Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

26 Jan, 2021

By Jon Rees and Rehan Ahmad

British banks are expected to make extensive use of cheap Bank of England loans in the next few months even as deposits from businesses and households rise amid the pandemic, according to analysts.

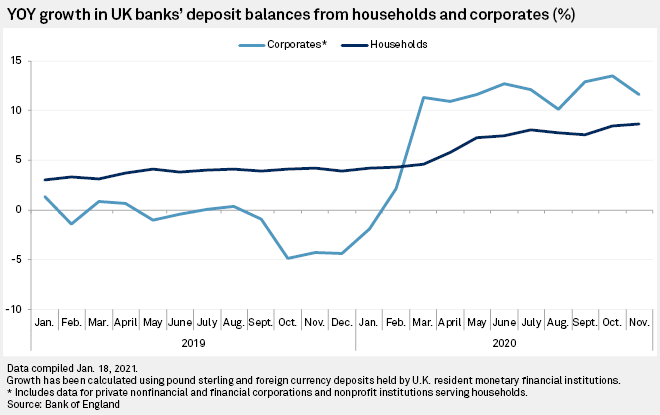

Corporate bank deposits in the U.K. rose more than 10% year on year in March 2020, having increased sharply since the start of the year. It was in March when the U.K. started its first national lockdown as the pandemic took hold and when the BoE launched a new funding support scheme for banks.

Consumers' deposits have grown more steadily, but by November were nearing 10% above levels seen the previous year.

Cheap funding

The BoE's Term Funding Scheme aims to incentivize lending to the real economy by offering funding at low interest rates. So far, there is £68 billion outstanding under TFSME, aimed at boosting lending to small and medium-sized enterprises, and a further £50 billion under its predecessor Term Funding Scheme. The scheme closes to drawn-downs in October, but banks are likely to borrow considerably more from it by then.

"As banks currently have deposits coming out of their ears they will generally delay TFSME drawings as late as possible, to preserve the cheap funding benefit well into 2025. Most will 'fill their boots,'" said Investec analyst Ian Gordon via email.

In a Jan. 11 report, S&P Global Ratings said the likelihood of U.K. banks availing themselves of further cheap central bank funding would depend on trends in loans, deposits and wholesale borrowing costs over the year.

"The banks have ... headroom to borrow a lot more from the Term Funding Scheme before the window to drawdowns closes later this year. I think the availability of that cheap funding from the BoE is going to substitute for senior wholesale funding, more so than this deposit inflow," said Richard Barnes, analyst at S&P Global Ratings, in an interview.

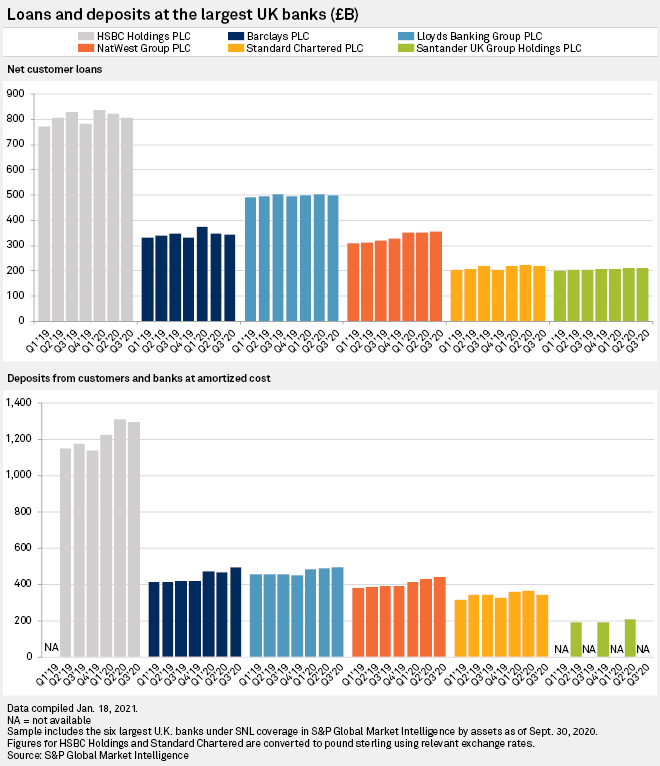

HSBC Holdings PLC, like Standard Chartered PLC, saw deposits peak in the second quarter of 2020, while the U.K.'s more domestically focused banks Lloyds Banking Group PLC, NatWest Group Plc and Barclays PLC, registered a peak in the third quarter.

