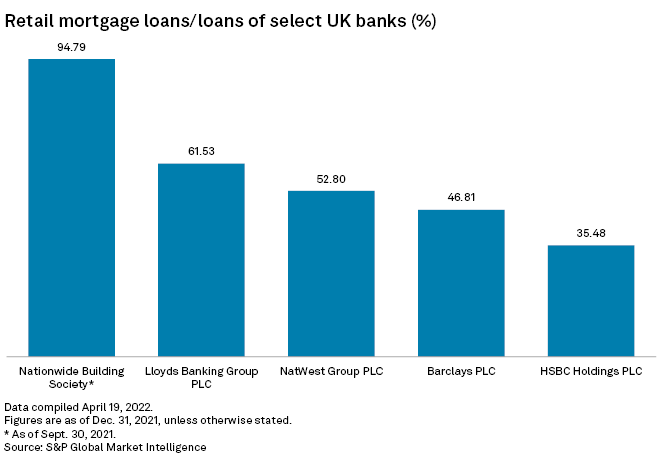

Nationwide Building Society categorized £16.4 billion out of £198 billion of its mortgage lending as Stage 2, indicating an increased risk of default, even though £15.4 billion of these loans were up-to-date at its full-year results in April.

Nationwide made a net impairment release of £27 million but said this was "subdued by the growing affordability pressure" on borrowers. The building society said it took care to check that its borrowers could afford their loans.

"The robust affordability checks we employ at the point of lending should mean that the vast majority of borrowers are able to absorb the increasing costs," said a Nationwide spokesperson.

Lloyds Banking Group PLC, the U.K.'s biggest mortgage lender, added an extra £100 million to its loan loss provisions when it announced first quarter results at the end of April. This was "to reflect potential affordability risks for our lower income customers," said the bank.

Lloyds, which did not respond to requests for comment, said previously that if inflation increased more rapidly than expected and the economy deteriorated more swiftly, it would have to revise its provisioning. Its open mortgage book stood at £295 billion in March 2022, up 4% on same time last year.

Cautious outlook

Reforms introduced in the wake of the 2008 financial crisis should mean borrowers are more resilient, said Roe. The BoE, for instance, requires lenders to limit the maximum loan to 4.49 times income for at least 85% of their purchase customers. Mortgage affordability checks on household spending are also applied.

Mortgage lending, much of it automated, remains profitable for banks which remain sufficiently well capitalized to cope with a rise in arrears while borrowers regard mortgage payment as a "priority debt," said Edwards, who also noted that borrowers could draw on savings built up during the pandemic as support.

"Arrears are coming from a very low base so it should be manageable economically, but banks are already beginning to take steps to pre-position their lending books to provide a buffer in the changing economic environment," said Edwards.