S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

8 Feb, 2022

By Sanne Wass

U.K. regulators handed down a record level of anti-money laundering penalties to banks in 2021, and experts anticipate fines to remain elevated as the country's Financial Conduct Authority embraces its powers to pursue criminal prosecutions.

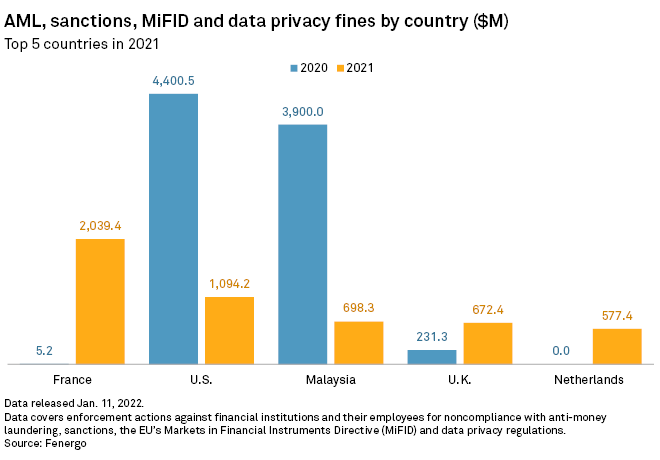

Cases led by the Financial Conduct Authority, or FCA, against NatWest Group PLC, Credit Suisse AG and HSBC Holdings PLC helped to drive the value of U.K. anti-money laundering fines to $672 million in 2021, more than tripling from $206 million in 2020, according to research by regulatory technology company Fenergo.

"In the past, fines were seen just as the cost of doing business," said Nick Baxter, a U.K.-based banking consultant and director at Rockstead, a provider of regulatory compliance services. "Now you've got to a point where the fines are so great, it's no longer cheaper to pay the fine and not fix the systems and controls."

Regulators across Europe are issuing larger fines than previously, said Rachel Woolley, global director of financial crime at Fenergo. There has been "a shift in the narrative" in that "eye-watering penalties" are no longer coming exclusively from U.S. regulators, Woolley said.

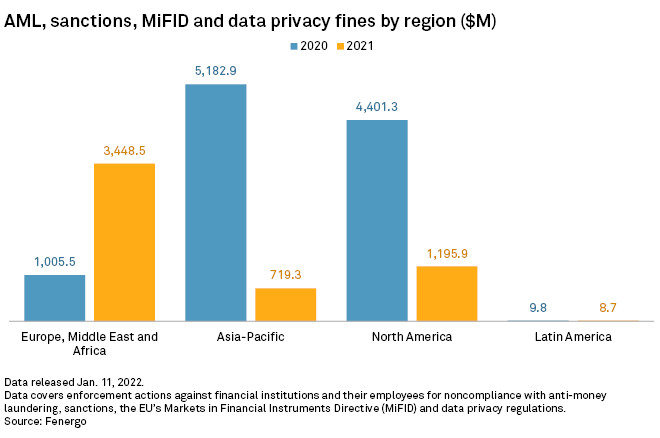

The increase in total fines value in Europe, and the U.K. in particular, bucked the global trend in 2021. The value of penalties related to breaches of anti-money laundering, sanctions, the Markets in Financial Instruments Directive and data privacy regulation worldwide halved last year, with U.S.-issued fines down about 75%, according to the research.

Beware the watchdog

The fact that the FCA is prepared to use its criminal powers has made it "a more powerful force," said Tony Wyatt, associate counsel at Ewing Law.

A case against NatWest in 2021 was the first time the FCA pursued criminal charges against a bank since it was given such powers under 2007 money-laundering regulation. It resulted in a U.K. court issuing a £264.8 million fine to NatWest in December 2021, after the bank pleaded guilty to failing to monitor suspect activity by a client that deposited hundreds of millions of pounds in cash over five years. CEO Alison Rose said at the time that NatWest regretted the failure and that it takes its responsibility to prevent and detect financial crime "extremely seriously."

The conviction was a "big win" for the FCA and will likely give it the confidence to pursue criminal enforcement actions in the future, said Julian Hui, a senior associate in the financial services regulatory practice at law firm Baker McKenzie in London.

"The FCA is demonstrating that it can actually do these big criminal enforcements and get big outcomes. [The NatWest conviction] will probably embolden it a little bit," Hui said.

The regulator told the Financial Times it has about 40 active anti-money laundering cases, the paper reported Jan. 17. Of those, 29 are regulatory investigations, two are criminal investigations and three are civil probes, while six are "dual-track," meaning they could result in either criminal or civil action.

Court-issued fines can be much larger than those granted directly by the regulator, Hui said. The reputational concern for banks being found guilty of a criminal offense "is massive," Wyatt said, adding that, once dealing with criminal law, directors in a bank can also become personally liable.

Hui expects the FCA to pursue at least one more criminal prosecution related to anti-money laundering regulation in the coming year or two. The big unknown is whether reported staffing shortages might start to bite, Hui said. The FCA had to turn to private law firms to help process applications and spent almost £1 million on headhunters in 2021 amid a high number of vacancies, the Financial Times reported in December.

When asked about the regulator's appetite to use its power to pursue criminal convictions, an FCA spokesperson said via email that anti-money laundering cases "remain a strategic priority" and that it "will take whatever enforcement action is necessary based on the evidence."

New European narrative

Europe, the Middle East and Africa was the only region in which the value of financial penalties increased in 2021, jumping to $3.45 billion from just over $1 billion in 2020, according to Fenergo.

Three of the five largest money-laundering penalties in 2021 came from Europe. These include a €1.8 billion fine issued to UBS AG after a French court found it had concealed serious tax fraud and illegal banking activities in the country, and a €480 million settlement between ABN AMRO Bank NV and Dutch prosecutors over anti-money laundering failings. The NatWest fine in the U.K. was the fifth-largest penalty of the year.

The U.S. continued to rank among the top issuers of financial fines, though penalties dropped to $1.20 billion in 2021 from $4.40 billion a year earlier, according to Fenergo. While U.S. regulators in the past have issued material fines to non-U.S. banks, 2021 saw a larger focus on local banks, with penalties generally of a lower value, Woolley said.

Location

Segment