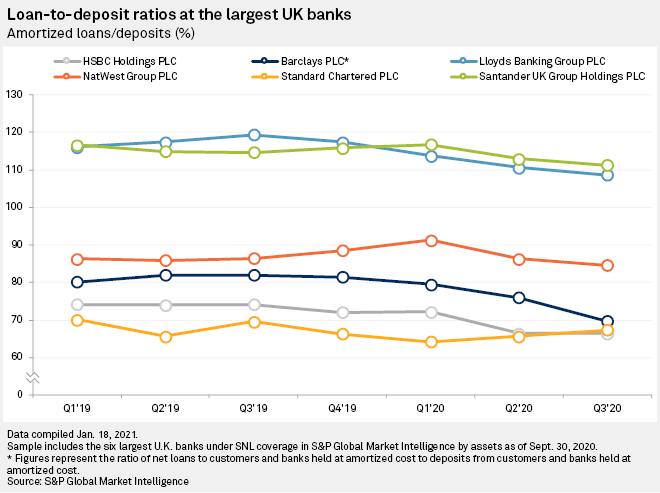

Loans, meanwhile, peaked in the first quarter of 2020 for HSBC and Barclays, but remained steady over the first three quarters of last year for the remaining banks even as deposits rose. Loan-to-deposit ratios fell across the board during the pandemic.

"Companies have taken U.K.-government guaranteed loans and they don't need to spend all the funds on day one; they've saved that at the banks. We expect corporates to deploy the proceeds of their loans into their businesses, so you'd expect that corporate cash-flow to be managed down," Barnes said.

It is not just businesses that have built up reserves during the pandemic. Some consumers, at least, have been able to bolster their household resources.

Indeed, the household savings ratio, which represents households' net savings, stood at 16.9% in the third quarter, down from a record 27.4% in the second quarter.

"If you're securely employed, unpleasant as the pandemic is, economically it could have been a boon. You're not able to spend as freely as you might want to, but you're earning as much and some of your costs are coming down — no commuting, for instance," economist Dhaval Joshi, Chief European Strategist at global investment research firm BCA Research, told S&P Global Market Intelligence.

"But there is another group of people whose job security is weakened. Paradoxically, this will only become apparent when the pandemic ends and government life-support schemes are turned off — that's when we'll see who's in a good position and who's not."

Margins squeezed

With deposits increasing sharply banks are likely to see their net interest margins squeezed, however.

"Because of central bank measures, banks aren't short of liquidity and even with the pickup in loan growth that we've seen as corporates have looked to draw down liquidity, the reality is that there is more liquidity than there is demand. That is a drag on banks' margins and profitability," Benjie Creelan-Sandford, an analyst at investment bank Jefferies, said in an interview.

Though further economic contraction is expected in the first quarter of 2021, economists are reasonably optimistic about the longer-term outlook with consumers' pandemic deposits likely to be key.

Restrictions are expected to be increasingly eased from the second quarter and then the consumer can play a "pretty decent role" in leading the recovery, according to Howard Archer, chief economic adviser to U.K economic forecasting group EY ITEM Club.

"Certainly, with those high savings ratios it does imply that many consumers are in a good position to spend, though a lot will depend on how much unemployment rises," he said in an interview.

Creelan-Sandford noted that banks benefit from better margins on consumer lending so a pick-up in consumer activity can be a powerful driver of profits for banks.

However, a sharp rise in consumer spending could spark an increase in inflation — with a spike in inflation likely in April anyway, said Archer, as temporary tax breaks for the hospitality sector end. He expects inflation to be slightly above 2% by the end of the year, up from 0.3% now.

Possible negative rates

The BoE continues to mull the introduction of negative interest rates with potentially profound consequences for banks.

"If things start improving from Q2 the case for the BoE to act will be diluted, so if they don't introduce negative rates soon, they won't do it at all. I'm personally still doubtful that the BoE will introduce negative rates, but it's a close call because of the difficulties the economy is facing in Q1," Archer said.

Creelan-Sandford said increased deposits at banks during a period of negative interest rates would act as a drag on margin — noting the experience of European banks where negative rates have long been applied by the ECB.

"There are set costs associated with negative rates and it's difficult to pass that cost on particularly in the case of retail depositors, but even on the corporate side as well. Banks are making efforts to pass the negative rates on, but it can be difficult to in the broader relationship with the client," he said.