S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

5 Jan, 2021

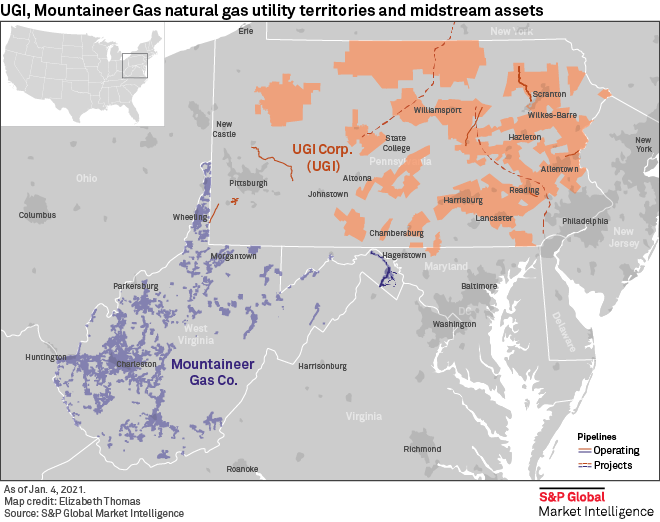

UGI Corp.'s $540 million deal to acquire West Virginia utility operator Mountaintop Energy Holdings LLC demonstrates the energy delivery company's confidence that natural gas distribution will remain a growth business for decades to come.

Executives at UGI framed the acquisition of Mountaintop subsidiary Mountaineer Gas Co. as part of their overall strategy to increase their exposure to natural gas businesses, grow regulated earnings and tackle greenhouse gas emissions reductions. They stressed that the combination is not about achieving cost cuts but about executing their long-term vision.

"This is not a synergy-driven investment opportunity. It's primarily driven by what we see as a really well-managed [local distribution company] with substantial opportunities for additional growth," UGI CEO and President John Walsh said on a Jan. 5 conference call.

The deal represents one of the largest acquisitions of a natural gas utility parent company or subsidiary in recent years. It follows a drop-off in dealmaking activity in the once-active gas utility M&A market. It also came in the final days of a year in which pipeline opposition, state climate policy and a growing building-electrification movement raised concerns about natural gas use and weighed on investor sentiment.

However, some analysts believe that those concerns are overblown, and gas utility executives in the nation's Midwest and mid-Atlantic gas production hubs have been more bullish about the fuel's future. UGI executives said one factor in their decision was the constructive regulatory and political environment in West Virginia, home to the Marcellus and Utica shale formations that underpin the top U.S. gas producing region.

Growing gas exposure and tackling emissions

The deal would accelerate UGI's plans to achieve a more even balance between its natural gas utility and midstream segments and its U.S. and international propane business. Currently, UGI's natural gas businesses account for roughly 40% of its earnings, according to UGI CFO Ted Jastrzebski.

"We view this transaction as a positive step to reduce the propane exposure by increasing regulated asset footprint," Swiss investment bank UBS said in a Jan. 4 research note.

Reflecting the company's confidence that natural gas will remain a critical fuel in West Virginia's energy mix, Walsh said the deal sets up decades of regulated investment in system enhancements. UGI plans to replace roughly 25% of Mountaineer's approximately 6,000-mile distribution system, with a focus on eliminating about 1,500 miles of bare steel main, said Robert Beard, CEO of UGI Utilities Inc. and executive vice president in charge of UGI's natural gas business.

The pipeline replacement program would also support UGI's focus on reducing its greenhouse gas emissions profile by cutting methane leaks from the Mountaineer system. UGI will also seek to build up Mountaineer's fleet of low-emissions compressed natural gas vehicles and incorporate renewable natural gas — an alternative fuel processed from methane waste sources — into its supply mix, Beard said. The company recently staked a claim as a leader in renewable gases.

UGI touts constructive regulatory environment

Regulatory mechanisms available in West Virginia provide a foundation for growth, Walsh said. The state's Infrastructure Replacement and Expansion Plan, or IREP, allows Mountaineer to recoup much of its capital spending with minimal lag time, he said. UGI also intends to take advantage of IREP's recovery allowance for system expansion into unserved areas, he added.

"[W]e plan to accelerate customer growth by expanding distribution systems into unserved and underserved areas of the service territory in a manner similar to our existing utilities' successful expansion programs," Walsh said.

UGI expects the deal to have a positive impact on earnings within the first full year of combined operations. The deal's $540 million enterprise value is equal to 1.4 times Mountaineer's projected 2021 rate base of $378 million. UGI plans to finance the deal through a combination of debt, existing liquidity and equity-linked securities such as mandatory convertible securities.

The company expects the transaction to close in the second half of 2021, subject to approval by the Public Service Commission of West Virginia and federal antitrust review.